WS33009 caution opendoor slowly 80202.1403546520.450.450

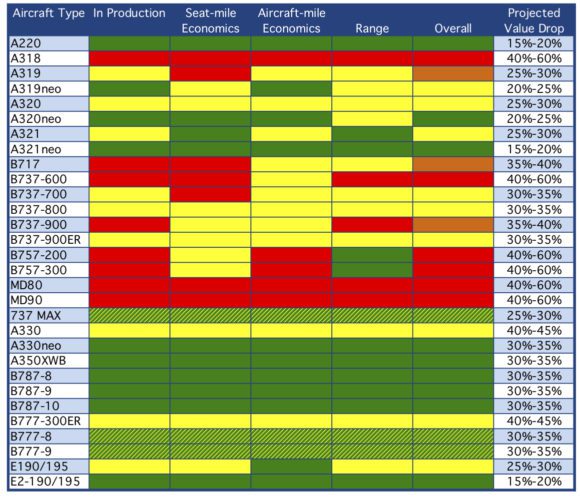

The global coronavirus crisis has decimated traffic and impacted airline traffic worldwide. Aircraft have been grounded worldwide, but some aircraft types will be more negatively impacted than others. Several older and less efficient aircraft will find values essentially at scrap rates, with the value of hours remaining on engines being the primary determinants of value. Newer types that are still in production will see value drops from 20-35% in the near term, and potentially over the intermediate-term depending on how long it takes the industry to recover.

Subscriber content – Sign in [maxbutton id=”1″ ] [maxbutton id=”2″ ]