A321 Jetblue MSN6512 Take off scaled

JetBlue expects to recover the capacity for the final quarter quicker than anticipated in August and outpace 2019 levels again. Capacity should be up by one to four percent over 2019 and end between zero and two percent for the full year, it said on October 25 in its Q3 earnings release. The airline continues to plan prudently as the operating environment remains fragile. JetBlue to recover Q4 capacity quicker than expected.

After serious operational issues in Q2, the US low-cost airline said it would reduce capacity in Q3 by -3 to zero percent announced in August. Today’s results confirm that the reduction has been only 0.5 percent. Strong leisure and visiting friends and relatives (VFR) traffic during the summer period forced it to up capacity quicker but still below pre-pandemic levels. JetBlue is seeing continued strong demand in Q4. Operations were impacted by hurricanes Fiona and Ian (-0,7 percent capacity), but they had a neutral impact on unit revenues. The carrier is adequately staffed now after recruiting new staff over the summer, with normalization in most segments except for pilots. But given supply chain and ATC issues, JetBlue prefers to keep a modest approach to capacity planning, said Chief Operating Officer, Joanna Geraghty.

Looking at the financial results, JetBlue reported a $57 million Q3 profit compared to $130 million in the same period last year. The Adjusted pre-tax profit was $118 million. Total revenues were higher at $2.562 billion versus $1.972 billion, resulting in revenues per seat mile (RASM) ending at 23.4 percent up from 13.5 percent in Q2. The load factor recovered to 86.1 percent as it carried 10.5 million passengers.

Northeast Alliance performing strongly

Particularly strong was RASM where JetBlue and American Airlines operate under the Northeast Alliance in the New York and Boston region, which “continues to unlock consumer benefits” with growth, new routes, and frequent-flyer benefits. Corporate bookings are at 90 percent of pre-pandemic levels, up from 80 percent in Q2. Here, too, JetBlue sees a strong recovery in the NEA region.

Operating expenses were up by 35.7 percent to $2.423 billion, with fuel costs by 86 percent to $865 million. This pushed the operating profit down to $139 million from $186 million and the operating margin to 5.4 from 9.4 percent.

For January-September, JetBlue reported a $-386 million net loss (2021: $-53 million), revenues of $6.743 billion ($4.203 billion), and expenses of $7.084 billion ($4.164 billion). The operating loss was $-341 million compared to a $39 million profit. For the nine-month period, the operating margin slipped to -5.1 percent from 0.9 percent. JetBlue ended September with $2.3 billion in liquidity and an Adjusted debt of $3.9 billion. It repaid $66 million of debt in Q3. After amending a revolving credit facility last week, the airline has another $600 million at its disposal.

In its outlook for Q4, seat capacity should be up by one to four percent, RASM by 15 to 19 percent, and costs per available seat mile (CASM) excluding fuel by 8.5 to 10.5 percent. CASM ex-fuel should see a seven percentage points sequential improvement over Q3. “Looking ahead, we expect our profitability to carry through to another solid quarter of mid-single-digit pre-tax margins in the fourth quarter, and we’ll look to expand on that further in 2023 as we continue to restore our earnings power,” said CEO Robin Hayes. Just today, JetBlue entered a forward fuel derivative contract that sees 27 percent of fuel consumption hedged for the final quarter, but no fuel is hedged for 2023.

Total capacity should grow by mid-to-high single digits next year compared to this year. JetBlue will unveil its next European destination soon. Competition on the transatlantic is strong and JetBlue is just a niche player, but its Mint product is appealing to many. This makes Hayes confident that his airline has the right tools for this market.

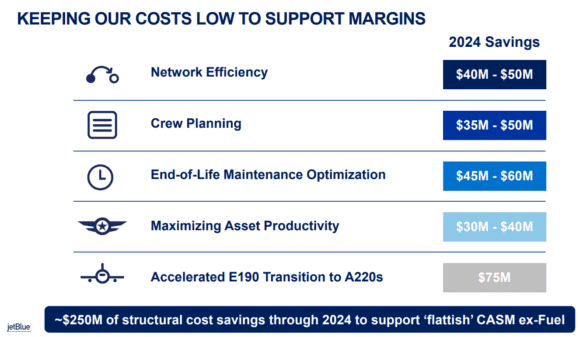

JetBlue continues its cost-saving strategy that should generate $250 million in structural savings through 2024 to get to ‘flattish’ unit costs, as was announced in August. This will not be easy, as 2023 will include some heavy expenditures in fleet maintenance and at airports. But retiring the Embraer E190 fleet in 2025 as it transitions to the Airbus A220-300 will bring $75 million in cost reductions once completed.

Counting on Airbus deliveries

Next year, eighteen A220s are in the delivery plan, as are six A321neo’s and five A321LRs. This depends on the rate at which Airbus can deliver. To be sure, JetBlue’s capacity planning for 2023 includes just fourteen A220s, five A321neo’s, and three -LRs. Six E190s and four A320ceo’s will be retired. Deliveries will push capital expenditures from $1.0 billion to $1.5 to $2.0 billion, but this depends on Airbus.

Robin Hayes is, of course, most happy that the stockholders of Spirit Airlines have voted 95 percent in favor of the merger agreement with JetBlue. “Together, we’ll build a truly national low-fare challenger to the dominant Big Four airlines and expand our compelling combination of award-winning service and low fares to more Customers across more destinations.” JetBlue will make a $272 million pre-payments to Spirit stockholders this quarter. The transaction is expected to be closed in the first half of 2024.

Views: 0