Lufthansa Group reported its earnings this week, which were mixed and somewhat disappointing. Lufthansa underperformed, while the remainder of the group performed well. In many ways, the results were a mix of unprofitable and profitable quarters and profitable and less profitable airlines within the group.

Group Profitability

Deutsche Lufthansa AG, the flagship German airline, reported nearly flat 2024 revenues, at €15,812M, up only slightly from €15,634M in 2023. Net profits for the year fell significantly to €372 million, down substantially from €6,765 million in the prior year.

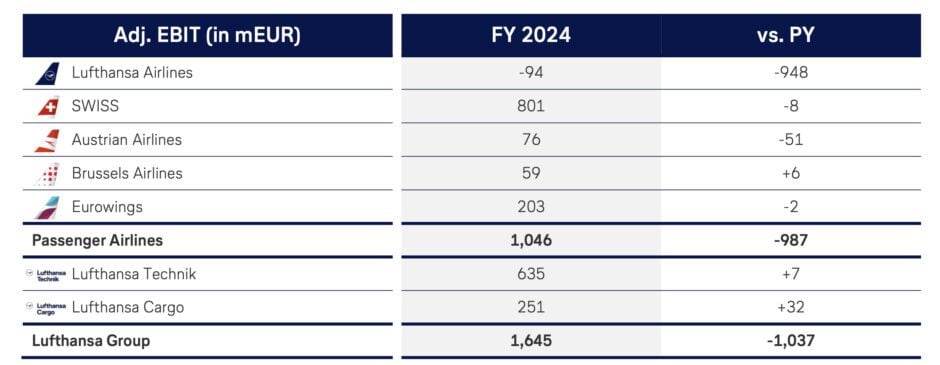

While Lufthansa had an adjusted EBIT loss, the other airlines in the group, along with the MRO and cargo operations, had positive EBIT contributions, as shown in the table below.

The group continues to pursue a multi-hub, multi-brand strategy, which it increased by adding an initial 41% stake in ITA Airways. Lufthansa Airlines’ turnaround program is mostly on track, and management has taken measures to stabilize operations, reduce complexity, and mitigate seasonality.

Unfortunately, Lufthansa is currently short 41 wide-body aircraft, which it was expecting. Fifteen of those aircraft are essentially complete, waiting for the certification of seats for its new Allegris business class. It now appears that Lufthansa will take delivery of those aircraft but not occupy the business class cabin until regulatory approvals are obtained.

The seat shortages will result in a more aggressive delivery schedule in 2025, with a new wide-body delivered every two weeks. Those 26 new aircraft should improve efficiency and fuel economy and deliver a more competitive cabin product with the Allegris First and Business class suites. The Allegris First Class seats have been certified, but the Allegris Business Class seats remain awaiting regulatory approval.

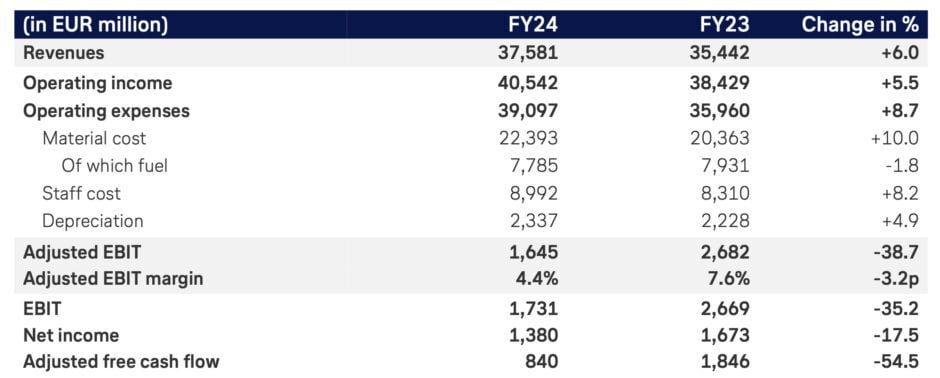

Despite strong revenue momentum, cost pressures and strikes impacted profitability in 2024, as shown in the following table. Group EBIT was down 35.2%, and free cash flow fell 54.5%.

A Mixed Performance in 2024

Lufthansa CEO Carsten Spohr summarized the results for 2024. “Aviation is and remains an industry of the future with sustained strong demand. Especially in unstable times, it enables international understanding through cultural and economic exchange. At the Lufthansa Group, we can look back on the strongest year in our history in terms of revenue, with a new load factor record. I would therefore like to thank our guests for their loyalty and all our employees for their great commitment.

Looking back, 2024 was a year of two halves for the Lufthansa Group. In the first six months, we still had to cope with a significant decline in operating profit – due, among other things, to strikes, delayed aircraft deliveries and operational challenges at our hubs.

The trend was reversed in the course of the year with two consecutive quarters in which we generated revenue of over 10 billion euros each for the first time, and in the fourth quarter we exceeded the previous year’s profit.

The further internationalization of the Lufthansa Group through the integration of ITA Airways, the significantly improved stability in flight operations and the growing satisfaction of our customers – all this shows that our strategy is right and our measures are taking effect. However, there is no question that we now also have to achieve an economic turnaround for our core brand Lufthansa. This year, 2025, will be a year of transformation for us with a clear goal: to further strengthen our position as the global number one outside the United States.”

Guidance and Outlook

Expectations and guidance for 2025 remain guarded. Till Streichert, Deutsche Lufthansa AG’s CFO, stated, “This year, we expect moderate capacity growth of around 4 percent. This will help to support our revenue growth, secure valuable market shares, stabilize our earnings, and further improve our operations.

Nevertheless, current challenges will persist. These include delays in aircraft deliveries and ever-present cost pressures. We therefore regard 2025 as a transition year in which we will lay the foundations for future increases in profitability. Nevertheless, progress will be clearly visible in every respect. This will also be reflected in our Adjusted EBIT, which we expect to be significantly higher than in the previous year.”

The Bottom Line

Implementing the turnaround plan at Lufthansa will be the key to the group’s profitability in 2025. With the seat shortage and the inability to entirely sell business class seats on new aircraft being delivered until the new seats are certified, we expect a revenue shortfall that will drop to the bottom line this year. Our outlook for Lufthansa is mixed, as supply-chain shortfalls with seats continue to impact results in early 2025. Certification of the new business class seats will help LH to be more competitive on its Boeing 787 wide-bodies, joining the smaller A350 sub fleet on which Allegris seats have already been certified.

While recent quarters show progress and improvement, completing the turnaround plan will be essential for Lufthansa in 2025. However, with items like the seats outside of its control, risks remain, and the outlook for 2025 remains clouded.

Views: 149