201223MAX GARY WEB002 source

Delivery delays at Boeing make it difficult for Southwest Airlines to plan far ahead into 2023. The airline is unsure about how many MAX aircraft it can expect and include in its schedule, so it is taking a cautious approach to capacity, Southwest said in its Q3 earnings release on October 27. MAX delays begin to affect Southwest’s capacity planning.

Southwest and Boeing have contracts for the delivery of 100 MAX 8s and fourteen MAX 7s this year. Until September 30, the airline received 35 MAX 8s, of which 23 in Q3. No MAX 7s have been delivered as the aircraft isn’t certified yet and probably won’t be before December 31. Boeing will need an exemption from Congress to certify the MAX 7 and 10 at a later date without the need for an extensive cockpit redesign to include new crew alerting systems, although this potential requirement seems to affect the MAX 10 only.

In its earnings release, Southwest says it expects “a portion of its deliveries to shift out of 2022 due to Boeing’s supply chain challenges and the current status of the -7 certification. Based on continued discussions with Boeing regarding the pace of expected deliveries for the remainder of this year, the Company continues to estimate it will receive a total of 66 -8 aircraft deliveries in 2022, including 31 -8 deliveries in fourth quarter 2022, and no -7 deliveries in 2022.”

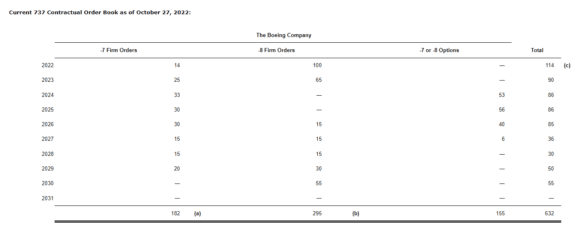

MAX 8 deliveries in 2022 should include five remaining options the airline exercised in Q3, together with four remaining options on the MAX 7 for delivery in 2023. This month, it converted seventeen firm orders for the MAX 7 that were scheduled for delivery in 2023 into MAX 8s. Southwest also exercised three MAX 7 options for delivery in 2024 and brought deliveries of fifteen MAX 7s from 2030 to 2026. Ten MAX 8s were advanced from 2031 to 2030. This fleet review follows that from July, when Southwest already amended its MAX orders.

Southwest now expects to take delivery in 2023 of 25 MAX 7s and 65 -8s, plus 63 MAX 7s in 2024 and 2025, as can be seen in the slide. Delays are expected to persist into 2024.

The delivery uncertainties have forced Southwest to review its retirement scheme for its 737NGs. Instead of retiring 29 737-700s this year, it will retire 26 now, including five in the final quarter. This brings the fleet to 768 aircraft in December compared with the previous guidance of 765 aircraft.

Capacity

This all makes it very difficult for Southwest to predict capacity for the coming months. “Today, we extended our flight schedule through July 10, 2023, and we currently expect first quarter 2023 capacity to increase approximately 10 percent and second quarter 2023 capacity to increase approximately 14 percent, both year-over-year. While we have not yet finalized capacity plans for second half 2023, and there is uncertainty around the timing of aircraft deliveries, we are building our 2023 capacity plan with a goal to have sufficient aircraft to operate our 2023 flight schedules, as originally published, in an effort to enhance operational reliability. We plan to allocate the vast majority of new 2023 capacity to network restoration and stronghold Southwest markets, which we consider to be lower-risk growth. We currently expect our route network to be approximately 90 percent restored by summer 2023, and fully restored by December 2023, compared with 2019 flight levels in pre-pandemic markets.”

Q3 results

Southwest Airlines reported a $277 million net profit for Q3 compared to $446 million last year. Total operating revenue were 32.9 percent higher to $6.2 billion from $4.7 billion, but expenses increased by 47.6 percent to $5.8 billion. This affected the operating result, which was $395 million versus $733 million last year. Hurricane Ian affected the operating result by $18 million, but this was offset by strong bookings during the rest of September.

“We are pleased to report solid third quarter 2022 profits and record third quarter operating revenues,” CEO Bob Jordan says in the earnings release. “Following record summer leisure travel demand, revenue trends remained strong in September 2022, bolstered by improving business travel trends post-Labor Day. Leisure and business demand remains strong, and we currently expect revenue trends to improve sequentially from third quarter to fourth quarter 2022, despite lower capacity.”

For January-September, Southwest reported a net profit of $759 million compared to $909 million last year, total revenues of $17.4 billion versus $10.7 billion, operating expenses of $16.2 billion versus $9.2 billion, and an operating profit of $1.4 billion compared to $1.5 billion. The carrier has $13.7 billion in liquidity, Long-term debt stands at $8.3 billion.

Although fuel costs were up 76.5 percent year on year to $1.8 billion, Southwest is hedged 61 percent in Q4 and fifty percent for 2023. In Q4, capacity should be down by two percent from 2019, but operating revenues up between thirteen and seventeen percent over 2019 as forward leisure and corporate bookings are solid. Full-year capacity will be at -4.5 percent compared to -4.0 percent in the previous guidance. Costs per available seat mile (CASM) excluding fuel are projected to be fourteen to fifteen percent up.

Views: 1