Avianca1 scaled

So far, Mexico and Colombia drive the Latin American airline industry recovery, according to stats provided by the International Air Transport Association (IATA). These two countries remain the only ones fully open across the subcontinent.

Looking at Mexico and Colombia’s capacities

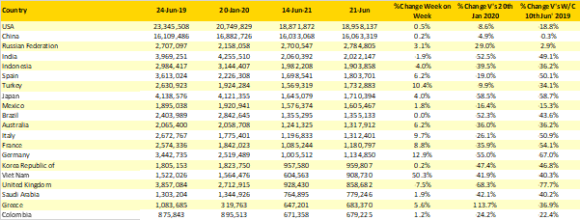

Both Mexico and Colombia are in the driver’s seat of the Latin American recovery in terms of passengers recovered and capacity offered. According to OAG, both countries are in the top 20 markets worldwide. Mexico is in number nine while Colombia is last.

Currently, Mexico is offering approximately 1.6 million weekly seats. The North American country is only 15.3% below the capacity it had in June 2019. Meanwhile, Colombia is offering nearly 680,000 weekly seats, 22.4% down from two years ago.

Among the top 20 countries in the world, Mexico and Colombia rank third and fifth in terms of capacity recovered compared to 2019. The top 5 is completed by Russia (#1), China (#2), and the United States (#4), said OAG.

Brazil is currently sitting at a 56% capacity, compared to its pre-pandemic levels. The South American giant is offering 1.3 million weekly seats; GOL expects Brazilian levels to rise up in the second half of the year.

Looking at Mexico and Colombia’s passenger numbers: they drive the Latin American recovery

So far, Mexico has had 26.3 million passengers between January and May, according to Government stats.

Mexican airlines carried 18.3 million, led by low-cost operator Volaris with 6.4 million. Compared to a couple of years ago, the domestic airlines in Mexico are still 33% down what they carried between January and May. Nevertheless, we should take into account that this market has lost one key carrier, Interjet. If we take Interjet out of the equation, we see that the remaining airlines are only 15% down of their pre-pandemic numbers.

In total, adding up the international airlines operating in Mexico, the country has received 26.3 million passengers in 2021. That’s 37% below 2019 numbers. The country still has restored key connectivity with Canada, and the traffic to Europe is only starting to pick up. Earlier this month, Spain allowed the entrance of vaccinated Mexicans.

Colombia so far has had 8.7 million passengers, as reported by local authorities. That’s still 46% down from the pre-pandemic numbers. Domestically, Colombia has had 6.6 million passengers so far in 2021. This market is 35% below pre-pandemic levels. while the international remains nearly 65% down.

In terms of capacity, Colombia is doing so much better than in terms of passengers. Why is that?

We see a few trends:

- Three Colombian carriers are under financial reorganizations. Avianca and LATAM are in Chapter 11 and EasyFly is doing the same under Colombian law.

- Recently Colombia dropped the requirement of PCR test for international travelers, meaning the ramp-up will only happen now.

- Colombia has faced political unrest in the last few weeks.

Final analysis

We expect both Mexico and Colombia continue to drive the Latin American recovery in the next few months. These two countries have no restrictions at all so travelers can visit freely. Meanwhile, other South American nations like Chile and Argentina remain with strict government policies.

Brazil will catch up as the vaccination campaign in the country continues. According to the Brazilian Government, nearly 100% of 30+ years old will be vaccinated by September.

Views: 1