2021 01 15 7 52 49

The writing had been on the wall for over a year, but now it’s official: low-cost airline Norwegian is going back to its short-haul roots and will forego on long-haul operations. The airline has announced a simplified business structure on January 14 on which the foundations – and high expectations – lay for its short and long-term future. It won’t become an easy path.

Formed in 1993, Norwegian only really established itself on the European low-cost market after it grew its Boeing 737-800-fleet from 2002. From Norway, Denmark, and Sweden, the airline was the Nordic competition to both Ryanair and Easyjet. For seven consecutive years, Norwegian was awarded by Skytrax as the “Best Low-Cost Airline in Europe.”

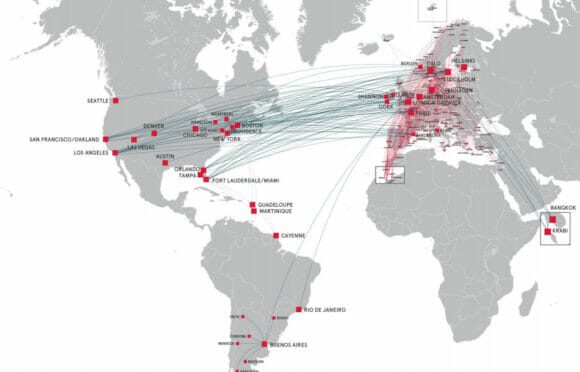

In 2013, Norwegian launched low-cost long-haul services out of Scandinavia, soon to be followed by a base at London Gatwick. Operating Boeing 787-8s and -9s, the airline added new bases in Rome, Barcelona, and Paris in 2016, from where it operated to the US East and West coast, Puerto Rico, and St Croix as well as East to Bangkok. It added Singapore and Dubai in 2017. That same year, Norwegian launched long-haul services into Argentina and continued building its network to sixty destinations from new bases such as Madrid, Amsterdam, Dublin, Cork, Belfast, and Shannon. The Irish hubs were served by 737NGs and MAX’ but closed again after the MAX 8s were grounded.

Norwegian’s long-haul network was at its peak in 2018. (Norwegian)

In 2018, Norwegian’s short and long-haul network had reached its maximum with 500+ routes to 150 destinations. The year marked the turning point, as after five consecutive years of pressing for growth the strategy shifted to profitability and cost reductions. It had to, as debts were mounting and doubt growing if Norwegian could ever continue like this. Over fifty routes – of which twenty long-haul routes – were closed down as the focus moved to the Nordic core and short-haul connectivity, supporting the long-haul network where appropriate. The feeder partnership with Easyjet was to have a pivotal role in expanding the Transatlantic network.

For the Summer of 2020, London Gatwick, Paris Charles de Gaulle, Barcelona, Rome, and Oslo were set to become the bases for thirty Dreamliners, with two more positioned in the US. “We shall be the leading long-haul low-cost airline in Europe operating as the engine of global low-cost alliance and dominating the Nordic short-haul market”, a January 2020 investor’s presentation said, which also stressed the return to sustainable profitability.

March 10, 2020, changed all this when the Covid-crisis kicked in full, and Norwegian was forced on just a single day to cancel 3.000 flights for the coming days weeks. Come April, and 95 percent of the fleet was grounded, including all Dreamliners. They never were to fly with the airline again.

In a bid for survival, the airline launched a restructuring and recapitalization plan that included NOK 3.0 billion in state aid and loans, the issuing of bonds, the cancelation of all its remaining 92 Boeing MAX 8s and five 787s orders, and a major conversion of debt into equity that has given lessors a 53 percent majority share. In total, Norwegian restructured its balance sheet by NOK 23 billion.

Only short-haul

The April 2020 plan already included the announcement of the relaunch as a smaller airline from Q2 2021, as it was clear that except for limited domestic operations, Norwegian would not operate again for the remainder of 2020 and the first quarter of 2021. This new business plan has been launched now on January 14 and focuses on its core Nordic and European markets. “Our short-haul network has always been the backbone of Norwegian and will form the basis of a future resilient business model,” said CEO Jacob Schram.

This network will be served initially by around fifty Boeing 737s, which Norwegian hopes to grow to seventy in 2022. These are owned and leased aircraft, with the twelve owned and four leased MAX 8s looking as obvious candidates. In January 2020, Norwegian had a fleet of 32 owned and 62 leased -800s.

“The Plan”, as Norwegian’s business plan is called, turns the page on long-haul: “ We do not expect customer demand in the long-haul sector to recover in the near future, and our focus will be on developing our short-haul network as we emerge from the reorganization process. Under these circumstances, a long-haul operation is not viable for Norwegian and these operations will therefore not continue”, said Schram. He only left a mouse gap as far as a return to long-haul is concerned: “Norwegian will continue to assess profitable opportunities as the world adapts and recovers from the impact of Covid-19.”

The airline will start insolvency procedures for its legal entities that employ long-haul staff in Italy, France, the UK, and the US. It hasn’t specified the number of staff that are affected by the closure of the businesses, with Schram only saying “our focus is to rebuild a strong, profitable Norwegian so that we can safeguard as many jobs as possible.”

As for the fleet, in early 2020 Norwegian operated eleven owned and 26 six Dreamliners, but they all will have to go.

Net debt to be slashed to NOK 20 billion

Norwegian ended Q3 2020 with a net-interest bearing debt of NOK 48.5 billion, the latest figure available. The plan intends to reduce debt to around NOK 20 billion, with a free cash position of NOK 4-5 billion and a positive EBITDA post-restructuring.

The company intends to raise NOK 4-5 billion in fresh equity by offering a rights issue of NOK 400 million to existing shareholders, a private placement, or a hybrid instrument. Parties have already shown an interest in the private placement, which is scheduled for the end of April. Post-restructuring, existing shareholders will have a five-percent share, impaired creditors 25 percent, and new investors seventy percent.

While the Norwegian government in November expressed its unwillingness to provide additional state aid or loan guarantees, the airline says in an investor’s statement that it “has recently reinitiated a dialogue with the Norwegian government about possible state participation based on the current business plan.”

The scaled-down Norwegian will continue as a low-cost airline, offering competitive fares across its domestic and European network. We have to wait for details to judge how to rate the chances of success of this airline, but rest assured Norwegian will be in a most vulnerable position here. The vultures are out there. Wizz Air has planned an assault on the Norwegian market and looks like a formidable competitor. So is Ryanair, which has been offering extremely low ticket prices in recent weeks. SAS has also set an eye on Norway, as has airBaltic from the next Summer schedule.

Views: 4