291592549 781369773298258 1742044223612760569 n

Iceland’s newest airline, Play, thinks that it has turned the corner on its worst losses and will produce an operating profit later this year. This is all thanks to reaching certain economies of scale in its fleet, network, and operations that will translate into lower unit costs and better financial results, the carrier said on August 23 in its half-year results. Play starts to see the benefits of economies of scale.

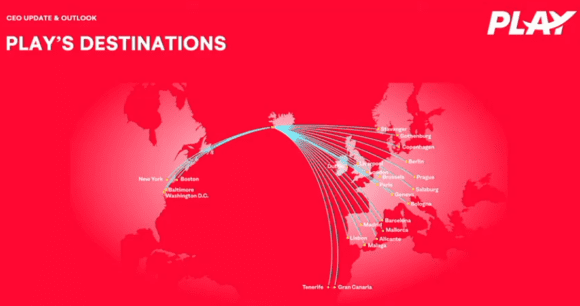

CEO Birgir Jonsson said in a webcast that Q2 has been the last quarter in the build-up phase of Play, which started when it launched services in June 2021. It operated a point-to-point network between Iceland and European destinations in phase 1 but transitioned to a hub-and-spoke model for phase 2 in Q2, launching services to the US in April and growing the fleet to six aircraft in June.

It is reflected in the numbers: from 36.700 passengers in April, Play grew to 87.500 in June for an aggregate of 181.000 passengers in Q2. It now serves 21 destinations, of which fourteen were launched in Q2 alone. After applying for routes to the US, it started new services in April to Baltimore/Washington, Other new destinations are Boston, Dublin, Lisbon, Prague, Gothenburg, Stavanger, Brussels, Malaga, Trondheim, and from June, Bologna Mallorca, Madrid, and New York.

Jonsson said that 64 percent of its destinations are new ones not offered previously offered by other airlines from Iceland and where there is hardly any competition. Its biggest travel market so far is that of Icelanders going abroad (44 percent), followed by visitors to Iceland (30 percent), and (since Q2) transit passengers (26 percent).

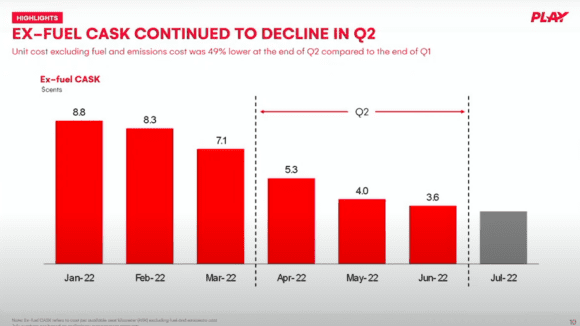

Growing the network and fleet three-fold between quarters has helped Play to benefit from the economies of scale. Its costs per available seat kilometer (CASK) excluding fuel have come down significantly from $0.088 cents in January to $0.053 cents in April and $0.036 cents in June when it took delivery of a sixth (leased) Airbus A321neo.

“We have reached our target of getting CASK under four dollar cents. We were down to 3.6 cents in June and we can see in our preliminary results that we are even lower in July. So the business model and the efficiencies are there, but, of course, we can’t discount the effects from the higher fuel costs”, said Jonsson. “It is not until we got the sixth aircraft that we start seeing the economies of scale. We see that already happening in June, July, and August”, said Chief Financial Officer Thora Eggertsdottir.

Revenues per ASK or RASK also reflect improvements, going up from $0.038 in January to $0.049 in June and even $0.068 in July. Yields per passenger are also higher

Net loss HY1 of $-25.6 million

So the Q2 and HY1 results don’t tell the complete story of Play in 2022. In Q2, it reported a $-14.3 million net loss, with an EBIT of $-14.4 million. Operating revenues were $32.5 million of which $24.4 million were from tickets and $7.7 million from ancillaries. While higher than $9.6 million in Q1, lower demand in May affected revenues as were lower than expected ancillary revenues. Passengers booked less for belly-hold luggage but preferred to take it on board since they were confronted with media reports of missing luggage in many airports. There was also less demand for cancelation protection, although Eggertsdottir said this reflects stronger confidence of the public and its wish to fly. Flight disruptions and delays resulted in some extra costs.

For HY1, Play reported a $-25.569 million net loss (2021: $-1.830 million), an EBIT of $-27.756 ($-3.974 million), and revenues of $42.158 million ($43K). Net cash flow was $-13.8 million. Total expenses were $56.4 million. Fuel expenses were $16.5 million in Q2 and $20.6 million for HY1, but personnel costs were also up as the airline grew its activities. While based in Iceland, it also has an administrative office in Vilnius (Lithuania). It ended June with $39.5 million in cash. Total liabilities stood at $273.7 million, including $40.2 million in deferred revenues.

Expansion strategy as the fleet grows

Play has hedged fuel costs at thirty percent in Q3 and fifteen percent in Q4, but it takes a cautious approach as prices are volatile. With fuel costs, the main determinator of Play’s results but the business model starting to work, the airline is confident that it can further improve on its results in Q3 and Q4. “We are now coming out of the development phase with a strong financial position and finally the external conditions are more favorable after strong headwinds. Oil prices are, for example, going down fast. We see brighter times ahead, our booking status is strong and we plan on showing a positive operating result later this year. People are clearly not deterred from traveling because of the coronavirus anymore. We see that in the increase of our long-term bookings and a drop in cancellation coverage,” said Birgir Jonsson.

Play expects to take delivery of three more A320neo’s and one A321LR via AerCap this coming winter, which will be inducted into the network early next year and bring the fleet to ten aircraft by next summer. It plans to recruit 200 more staff next year to bring its total workforce to 500, which is part of its expansion strategy. Play will add Liverpool to the schedule in October, Geneva in January, and to Washington Dulles from April. More destinations in Europe and North America will follow. The carrier will also start offering belly-hold cargo services as it wants to tap into new revenue streams.

In its guidance for 2022, Play expects a positive operating result/EBIT in HY2, revenues of $150-160 million, CASKs excluding fuel of under four dollar cents, and to carry around 800.000 passengers. “This is a completely different company than it was six weeks ago”, Jonsson remarked.

Views: 26