BREEZE EMB 195.0

David Neeleman is a master airline entrepreneur. He’s very good at starting airlines. His latest effort, Breeze is showing signs of progress. And progress in the US domestic market is difficult – competition is intense and brutal. Yet there are signs that Breeze is making progress.

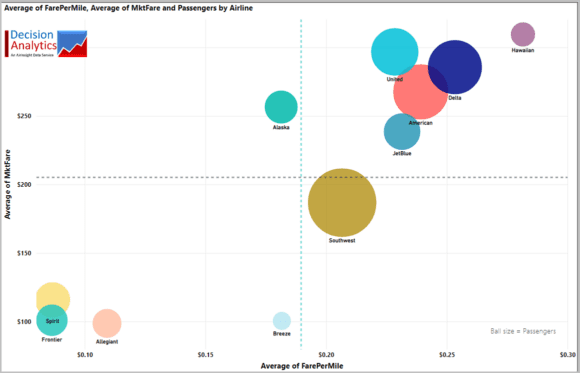

Using the DB1B database we have two charts to illustrate the point. This first chart compares the average market fare with the average fare per mile. The ball size reflects the number of passengers. The chart lists data through March 2022.

Notes:

- Breeze’s average fare compares with the ULCCs. But it has an average fare per mile much closer to the industry average (dashed green vertical line).

- This means chasing new markets allows Breeze to offer ULCC level fares (very attractive) but operate in markets with little if any, competition.

- By the way, you can see why JetBlue is so determined to grow. It’s right there with the giants and needs heft to survive. If you’re not big, in that space you get badly bruised. JetBlue needs to bulk up to survive.

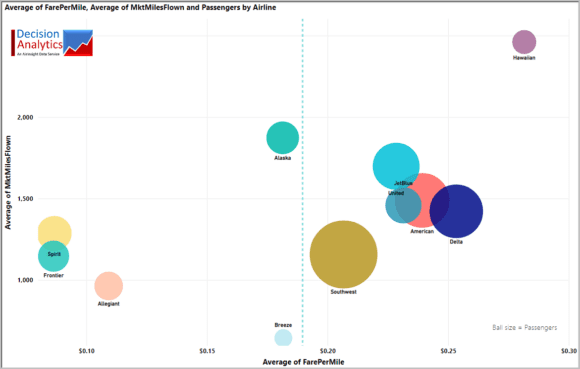

Our second chart is similar to the first one (2022 through March), except now we look at average stage length and average market fare/mile. Broadly the airlines are in similar locations.

Notes:

- Breeze flies shorter legs and, using smaller aircraft, should mean lower costs. Breeze’s average fare/mile at 18c/mile is the same as Alaska’s but Breeze’s average stage is only one-third as long. Not only cheaper but this allows the Breeze fleet more daily turns. More turns mean more disruption among markets being either ignored or discarded by regionals.

- Consequently, Breeze gets to stay out of the way of the bigger airlines. Attracting no competition is very useful. If a regional decided to chase Breeze, it wouldn’t offer a more attractive offering – regional jets are cramped and don’t offer the product Breeze is selling. Breeze not only operates the much more comfortable E-190/5, but it also has the A220-300s.

Other ideas worth noting:

- Alaska and Hawaiian appear “lonely” and exposed. Given industry consolidation, how long will they remain “lonely”?

- And next, who makes a move to acquire? If the DoT allows Spirit to be absorbed by JetBlue, these two might go into play.

Views: 3