A review of the retirement ages for 737s over the generations shows something really interesting.

Looking at the 2019 fleet data and the 737s that have been retired – not written off or parked – shows that each generation has been retiring earlier. The NG’s that have been retired saw half the life of the earliest generation.

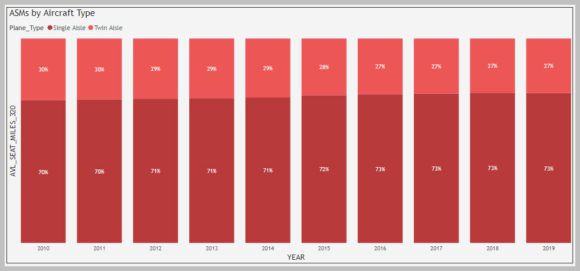

Single-aisle aircraft are increasingly treated as commodities. Pricing is rock bottom as Airbus and Boeing battle for each deal. Throw in the lessors who need to eke out a margin and one can imagine how tightly priced this market is. These aircraft today typically undertake six to seven turns per day (certainly in the US). The following chart shows the US experience – single-aisle aircraft routinely deliver over 70% of the ASMs. They are the industry’s workhorses.

That means that their economic lives are shorter than the earlier generations that were not worked as hard.

The 737 offers the longest history in this segment to demonstrate the growing commoditization. Its popularity among the largest LCCs (Southwest, Ryanair, and Lion) reflects Boeing’s ability to produce the 737 in quantity and sharp pricing. The three airlines mentioned built their business on the 737.

While one can explain the shorter economic life of the newer 737s being due to the aircraft doing more cycles than earlier models, we believe there is also a factor in the commoditization of aircraft. This is not unique to aircraft, automobiles are going the same way. Ford started talking about this in 2015. In 2016 the commoditization of air travel was written about in 2016. Indeed, the Harvard Business Review discussed this back in 2009. The HBR article states: “Hesitate or delay, and you get beaten. You win only by outdistancing the competition, innovating and inventing faster, with more certainty, and with greater breadth than the rest of the field.“

This change seems to be playing out in a way where OEMs know their equipment won’t need to last as long. Perhaps 15 to 20 years for a single-aisle aircraft. The pressure to innovate to drive down operating costs means that every aircraft will likely see its economic life shrink.

A shorter economic life has implications across the industry, from financing to cargo conversions to maintenance. As technology shrinks the timeframe for recovery of new investment, will we continue to see upgrades of older models instead of new models so that OEMs can gain a better economic return? The implications of a shorter life for each new series, combined with the damaged reputation of an aircraft, could shorten expected lifetimes closer to the 15-year time frame. That impact will reverberate across the industry.

Views: 25

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →