2019 10 02 12 00 52

The mainstay of the 100-150 seat market in the US has been the A319 and 737-700. Each of these types is beginning to age. We examined maintenance costs for both types and found that as a percentage of total costs they are moving in different directions. See the following chart. The source of the data is the US DoT Form 41.

On an overall cost per hour basis, the aircraft remains close with a slight cost advantage to the A319.

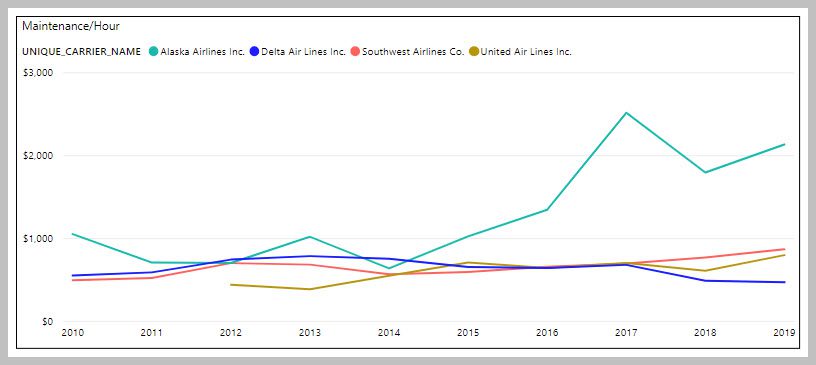

The Boeing 737-700 is used by several large US airlines and is seeing rising maintenance costs that must have operators looking for alternatives. The densest LOPA is found at Southwest at 143. Although the MAX7 will come with up to 150 seats and is seen as the obvious replacement for the 700NG, orders have been anemic.ed on the US Dot Form 41. Clearly, Alaska Airlines is under the most pressure to find a solution. The largest operator of the 737-700 is Southwest Airlines. The curve for that airline is also rising. Only Delta, with a handful in service, has seen a decline in maintenance costs. Delta will probably replace these 700NG with A220s when the time comes. Southwest has been acquiring 800s and MAX8s and has sold several -700s to United. United and American have both been in the market for used A319s.

To get an idea of what the 700NG is costing operators for maintenance, take a look at this chart.

Taking a more detailed look at the numbers we see this. Overall the US 700NG fleet is steadily becoming more expensive to operate. Were the MAX8 available, we might expect to see an active process of retirements as airlines seem to favor the larger model. But these airlines (excluding Delta) with MAXs on order cannot afford to retire anything for want of seats.

The need for a solution is manifest. Airbus offers a solution, but there are no delivery slots. Delta has delivery slots on the A220 tied up for a few years. Boeing has no available solution. The only solution for new aircraft in the near term is from Embraer, soon to be Boeing Brazil. Since this becomes a “Boeing” solution in 2020, might we expect to see a flurry of activity? Meanwhile, the used market remains firm.

Views: 5