737 1000px

The acquisition of the aircraft portfolio of SKY Fund I and the effects of the war in Ukraine dominated 2022 for aircraft lessor Dubai Aerospace Enterprise (DAE). While it grew its portfolio, a write-off on nineteen aircraft in Russia pushed DAE into an adjusted loss of $-279.3 million. Russian write-off pushes lessor DAE into a loss.

Without the asset write-off of $576.5 million, DAE would have produced a $258.6 million profit compared to $188.3 million in 2021. DAE had 22 aircraft placed in Russia and had written off the value of nineteen, plus maintenance reserves and security deposits. The lessor has filed insurance and litigation claims

Total revenues were $1.138 billion, down from $1.238 billion in the previous year. This includes lease revenues from DAE Capital and maintenance revenues of DAE Engineering/Joramco, which reported its strongest year ever. The lessor gained $97.5 million on the disposal of ten owned and 23 managed aircraft and reported a $29.4 million gain on the business combination with SKY Fund I.

Lower revenues

At $1.024 billion, lease revenues were $112 million lower than in the previous year due to lease terminations for aircraft in Russia, as well as cash accounting for airline customers that entered administration plus divestments of aircraft. Engineering maintenance increased to $107.7 million from $88.8 million.

The full acquisition of SKY Fund I from SKY Leasing was completed in November, which cost DAE $1.4 billion in legal and professional fees – more than the $1.3 billion that the 36 aircraft are valued. But they are new-technology aircraft that DAE was keen to add to its portfolio and should generate good revenues in the coming years. Fifty percent of DAE’s lease rentals is coming from airlines in the Middle East, Africa, and South Asia regions.

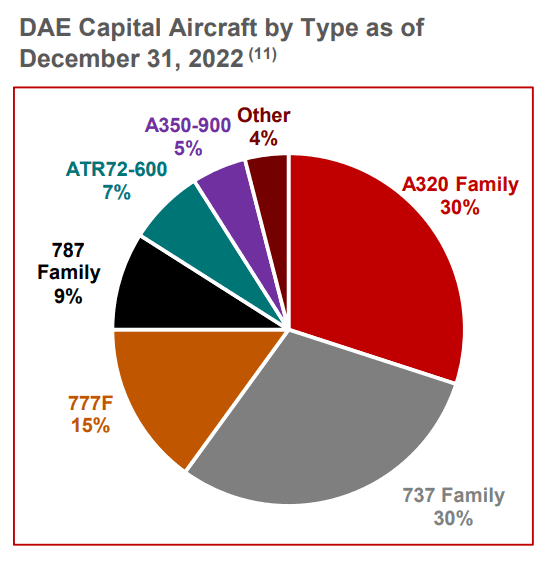

DAE grew its owned fleet to 330 aircraft from 296 in 2021 and its managed fleet to 104 from 79. This includes 34 Airbus A320neo family aircraft, up from ten. The number of A320ceo’s grew to 139 from 125. The number of Boeing MAX grew to 37 from twenty, of which ten were previously ordered by DAE from Boeing. The 737NG fleet went up to 101 from 95. The widebody portfolio is virtually unchanged and consists of 24 Airbus A330ceo’s (26), two A330neo’s (0), four A350s (four), eleven Boeing 787s, three 777s, and twelve 777Fs (thirteen).

Limited new orders

DAE’s strategy of predominantly acquiring aircraft through mergers and acquisitions is reflected in its low number of committed aircraft of six, including two A320neo’s, two 737NGs, one 787, and one 777F. Airbus’ orders and deliveries book for January includes one new A320neo. Including 67 ATRs, this brings DAE’s portfolio to 440 aircraft, up from 385 in 2021, of which 315 are narrowbodies.

DAE ended the year with $2.7 billion in liquidity compared to $2.9 billion a year earlier. Net loans and borrowings stood at $8.0 billion, up from $2.4 billion. From 2024 through 2026, most of this debt has to be repaid.

Views: 4