2020 06 04 airBaltic VNO CDG

airBaltic almost halved its net loss in 2021 and, more importantly, produced a small positive EBITDAR again. This despite the very challenging year that was dominated by the Covid-crisis, it reported on April 14. The improvements reflect a revised business model around a single-type fleet. Single-type business model benefits recovery of airBaltic.

The carrier of Estonia, Latvia, and Lithuania ended the year with a net loss of €135.7 million compared to €-264.6 million in 2020. EBIT improved to €-82.5 million from €-201.7 million, but EBITDAR was positive at €0.3 million compared to €152.3 million. Despite being still 65 percent down compared to 2019, airBaltic grew its revenues to €204.1 million from €144.8 million as it carried 21 percent more passengers or 1.63 million on routes to 94 destinations. Passenger revenues were €180.6 million, up from €130.6 million.

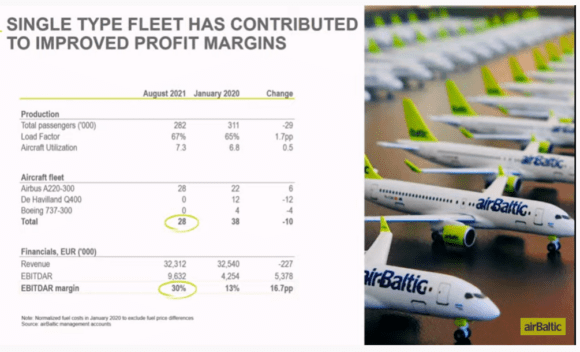

The load factor was on average 53.6 percent, up two percentage points. August was the best month when it carried 282.000 passengers at a 67 percent load factor and produced a profit for the first time. At €32,3 million, revenues were almost on par with January 2020, which was the last month before the Covid-crisis hit and airBaltic operated with a different business model and the fleet still included ten extra Boeing 737-300s and De Havilland Canada Dash 8-400.

New business model makes a big difference

Chief Financial Officer Vitolds Jakolevs pointed out that in August, the profit/EBITDAR margins improved tremendously from thirteen to thirty percent from January 2020 to August 2021. “This means that the strategic decision to shift to a single-type fleet of A220s is already giving dividends and gives us a proper basis for believing that, once the market recovers, this airline will be operating at different profitability levels than it did in pre-Covid times.”

Slide comparing the differences between the old business model with a multiple aircraft fleet in January 2020 versus the current single-type model with improved margins. (airBaltic)

At 57 percent, airBaltic is the market leader at its main hub in Riga but takes the runner-up position in both Vilnius and Tallinn. Jakolevs pointed out that airBaltic operated at level revenues last year that was comparable to that of 2006.

Wet-lease strategy to be expanded

During the pandemic, airBaltic drew up its revised business plan ABOVE 2026 to focus on the post-Covid market. The airline was forced to ground a large part of its capacity but has since then decided to wet-lease out more aircraft, as CEO Martin Gauss explained to AirInsight two weeks ago. The number of wet-leased Airbus A220-300s will grow to eleven, with five operated by Eurowings and Eurowings Discover and another four by SAS. More aircraft are made available for wet-lease in the next couple of years, but only if demand in the Baltic States is lagging behind. airBaltic will take delivery of more A220-300s until 2024, which brings the fleet to fifty aircraft. It has options on thirty more.

Next month, airBaltic will receive the second part of the €90 million in equity from the Latvian government, which is its main shareholder. This first part of €45 million was received in December and helped to partly compensate for the negative equity, which ended at €-118 million last year compared to a positive €17 million in 2020. This confirms how the balance sheet has taken a serious hit during the pandemic, Jakolevs said. The airline expects to start repaying the government investment when it initiates a public offering of shares, which is planned no earlier than the end of 2023 and more likely in 2024. The company continues to hire 250 additional staff, having already rehired 400 people to bring its workforce to 1.750 right now. As it grows to fifty aircraft, it will have a staff of some 2.500.

More bases outside the Baltics are under evaluation

This summer, airBaltic plans to grow its network to 98 routes, including six from its new base in Tampere (Finland) that opens in May, which is its first base outside the Baltics. Chief Commercial Officer Pauls Calitis said that “we have a number of other opportunities that are being evaluated. At the right time, we would be able to execute it. We have the aircraft coming in, so we have the capacity to add more bases than the ones we currently have.”

In the first fourteen weeks, the airline has seen leisure bookings go up by on average 382 percent compared to last year. Business bookings are not expected to recover until 2023 and 2024. Its decision to suspend service to Ukraine and Russia could result in a revenue impact of 6.8 and 2.3 percent respectively if this extends for the full year.

airBaltic guides 2022 with an almost doubling of revenues to €400 million and also a doubling of passenger numbers to 3.3 million. Capacity in ASKs should hit the highest level in the airline’s history at 7.7 billion, but this also includes the operations for Eurowings and SAS. Jakolevs said that airBaltic expects to become consistently profitable in 2024 as it grows its fleet to the optimal size of fifty aircraft, but this all depends on the recovery.

Views: 6