IMG 7382

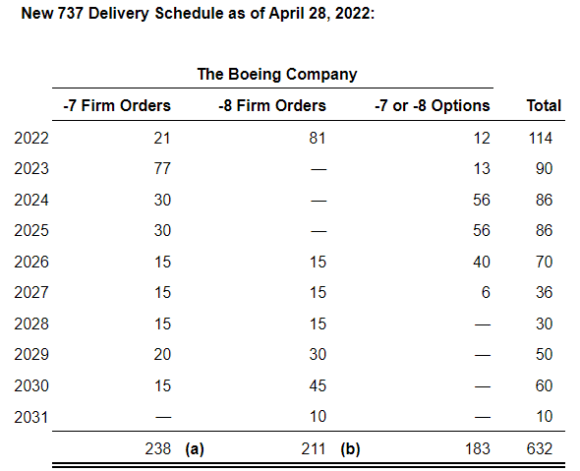

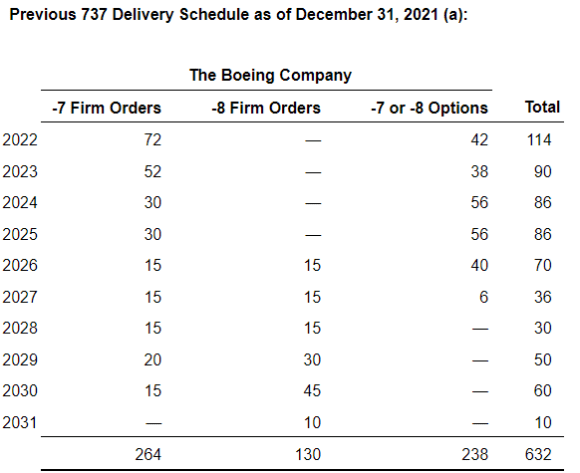

Due to the uncertain time schedule of the Boeing MAX 7, Southwest Airlines has renegotiated its long-term MAX backlog. It has reduced the number of MAX 7s on order by 26 and added 81 MAX 8s to its order book by converting previous orders and exercising purchase rights, it reported on April 28 in its Q1 results earnings release. Southwest reshuffles MAX 7 and 8 orders and deliveries.

In the fleet plan for 2022 that it released in December, Southwest was counting on the delivery of 72 MAX 7s this year. But as discussed in Boeing’s Q1 earnings release yesterday, the airframer has no certainty when the type will be certified by the FAA and other regulators. Although the MAX 7 has completed most of its certification flights, the FAA isn’t willing to rush to rubberstamp the certification procedure. During the earnings call, CEO David Calhoun hinted at a shift within the MAX production split this year if the MAX 7 and -10 continue to be delayed.

More MAX 8s, fewer MAX 7s

Southwest has responded to the situation and converted forty MAX 7 orders that were up for delivery this year into MAX 8s and moved one delivery to next year. It brought forward the delivery of one MAX 8 from 2023 to 2022. To fill the gap of MAX 7s that are unlikely to join the airline this year, it exercised sixteen MAX 8 options for delivery this year and exercised ten options for -8s that were scheduled for 2023 but will now be delivered this year. Southwest has shifted ten MAX 7s on firm order to 2023 and exercised two options also for delivery next year. In the first quarter, the airline had already exercised options on fifteen MAX 8s for delivery this year and on twelve MAX 7s for delivery in 2023.

The updated schedule for 2022 through 2024 now sees the following deliveries (in brackets the numbers for December): MAX 7: 2022 21 aircraft (72); 2023 77 (52). MAX 8: 2022 81 (0); 2023 0 (0). Options MAX 7 and 8: 2022 12 (42); 2023 13 (38). Between 2024 through 2031, the delivery schedule is unchanged. The total number of MAX 7s now changes to 238 from 264 and for the MAX 8 to 211 from 130. Southwest still has 183 options compared to 238 in December.

During the earnings call, Chief Financial Officer, Tammy Romo, explained the reshuffling of orders and deliveries: “We are eager to get the MAX 7 into our fleet and we remain confident in the aircraft. We simply wanted to ahead with our 2022 order book to provide more certainty, given the ongoing certification process for the -7. We are grateful for the flexibility in our order book to shift between the -7 and -8 and our plan this year to take 114 aircraft deliveries and retire 28 737-700s remains unchanged.” Romo added that “we feel really good about the MAX 8.” Southwest will make a decision later this year on exercising the remaining twelve options it has for 2022 but has no wish to give up the production slots. It feels comfortable if the fleet mix ends up at 60/40 MAX 8/MAX 7s instead of the opposite mix that was originally planned. The airline maintains its Capex guidance of $5.0 billion for this year.

Full-year capacity reduced by four percent

Southwest Airlines reported a $278 million Q1 loss compared to a $116 million profit in the same quarter of 2021. The operating result was $-151 million compared to $199 million. Operating expenses were up 161.5 percent to $4.8 billion, of which fuel costs 114.1 percent higher to $1.0 billion took up the lion’s share. Salaries, wages, and benefits were also higher to $2.2 billion, an increase of 41.9 percent. Total revenues increased to $4.694 billion versus $2.052 billion last year, of which $4.135 billion were from passengers, up from $1.712 billion.

January and February were weak and resulted in a $380 million headwind from reduced bookings and cancelations. But March saw a return to strong profitability and revenue per seat miles (RASM) and operating revenues were even higher than in Q1 2019, the first time this happened since the start of the pandemic.

Like many other airlines, Southwest suffered from acute staffing issues in January as Omicron cases increased, costing the airline another $50 million extra. This forced the carrier to cancel many flights. To be better prepared, the carrier has hired 3.300 new staff in the first-quarter net of attrition and remains focused on hiring and training. While not as drastic as the ten percent capacity that JetBlue has announced for the full year this week, Southwest, too, is reducing capacity. It expects to return to 2019 capacity levels this year, but this has now been revised to minus four percent for the full year and minus seven percent in Q2.

The carrier is expecting Q2 operating revenues to be eight to twelve percent up from 2019 as leisure bookings are strong and also look good for May and June. Business travel should recover to seventy percent of 2019 levels, having been down at 45 percent in Q1. While high fuel costs affect the industry, Southwest says it is well-prepared. It had hedged 63 percent for the second quarter and sixty percent for HY2 with a price per gallon of $2.75-$2.85.

Views: 3