230723 D225 Plane 7 source scaled

UPDATE – Boeing’s announcement that the first deliveries of the MAX 7 will only start in 2024 must have come too late for Southwest Airlines to include in its HY1 earnings release. The carrier still includes 31 deliveries of the type for 2023. But during the earnings call, President and CEO Bob Jordan made it clear that Southwest is counting on the MAX 7 to enter service only sometime next year. Southwest’s MAX 7 planning can go out of the window.

Southwest continues to plan conservatively for the rest of this year. It reiterates its April guidance for schedule planning and remains confident that it will get seventy MAX 8s this year and retire 26 737NGs. This is twenty aircraft below the January plan and brings the fleet to 814 aircraft by the end of December. “The 2024 plan should be much more stable. We are currently planning to fly the MAX 7 at some point next year but if not, we will take MAX 8s instead just as we are doing now,” Jordan said.

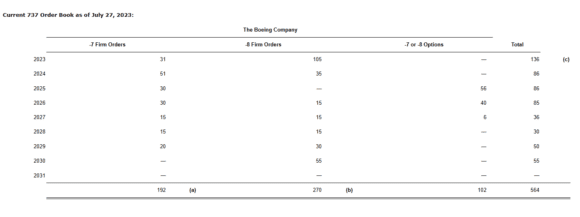

The number of aircraft deliveries differs from what Southwest includes in its contractual deliveries list (see below). This has been further amended in the past quarter following changes to its MAX orders, as has become de rigor in all recent earnings releases. Since April, Southwest exercised options for nineteen MAX 7s for delivery in 2024. At the same time, orders for sixteen MAX 7s for delivery in 2024 have been converted into MAX 8s. This brings the total MAX 7 orders to 192, up three from April. These aircraft should be delivered next year.

82 MAX 7s now to be delivered in 2024

Following the delay of the first deliveries until 2024, Southwest must now be preparing for the induction of 82 MAX 7s next year: 51 that were in the 2024 schedule, plus the 31 scheduled for 2023. Actually, fourteen of these are listed as contractual deliveries from 2022 that were pushed out last year.

The number of MAX 8s on order now stands at 270, up from 254 in April. The schedule includes 105 deliveries this year, which is identical to the April guidance, of which 32 were supposed to have happened last year. In 2024, the number goes from nineteen to 35 aircraft. Southwest now has 102 options remaining for either the MAX 7 or -8s. Once they are exercised, this would bring the fleet to 564 aircraft. In Q2, Southwest took delivery of 21 MAX 8s and retired eleven 737-700s.

Southwest’s delivery schedule for the Boeing MAX 7 and -8. The airline is taking a more conservative line for capacity planning purposes. (Southwest Airlines)

Record-high revenues

Southwest reported a $683 million net profit for Q2, compared to $760 million in the same period of 2022. Total revenues reached an all-time quarterly record at $7.037 billion, up from $6.728 billion. Passenger revenues were $6.409 billion versus $6.119 billion, ‘other’ revenues $581 million versus $562 million, and cargo flat at $47 million. Leisure bookings were strong but also close in. While business bookings saw a sequential improvement over Q1, they are still lagging behind.

Like other airlines, Southwest reports lower revenues per available seat mile (RASM) compared to Q2 last year. The drop of 8.3 percent is largely driven by “a five-point headwind from approximately $300 million of additional breakage revenue in second quarter 2022. The higher breakage in the second quarter of 2022 was driven by higher-than-normal flight credits issued during the pandemic that were set to expire unused, prior to the Company’s July 2022 policy change to eliminate expiration dates on qualifying flight credits. The percentage of breakage revenue normalized to historical levels beginning in the third quarter 2022.”

Operating expenses for the quarter increased by 12.1 percent to $6.242 billion, with one the biggest increases coming from salaries and wages at 26.5 percent to $2.786 billion. Fuel costs were 14.2 percent lower to $1.403 billion. The operating profit was $795 million, down from $1.158 billion in Q2 last year.

The HY1 results still reflect the after-effects from the Christmas-period meltdown in 2022, which resulted in a $-159 million net loss for Q1. But thanks to the strong second quarter, the net profit was actually higher than in HY1 last year: $524 million versus $482 million.

Revenues increased to $12.743 billion from $11.422 billion, of which $11.514 billion was from passengers (up 12.3 percent). Operating expenses increased 17.4 percent to $12.232 billion. Fuel still came out more expensive at $2.950 billion, up 11.7 percent year on year. The HY1 operating profit was 511 million, significantly down $1.007 billion last year.

Network optimization

Jordan says in the earnings release that Southwest has largely restored the network, but it is not optimized. “We are working to align our network, fleet plans, and staffing to better reflect the current business environment. While business revenues continue to recover, they are not back to pre-pandemic levels—therefore, we are revamping our 2024 flight schedules to reflect post-pandemic changes to customer travel patterns. We estimate these meaningful network optimization efforts and the continued maturation of our development markets will contribute roughly $500 million in incremental year-over-year pre-tax profits in 2024, which we believe will support another year of margin expansion.”

The optimization, which should become effective by March next year, will reduce costs and improve revenues for 2024. The main driver is to adapt to the new travel behavior, notably in business travel. From pre-pandemic short-haul travel, frequent trips, and more mid-week travel, leisure and business customer behavior has changed to more long-haul travel. Asked if Southwest is not responding to a hang-over effect from the December meltdown and negative perception, Bob Jordan replied that recent record bookings confirm that customer confidence in the airline remains.

Speaking about December and the upcoming Winter, the carrier has almost completed “a robust winter operations plan” that should guarantee that last Christmas was a one-off. Southwest is not giving guidance for next year except that it expects Q1 capacity to grow fourteen to sixteen percent year on year. One target clearly is to get back to 2019 profit levels as quickly as possible.

Q3 bookings are strong, with more bookings registered right now than at the same time in Q2 thanks to a good response to the airline’s sales campaign. Third-quarter capacity is guided for a twelve percent growth and 20-22 percent in Q4, but the full-year average will be fourteen to fifteen percent as stated in April. RASM will likely be down by three to seven percent in Q3. Higher costs from new labor contracts will push costs per available seat mile (CASM) excluding fuel up by 3.5 to 6.5 percent year over year, but they should be down by one to two percent for the full year.

Southwest ended June with $12.2 billion in cash and short-term investment, plus a $1.0 billion credit line. Long-term debt stood at $8.0 billion.

Views: 44