A controversial tweet from Donald Trump has caused concerns about the future of Air Force One. The President Elect...

747-8

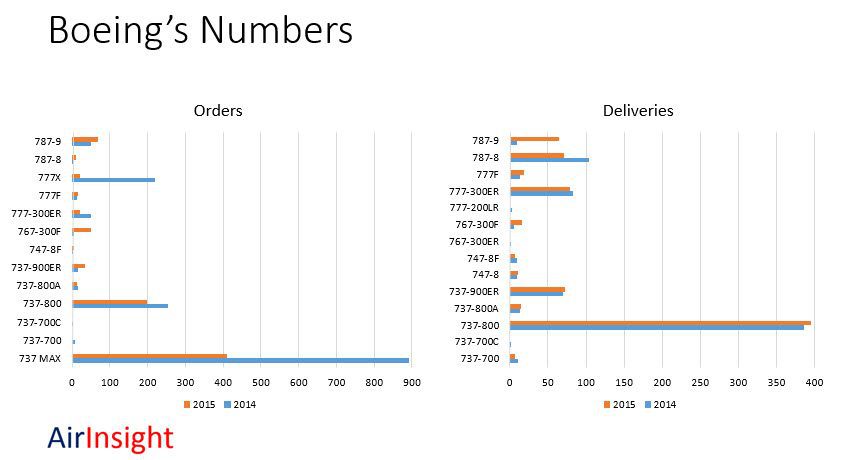

Yesterday Boeing released their 2015 O&D numbers. Let’s look at the numbers. First a chart to show the scale...

Russian airline, Transaero, deep in financial difficulties, was supposed to be taken over by Aeroflot. Turns out Aeroflot won’t...

AirInsight’s newest report is will be available Friday, January 16th. The report consists of 46 pages with 23 tables...

The fact that the Very Large Aircraft segment has slow demand is not in doubt. Sales have been at...

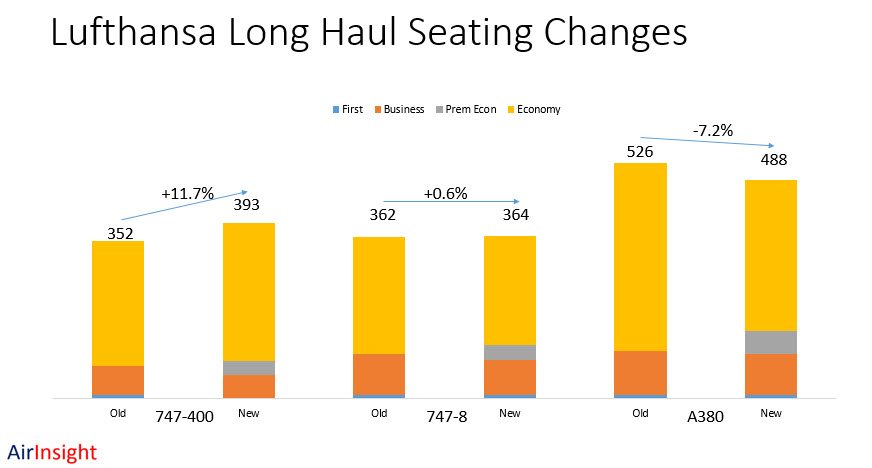

As Lufthansa tweaks its business to become more competitive, it has undertaken some interesting actions on the long haul...