A330neo 1 scaled

TAP Air Portugal returned to profitability for the first time since 2017, ending 2022 with a strong fourth quarter and the full year with a small profit. The airline is seeing the first positive effects of the transformation plan but warns of headwinds and challenges ahead. And this includes troubles in the Board room. TAP Air Portugal returns to profit after four years of losses.

TAP produced a €65.6 million profit for FY22 compared to €-1.599 billion in 2021, a huge improvement thanks to the strong recovery of air travel. Revenues were €3.485 billion versus €1.389 billion, of which €3.072 billion came from passengers (2021: €1.067 billion), €258.3 million from cargo (€236.2 million), and €132.1 million from maintenance (€54.1 million).

Not surprisingly, operating expenses were higher to €3.217 billion from €2.877 billion, with fuel costs at the top of the bill three times higher to €1.097 billion. Hedging saved the airline only €85.5 million in fuel costs. The operating result or EBIT was €268.2 million, up from €-1.489 billion in 2021. TAP carried 13.8 million passengers in 2022, up 136.1 percent year on year, and operated at 87 percent capacity compared to 2019.

Looking at Q4, TAP produced a €156.4 million net profit versus €-971.5 million in 2021. Revenues reached a record-high and totaled €1.045 billion (2021: €561.7 million), of which €917.8 million came from passengers but they were predominantly driven by higher fares and higher capacity. Passenger revenues per available seat kilometers were up by 54 percent year on year to €7.64 cents. Total expenses were €922.1 million, down from €1.627 billion. The operating profit was €122.7 million versus €-1.066 billion.

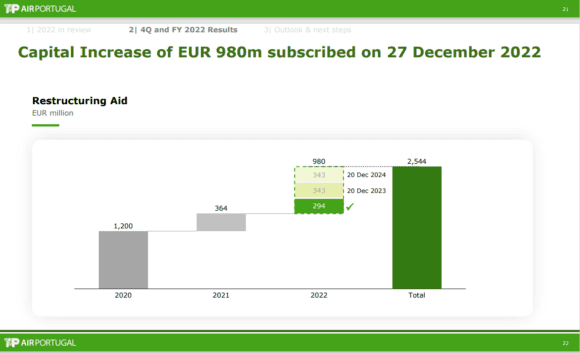

TAP Air Portugal has received 1.858 billion in restructuring aid from the Portuguese state, with another 686 million to come. (TAP Air Portugal)

Headwinds

Not all went to plan in 2022. At the start of the year, it was Omicron that kept demand low, but this changed in the spring. By then, geopolitical issues and inflation were new headwinds. During the summer TAP was confronted by operational issues and staffing constraints at various airports in Europe, a strike of its own crew, a software update that went wrong and affected 300 flights, supply chain issues, fewer aircraft deliveries, engine issues, and an aircraft that was in Guinee for four months.

Some of the issues will continue this year, including high inflation. But TAP is also capacity constrained at its Lisbon hub and feels the pressure from low-cost rivals like Ryanair and easyJet, who plan to grow capacity in Portugal this year. It means that TAP needs to be focused on keeping the costs down, generating cash flow and a stable income position, and deleveraging the balance sheet.

Transformation plan

The airline is on the right track with its transformation plan, which it launched during the Covid crisis and included a full bailout by the Portuguese government. Since 2020, the state has injected €1.858 billion in restructuring aid into TAP Air Portugal, with two more cash injections of €343 million each planned for December 2023 and December 2024. It has helped to bolster liquidity to €1.043 billion, but total financial debt stands at €1.618 billion, up €162 million over 2021.

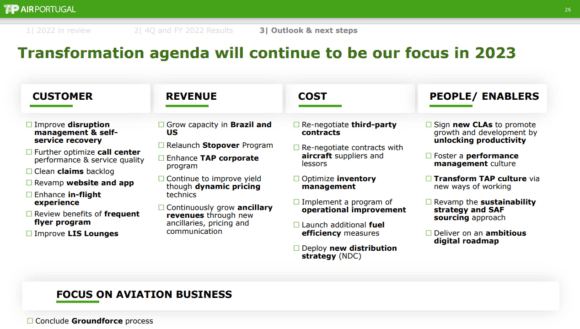

A slide showing the priorities for 2023 in the transformation plan. (TAP Air Portugal)

The first year of the transformation plan has already generated success. On the revenue side, RASKs were up by 21 percent over 2019, ancillary revenues by 28 percent, and cargo, and maintenance by eleven percent. Costs have been reduced: by renegotiating contracts with suppliers, €150 million was saved. Weight reductions reduce costs per aircraft by €1.5 million, while fuel efficiency measures have saved €9 million. As CEO Christine Ourmières-Widener said last year, TAP wants to renegotiate all collective labor agreements, many of which are outdated. All CLAs have been denounced and are being renegotiated. TAP also improved its customer call center response, reduced its refund backlog by 82 percent, and opened 31 new lounges.

Priorities for this year are growing ancillary revenues even more, improving yield through dynamic pricing, enhancing the TAP Corporate program, and growing capacity in Brazil and the US. Renegotiated contracts with suppliers, lessors, even better fuel efficiency programs, and a new NDC strategy should reduce costs further. On the labor side, the airline already recruited 773 new staff, but the new CLAs should reduce costs and improve productivity. The focus is also on further improving the customer experience and operational resilience.

CEO issues

It remains to be seen if Christine Ourmières-Widener and the Chairman of the Board, Manuel Beja, will be around at the next Q1-results earnings call. Both have been fired on March 6 by the Minister of Finance over alleged misconduct, as they both approved a €500.000 compensation to another member of the Board of Directors, Alexandra Reis. The Portuguese accounting office concluded that the compensation was disproportionate and unlawful, which resulted in the CEO’s and Chairman’s dismissal.

However, on March 14, a final decision has been postponed until a hearing, which should be held by the end of this week. Only then a final decision on the sacking will be made. Until then, Ourmières-Widener and Beja remain in office, which explains why the French CEO was presenting the 2022 results today. Immediately after her sacking, she already announced that the decision had been discriminatory and that she would seek legal steps.

Views: 19