2020 12 29 8 12 24

In the end, aircraft deliveries are a more important metric than orders. Customers sometimes order a cheaper, smaller model, especially in the single-aisle market, and then upsize when the aircraft is ready to build. The single-aisle market carries (by far) the plurality of air traffic. This makes it the most important market, even if the aircraft are commoditized.

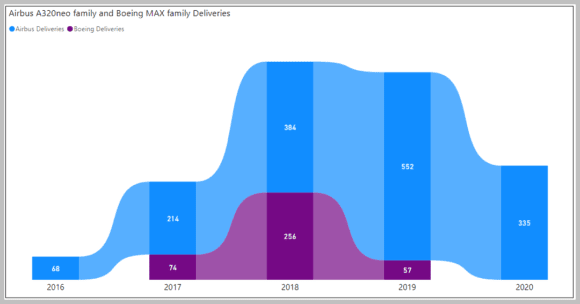

As the year closes, and the MAX can now be delivered again, what does the delivery history look like? The chart below is through November 2020. The numbers are likely to show a year-end spike, and this will be reported in mid-January 221.

The grounding of the MAX clearly puts Boeing way behind in this crucial market. MAX deliveries going forward are going to be less rapid than they might have been, given the pandemic. About 10% of the MAX backlog was delivered prior to the grounding. As we have pointed out, there are several airlines that want their MAXs as soon as possible anyway. There are (strongish) airlines that see current market weakness as an opportunity to capitalize on the weakness in markets as other airlines close down.

Moreover, Boeing 737NG operators kept older aircraft in service because they had to since MAX deliveries were frozen. These bankable airlines want their MAXs. They want them on their network planning timeline, but if an airline has just put an NG through an overhaul, they will likely want to get their five years out of that overhaul and will move the delivery skyline appropriately to match their fleet needs and financial wherewithal. Just because the MAX is now available doesn’t mean you want to take it during a pandemic when you have just spent money on maintaining an NG that should have been a run-out trade-in.

At the same time, bankable airlines with A320neos managed to take deliveries and retire older A320ceos. This has allowed them to have better operating economics. Moreover, their pilot cadre remained current whereas MAX pilots need some additional training. The benefit of uninterrupted timing is the critical factor here – aircraft purchased for replacement continued as scheduled, while aircraft for growth were deferred, which is why Airbus cut its production rate. And while lower maintenance costs are a benefit, it is dwarfed by the 16% improvement in fuel burn.

The single-aisle segment is brutal. It is also the segment where LCCs ensure the thinnest margins. This is why so many have gone out of business. But we see that some of the strongest single-aisle operators today are those LCCs that have the critical mass and are financially viable. Their success means this segment will continue to see razor-thin margins.

The good news for Boeing is that they have several bankable customers eager for their MAXs. But among the hundreds of undelivered and parked MAXs there are several “white tails”. Alaska took advantage of this to acquire deals on aircraft believed to have been ordered by Primera, which is now out of business. Alaska got a deal and Boeing thinned their “white tails”. Because a large number of MAX orders have no customer identified, it is not clear just how big the “white tail” pool is. We do know, for example, that Jet Airways with 125 ordered account for several of these. Then we have Lion Air with 251 on order, a number that was in doubt pre-Covid and pre-crash. And, for that matter, how stable are the Ethiopian MAX orders? Only five have been delivered.

Airbus and its customers have been able to build a substantial market advantage. In a commodity segment, where the lowest production costs are the Holy Grail, Airbus has picked up a lead. And it is a lead that Boeing will have to fight hard to overcome. Commodity pricing means trouble for the supply chain and labor. Boeing does not want any more labor trouble (a subject worthy of a post of its own). It has tried to keep its MAX supply chain on life support. The options for Boeing to win back the market are going to be expensive, no matter what it does.

Three additional thoughts warrant mention. Airbus has built a market share advantage by filling the 757 market with A321neo variants as larger MAX models are not really competitive. Airbus also captured the 135-seat segment with A220-300 against MAX7. The MAX has, effectively, one successful model (-8, which is very competitive) but does compete well with A321neo. Airbus now has a 60-40 lead in orders, a difficult challenge for Boeing. The old adage is that it costs 10 times as much to regain as it does to defend market share will haunt Boeing.

The Bottom Line

The “so what” is that Boeing doesn’t have a viable competitor to the A321, has lost 10 points of market share, and can’t afford to but also can’t afford not to invest in a new aircraft to compete effectively with the A321. Otherwise, it will continue to lose market share and within a decade become a clear number two player rather than vying for industry leadership.

Boeing is between a rock and a hard place and doesn’t know if the airlines operating the MAX will experience a passenger backlash.

They are effectively re-delivering 370 plus aircraft that were grounded and have 450 aircraft on the ground, all in a market that can’t support the additional capacity. While deliveries count, production also is needed to maintain the supply chain.

Views: 2