DSC1006 scaled

The news that Boeing is adding a MAX FAL at Everett must have customers sighing with relief. MAX deliveries have been slower than desired. Boeing needs to catch up after nearly two years of MAX grounding. The market also changed during the grounding, requiring more than tweaking at Renton.

As noted by TAC, the Everett decision was made without Boeing trying to get State tax breaks and without a “corrosive cudgel held over the heads of employees” or demands for labor contract renegotiations. That seems to signal Boeing is not in the mood for time-consuming conflicts. Almost certainly, to the relief of everyone in the Pacific Northwest.

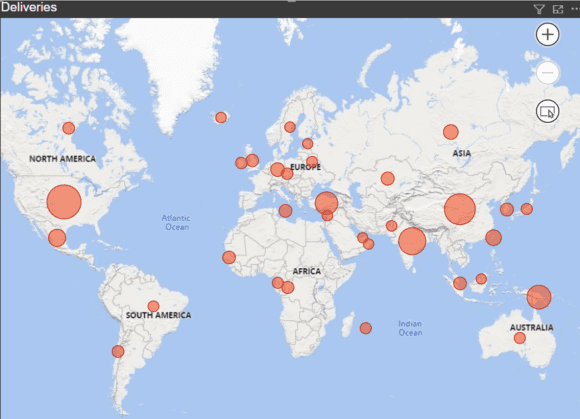

Our view is the “North Line” might be best focused on the MAX10. This allows Boeing to catch up on the market’s evolution to larger single-aisle aircraft. Airbus had a glorious monopoly period while Boeing worked through its MAX crisis. The following map shows where Airbus delivered A321neos over the past two years (through Jan 30, 2023).

The global airline industry bought into upsizing. Whereas it used by the US airlines were the biggest fans of the larger single-aisles, that demand now also exists in India, China, and the EU. Moreover, a global pilot shortage means moving growing traffic with larger aircraft. The fact that these aircraft have a longer range (in the case of the A321neo variants) adds to their ubiquity.

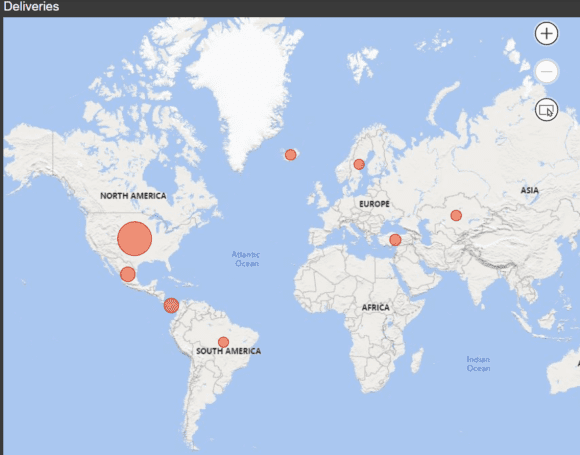

Now look at the MAX9 deliveries for the same period; it is self-evident what Boeing needs to do. The MAX9 does not compete effectively with the A321neo. The market needs the MAX10 capacity and responded with orders. As efficient as Renton is, can it be squeezed to deliver faster?

Consider also that Boeing has to get the MAX7 delivered to its key 737 customer. That would be Southwest Airlines, which has taken delivery of 108 MAX8s over the past two years (through Jan 30, 2023). The MAX7 is a niche model and attracted greater interest than the A319neo. Airbus has the A220 family to offset tepid A319neo interest. The MAX7 is all Boeing has, and therefore must address this market. Southwest has taken MAX8s and would likely have taken fewer of these were the MAX7 ready.

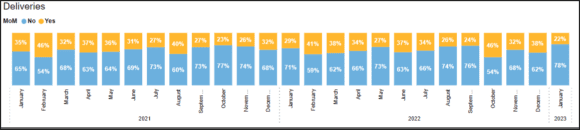

Readers are familiar with our focus on the single-aisle MoM. The following chart is a refresher of where the market is. Among single-aisle deliveries, MoM demand continues to grow. Boeing needs to address this demand with the MAX10. The sooner, the better.

The Everett “North Line” is going to help MAX production to the relief of customers. This is also great news for the supply chain that helps justify capex made before the MAX grounding. Boeing’s decision to hire more people also signals the market positively. The combination of news from Boeing is favorable across the board.

Views: 0

From Boeing’s Form 10-K:

“At December 31, 2022, we had 27 737-7 and 3 737-10 aircraft in inventory and 236 737-7 and 720 737-10 aircraft in backlog”.

At December 31, 2022, Airbus delivered 931 A321neos and had 3678 A321neo aircraft in backlog.