Frontier A321XLR e1560947480320

Yesterday, we looked at Frontier’s results.

Frontier chased Spirit and lost out to JetBlue. As we were told, no matter how that turned out, Frontier would make money on the deal because if JetBlue won, they would pay it a premium on its stake. Now that the JetBlue/Spirit deal is iffy, Frontier might benefit again. Spirit needs help, and Frontier might be the only source of that help.

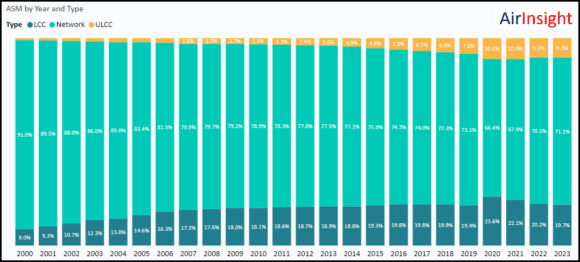

Let’s take a different approach to looking at Fontier’s performance. The chart below shows interesting trends. Note that the ULCC segment is growing faster than the LCC segment. The majors are winning some business back by offering those basic fares.

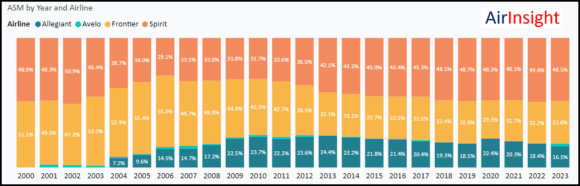

Digging into the ULCC segment, we get this chart. It is useful to see how big the players in the ULCC segment are relative to each other. Frontier is a lot smaller than Spirit and is not struggling as much.

History shows Frontier’s growth has been more deliberate and measured. This leaves it stronger and able to capitalize on bigger but weaker competition.

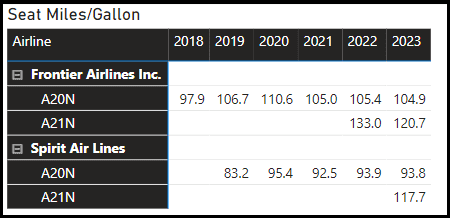

Frontier noted the lower fuel burn in its statements. Borth Spirit and Frontier have upsized the A321neo and opted for the Pratt & Whitney GTF. Here’s what their fuel burn numbers look like. While we have good reason to doubt the veracity of Spirit’s DoT reporting, the difference between the two is significant. (Since you’re wondering, yes, the DoT knows about Spirit’s reporting.) The poor reporting and the numbers confirm Frontier is run much more tightly.

Views: 4