DSC7473

Amsterdam Schiphol decided to limit slots next summer. Here is a link to the airport’s Capacity Declaration for Summer 2024. And here is the airport’s explanation to the cargo community. Reaction from the US airlines was negative.

The US DoT also retaliated by considering limits to the schedules of KLM and Martinair. JetBlue just started service to Amsterdam and seemed to have lost all 2024 access. Delta decided to bring in their lawyers.

Under pressure from the DOT and European Commission, the Dutch caretaker government backtracked and allows some 452.500 movements this year, up from 441.800 in 2023.

Still, a new government could continue plans to reduce capacity in November. How will this play out? It is still unclear, but it helps to understand the impact size using the I-92 data. This data is unique in that it is a census of every flight departing the US. The passenger count is a census, not an estimate. It is reported more quickly than any other source.

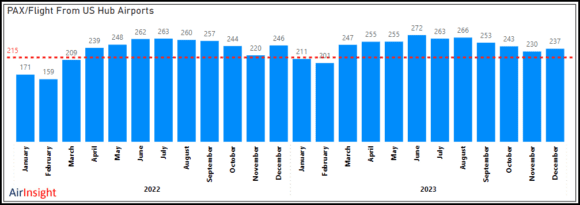

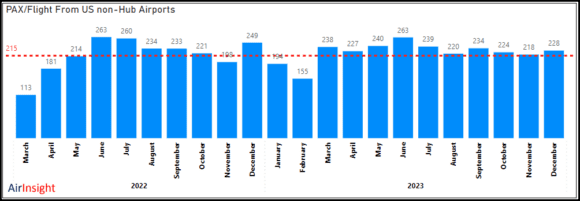

Using this (just updated for the full year 2023) data source, we can track traffic flows from the US to Amsterdam monthly, starting January 2022. We have two charts – the first is for traffic from US hub airports. The second is for non-hub US airports.

On the charts, note a horizontal red line 215, which guides where a single-aisle MoM aircraft might operate. The reason for adding the line is to highlight an important metric. Even as the ESG comes under scrutiny, there is still a consideration for an industry trying to go green. After all, Schiphol states slot scarcity is related to “...balances the requirements of aviation growth at Amsterdam Airport Schiphol, noise reduction and local environmental quality.”

Looking at US traffic from hub airports, the seasonality is clear with AMS as the destination. The summer months warrant large aircraft. Note also that 2023 monthly numbers are somewhat higher than 20222, guiding to growing volumes.

What should we expect from losing AMS slots? Even larger aircraft. Delta’s A350-900s might not be large enough for its flights, and the same applies to its A330-900s. Delta may be working on a solution, though. KLM’s largest aircraft is the 777-300ER, which has a DVT-inducing 408 seats. KLM will probably have to put this fleet into the US in the summer to optimize its operations.

What about US non-hubs? The following chart shows that typically, a single-aisle MoM works more often than not. There is seasonality that demands larger aircraft at peak times.

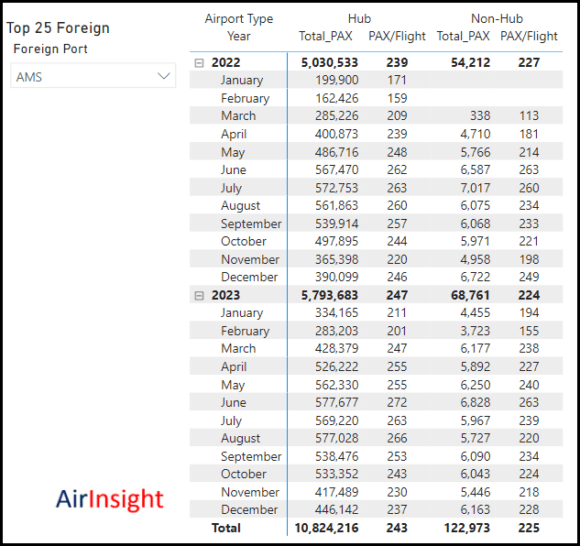

Although US hubs account for ~98% of the traffic to Amsterdam, there are opportunities in niche markets. The table below provides another view of the size of this market.

The non-hubs are small, but an airline can unzip opportunities with the right single-aisle MoM.

Besides the obvious Dutch-based operators like Transavia (its first A321neo just delivered), there are the MAX 9s at Icelandair and the A321neos at PLAY.

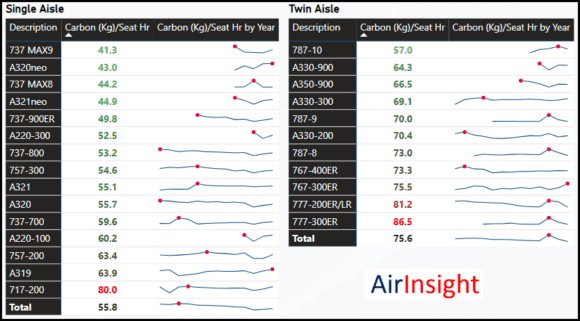

Let’s get back to the ESG part of this post. Schiphol wants cleaner and quieter operations. The engines on the newest aircraft are exceptionally quiet. These new engines also offer state-of-the-art fuel burn.

The MAX 9 and A321neo are among the greenest single-aisle aircraft and could serve many US flights to Amsterdam. JetBlue flies the A321neo to Amsterdam – you would have thought Schipol would jump at the chance to allow this green operation to continue!

On the twin-aisle side, the 787-10 is on top and is used by both KLM and United. The A330-900 and A350 rate are among the greenest models. The 777 models used by American, United, and KLM are the least “green.”

Bottom Line

How will the standoff between Schiphol and the US Dot play out? It’s not clear just yet.

We can say that the airlines need to upsize their aircraft serving the market. KLM and United have the right 787-10, and Delta’s A350 and A330-900 are also the right tools for the job. United and KLM can upsize further to 777-300ER, a less green option. If demand grows beyond this capacity, expect fares to rise appreciably. With 98% of the market, should we expect any big moves? Probably no more than equipment optimization to ensure the highest revenues at the lowest cost. The ESG pushback underscores that industry “green” is not the same “green” that the environmentalists want.

Finally, the non-hubs could exploit any US hub capacity constraints. If Schipol allows it, these operations will use the cleanest and quietest aircraft. Schiphol should encourage and favor these operations. But Dutch politics seem to be rather different.

Views: 1