E175 E2

The US has long been the leading regional airline market. But there’s a wrinkle. No OEM in the regional aircraft business will succeed without offering an aircraft that complies with the US Scope Clause.

As a consequence of this outdated policy, the market is increasingly stymied. New aircraft are heavier due to the introduction of new engine technology. This is the reason we don’t have the E175-E2 or Mitsubishi SpaceJet. Both would have delivered double-digit fuel burn improvements over current models in service.

The Scope Clause is an unsustainable tax

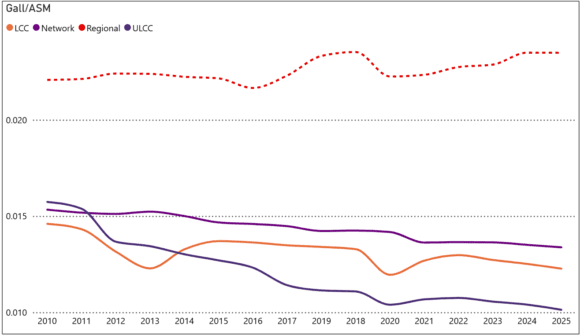

There is a trickle-down of the Scope Clause to the airline operational issues. If regional airlines can’t improve fuel burn, then service must shrink. Take a look at this chart, which effectively illustrates the situation.

Regionals may not pay for their fuel when operating for a major airline. But their economics are upside down, and the trend is increasingly uncompetitive. Flying older, high-fuel-burning aircraft is a threat to the industry.

The state-of-the-art regional aircraft, the E175, first flew in 2003. Over the past 20 years, this aircraft has been in service, and Embraer has tweaked it to improve its fuel efficiency. But enhanced winglets, aerodynamic tweaks, engine and flight software tweaks only get you so far. A step change is needed.

Regional airlines must upsize aircraft to achieve economies of scale. But they have hit the Scope Clause wall, and there’s no relief in sight. While other airline types show declines in fuel burn, regionals are heading in the opposite direction.

The Scope Clause has become an unsustainable tax on travelers, causing small communities to lose air service and harming more people than it “protects.”

Options?

How do US regionals achieve relief through economies of scale? In a word, consolidate. This is what the bigger airlines also did. Let’s take a look at what’s happening with US regionals.

This three-page model provides a clear understanding of the trends in the US regional airline industry. It’s not a pretty picture.

SkyWest

The consolidation trend is clear. SkyWest is the Big Dog, and it’s getting bigger. That’s great for shareholders. However, even this company, with 488 aircraft and a well-run operation, cannot deliver air service at will. The pilots’ union has attempted to stop creative ways to build air service.

If one of the country’s best-run airlines can’t escape the Scope Clause, what future awaits other regional airlines? Should SkyWest transition to larger aircraft, such as the E190-E2? This requires a significant shift in their business. And it means no longer being a regional airline. There’s enough risk in running an airline without having to take on extra risks. Besides, how do you think SkyWest’s big airline partners are going to react? You don’t bite the hand that feeds you.

Industry Implications

The evolving situation facing the industry is not great. The market is shrinking because the Scope Clause is pricing out traffic. For new regional aircraft technology to succeed, it used to be that you needed to get a US regional to sign up. Mitsubishi did this with Mesa. Both brands are gone.

For Maeve to sell their new regional jet, they must focus on SkyWest to succeed. That is a lot of risk; all the eggs are in one basket.

Looking forward, we see clouds and no silver lining.

Views: 515

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}