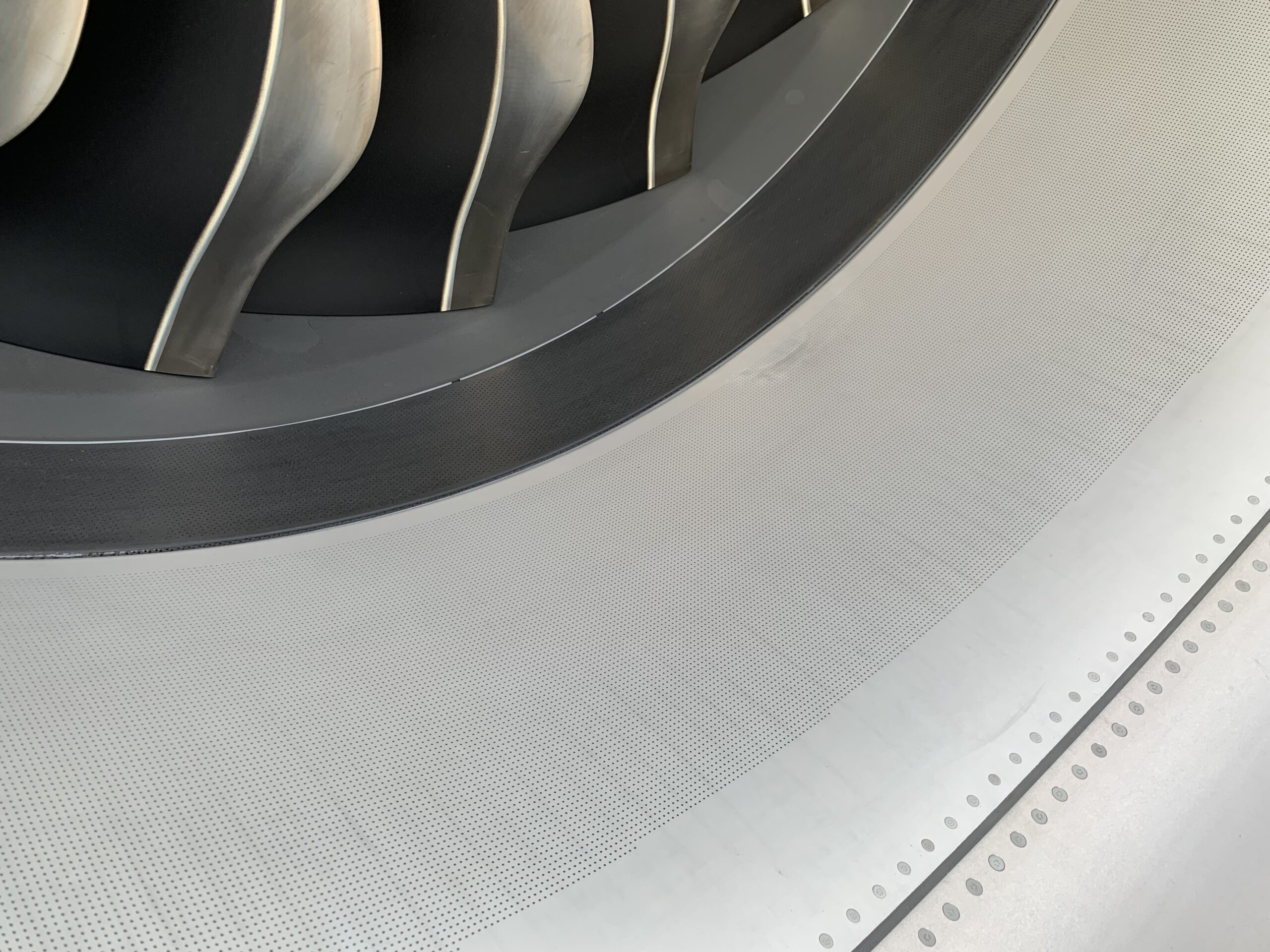

IMG 0186 scaled

Engine maker Safran upholds its target that it will be able to deliver 2.000 CFM LEAP engines in 2023, despite suffering from continued supply chain and labor constraints. For this reason, CFM, which is jointly owned by Safran and General Electric, will unlikely meet its target this year. Safran upholds target of 2.000 CFM LEAPs next year.

In its Q3 results presentation, Safran reported the delivery of 347 LEAPs in Q3, in line with what GE said earlier this week. In the first six months, 465 LEAPs were delivered, so this brings the number to 812 this year to date. But the original plan for this year is to deliver 1.200 LEAPs to Airbus (A320neo family), Boeing (MAX), and COMAC (C919). Only seventeen CFM56 were delivered in Q3.

In the earnings call today, Safran CEO Olivier Andries said that “we have picked up LEAP deliveries versus the second quarter, but it is not enough. We are not recovering yet our depth of delay.” He said production delays of castings at the two US specialized companies and delays of electrical components are the main reasons why engine deliveries are lagging behind. Andries expects Q4 deliveries to stay at Q3 levels, which would mean that deliveries would get to some 1.160 engines for the full year. But Andries, who will be nominated for a new term as CEO at next year’s AGM, repeated that 2.000 LEAPs in 2023 remains the objective, as he said in December 2021.

Airbus CEO Guillaume Faury said earlier today in the Airbus earnings call that engine deliveries have stabilized but are still below the numbers that were agreed on late last year. This not only affects the CFM but also Pratt & Whitney and likely Rolls-Royce too. Boeing President and CEO David Calhoun also blamed the lower production rates of the MAX mainly on the engine manufacturers not being able to give him the number of engines that he needs.

Safran said that flight cycles of CFM engines, which include the LEAP and CFM56, are now back to 84 percent of 2019 levels. North America, the Middle East, and South America have fully recovered to pre-pandemic levels, while Europe is still at 89 percent. China was at 63 percent in June, but cycles have dropped back to 36 percent after new travel restrictions were implemented. Retirements of second-generation CFM56s remain low at 75 in the first nine months.

Safran reported €4.849 billion in total revenues in Q3 (2021: €3.734 billion). Of this, €2.503 billion (€1.812 billion) is from aerospace propulsion, €1.820 billion (€1.535 billion) from equipment and defense, and €522 million (€385 million) from the interiors business. Safran expects to conclude 2021 with revenues of around €19 billion.

Views: 8