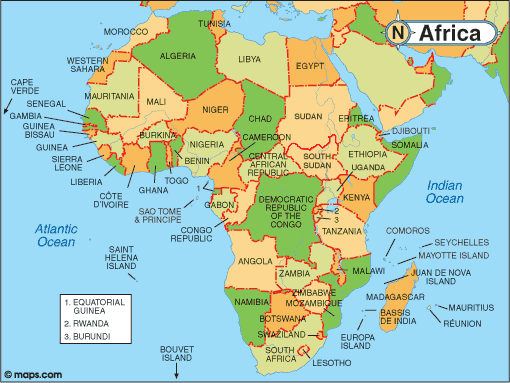

mapAfrica

Boosting Intra?Africa Connectivity

Embraer Report: Africa’s Airlift Potential

An Embraer analysis highlights that Africa currently handles a mere 2.1% of global air traffic, despite accounting for 18% of the world’s population. The report stresses the need for more direct intra-regional flights, optimized hubs, upgraded technology, and right-sized aircraft to unlock growth (embraercommercialaviation.com).

This analysis is apropos, since Embraer is the only source of regional jets. It dominates the North American market and sees Africa as a good market for their ERJ-175. Africa is an interesting market because distances are vast, markets are small and roads are poor. Aviation is the optimal solution. Regional jets have more range and speed than turboprops which would be the only other option.

The intra-African connectivity isn’t being held back by aviation technology. The key problem is state myopia; legacy thinking about open markets and state owned airlines.

Legal Dispute: Air Sénégal vs Carlyle

Dakar Court Ordered Aircraft Repossession

Carlyle Aviation Partners appealed to a Dakar commercial court to reclaim four leased Airbus jets (two A319s & two A321s) from Air Sénégal, citing non-payment of lease fees (~USD 10 million). Air Sénégal contesting claims, citing grounded aircraft and overpayment. The matter remains unresolved (ch-aviation.com).

This problem impacts the entire region, not just one airline and one country. State ownership should come with sovereign backing that can be relied upon. But no, not in Africa. Lessors like Carlyle will rightly increase rates and fees to offset perceived risk doing business with African airlines. Commercial aviation works best when all parties can make a profit.

Regional Aircraft Forecasts & Demand

Embraer Outlook: 10,500 Sub?150?Seat Jets Needed

Ahead of the Paris Air Show, Embraer projects demand for 10,500 regional aircraft (jets and turboprops) worth $680?billion through 2044. Africa is expected to account for 4.4% of this demand. (runwaygirlnetwork.com).

As noted above, Africa is a prime target for regional aircraft. Embraer should see great success. So should ATR of course. There are certain experts in the African market that understand the regional nuances and risk. For example, Irish lessor, ACIA Aero Leasing. There’s also South African banks which have been part of several deals.

Market Opportunities

Infrastructure & Alliances: Building regional hubs and partnerships (e.g. Ethiopian-ASKY) are key to realizing the connectivity potential identified by Embraer. There is a subtext here too – Ethiopian is looking at the A220 and the E2. Smart move by Embraer to highlight Ethiopian.

Aircraft Solutions: Right-sized aircraft, such as regional jets and turboprops, present high-growth opportunities in smaller-city markets. The challenge though is there are only two credible OEMs.

Financial Stability: The Air Sénégal lease dispute highlights the importance of strong financial frameworks for fleet expansion and route sustainability. Bankable deals come with special sensitivity – some states and their airlines are bankable and some are not.

Summary

Rise in Regional Aviation

- Demand for affordable, direct regional air travel is intensifying. Despite the limitations, poor African transport infrastructure favors aviation. Can the hurdles be overcome?

- Right-sized fleet investments are essential to capitalize on this potential. Because of the risk, many deals are done for older, second-hand aircraft. This helps since the capital cost is lower. But African MRO support is thin. And then there’s fuel costs and taxation. The tradeoffs are complicated. The number of African airlines buying new is small.

- Legal and financial challenges, such as the Air Sénégal case, underscore the need for fiscal preparedness. You can see there is a thread that runs through all these points. They intersect and connect, creating a Gordian Knot.

Views: 123

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}