MAX7

As we approach the re-entry into service of the Boeing MAX, the timing could not be more challenging. Traffic is recovering, but way too slowly for almost every market outside China. Yet we read about airlines here and there that are eager to get their MAXs. The true answer is just about everybody who ordered a MAX needs it and those who canceled probably would still like them if circumstances were different.

To get an idea where the MAX is needed for growth or replacement we took a look at the 2Q20 active 737 passenger fleet to see what we could find. We coded the colors in the model to reflect each 737 generation.

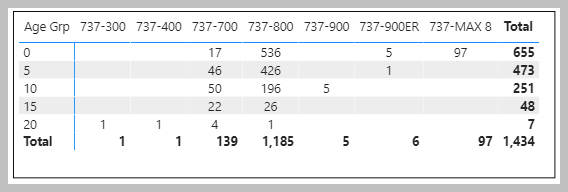

The most rapidly recovering air travel market is in China. This what the Chinese 737 fleet looked like at the end of 2Q20. If we use 15 years as a benchmark age for replacement, there were 26 -800s ready for replacement by MAX8s. China already had 97 MAX8s ready to come back into service. If we can get beyond the US/China politics (and that may be about to occur, depending on the final US election numbers) China does not look to be as rich a market for more MAXs for now, as one might have expected. The smaller models (-300 through -700) are not where the MAX offers anything more attractive than Airbus, or Embraer for that matter.

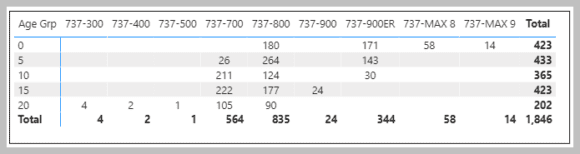

The next big market here Boeing looks like it has opportunities is in the US. This what the US-based 737 looked like at 2Q20. We would again dismiss the models below the -800 as MAX opportunities as the MAX7 has received little attention in the US. In the US, 20 years seems like a better benchmark for replacement age among US carriers. There were 90 -800s of that age, and 58 MAX8s ready to re-enter service. Which shows opportunities for Boeing. Moreover, the -900s are also primed for replacement by the MAX9.

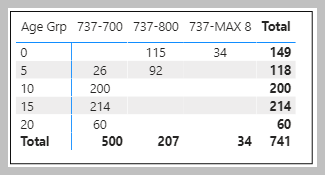

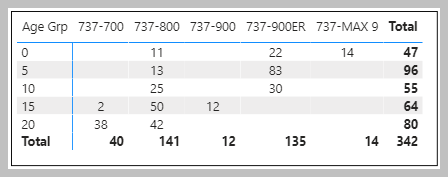

When we focus on the US, the 737 “Big Dog” is Southwest Airlines. Here is what that airline’s fleet looked at 2Q20. The table demonstrates that the aircraft acquired over the past five years have been primarily the -800 and MAX8. Southwest last took delivery of a factory -700 delivery in 2011. Any -700 acquired since then has been second hand. The table shows that there over 400 -700s aged 10-15 years and another 60 approaching 20 years. This is probably why there has been chatter about Southwest looking beyond Boeing for an aircraft this size. Over 60% of their fleet is primed for replacement over the next five years.

That, in itself, is a huge market. The key for Southwest is economics – the costs of training two sets of crews and complicating life versus the savings that could be achieved over the MAX by A220. But in either case, commonality demands a quick replacement schedule with the new airplanes, and it is arguably an easier transition with Boeing than Airbus.

That, in itself, is a huge market. The key for Southwest is economics – the costs of training two sets of crews and complicating life versus the savings that could be achieved over the MAX by A220. But in either case, commonality demands a quick replacement schedule with the new airplanes, and it is arguably an easier transition with Boeing than Airbus.

But is MAX7 is still the most attractive option? Southwest could be signaling because adding a new model is not an easy decision. On the other hand, Airbus has been talking to Southwest for a long time. They visited the A220 at airBaltic a few years back to “kick the tires”. Southwest is certainly playing the right cards, as Boeing and Airbus will offer the lowest prices possible. Airbus would be thrilled to see its Mobile FAL churning out A220s for the next decade.

What about other US carriers? American and United are MMAX customers. Delta is, apparently, a firm target for Boeing. While Delta may still be smarting from Boeing’s ITC CSeries dumping case, business is business and a deal is a deal. Delta is certainly in a financial position, like Southwest, to strike a bargain. Delta became a bit like Lufthansa with “horses for courses” in some respects. The question is why a small sub-fleet of Boeings against A321neos? Yes, the MAX8 is more fuel-efficient than the A320neo but might lack customer preference.

This was the situation at American as of 2Q20 and they chose to replace over 300 MD-80s with 737-800s.

This initially worked well for the airline. However, as we pointed out in 2019, American’s decision to split its order between Airbus and Boeing was a good derisking move. But the post-merger management chose to push back A320neo fleet deliveries and take MAX8s first. Turns out that wasn’t the smartest choice.

American does have over 70 -800s that are aging and the 24 MAX8s need to be supplemented to enable retirements. American has been one of the more aggressive airlines chasing market share during the pandemic. Use this model to see this. Boeing is likely to see American take MAXs deliveries in 2021 to allow retirement of older -800s that are almost much more expensive to operate.

What about United? Here we have something a bit different. United is almost as old as Boeing and was, once upon a time, part of the Boeing family.

United, especially since the Continental merger, is very loyal to Boeing. Breaking into United proved impossible for Bombardier. Airbus had success with the A319 and A320 long ago and more recently with the A350. But the A350’s future at United is uncertain.

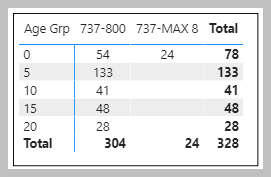

United was the first airline to operate the MAX9. As the table illustrates United interest in the -700 in 2016 was something of a red herring. Its focus has been on the -900 and MAX9 for the past five years. It has 92 aging -800s that look like ideal targets for the MAX8. Especially given the number of whitetail MAX8s Boeing is trying to do deals on. United is also likely to take more MAX9s as it retires the 757. The airline’s A321XLR won’t arrive until 2025 and for US domestic and regional routes the MAX9 would probably work satisfactorily until then.

The A321XLR and MAX product lines don’t compete directly, as they are in different range classes. The MAX9 is primarily a domestic airplane, while A321XLR is an international airplane. This reinforces what so many have said, the 757 replacement remains nuanced. Having the MAX9 and the A321XLR will create some level of capability duplication.

Below we offer a model that looks at the active 737 fleets where readers can slice and dice the data to see each airline, region, and country. Remember to use the double arrow to optimize the view.

Views: 4