embraer e195 e2 airlink azorra 2

This is a story that aims to demonstrate why state ownership of an airline is (there are few exceptions) a mistake. It also plans to explain why “right sizing” is the best approach for fleet planning (again, there are exceptions).

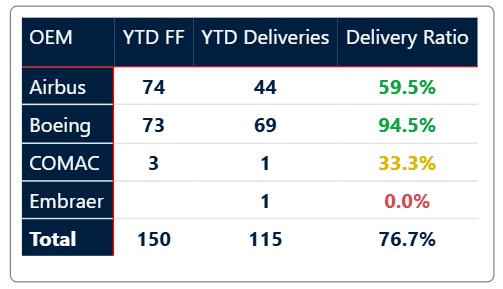

The case uses the route between Cape Town and Johannesburg in South Africa. This is, by far, the busiest city pair in the country. The following chart lists South Africa’s top ten domestic city pairs.

The two airlines we focus on are South African Airways (SAA), a state-owned airline, and Airlink, a privately owned airline.

South Africa deregulated its domestic airline market in July 1991, following the implementation of the Air Services Licensing Act No. 115 of 1990, which took effect in mid-1991. This legislation officially removed government restrictions on route entry, capacity, frequencies, and fare setting. Under the new regime, private airlines could freely compete with SAA, which previously held a market share of over 90% in the domestic market. As with all markets that have been deregulated, startups flooded the market, and most ultimately collapsed.

Airlink’s History

Formed in 1992 by Rodger Foster and Barrie Webb, Airlink was established after acquiring the defunct Link Airways and integrating regional operators like Midlands Aviation and Citi Air, officially launching operations in mid-1992. On 25 March 1995, Airlink formally rebranded as SA Airlink.

In 1997, SA Airlink entered into a franchise agreement with South African Airways and South African Express, operating as a feeder carrier under the South African brand. In 2008, Airlink completed IATA’s Operational Safety Audit, gaining accreditation under the 4Z airline code. It holds a unique historical milestone, becoming the first airline to operate a commercial charter into Saint Helena in May 2017, followed by scheduled service later that year.

In January 2017, Airlink became the first South African airline to operate Embraer E-Jets, introducing the E170 and E190 to replace its aging fleet.

In 2020, Airlink formally ended its 23-year franchise with South African Airways, rebranded back to Airlink, and began issuing tickets under its own 4Z IATA codes. SAA had effectively collapsed as an airline. This separation was accompanied by a legal battle in which Airlink attempted to recover revenues from SAA.

By early 2021, Airlink ranked as Africa’s second-largest airline by flights and third by seat capacity, operating ~65 Embraer jets and serving 50 destinations across 15 countries.

In July 2023, the South African High Court dismissed Airlink’s R890 million claim, reaffirming past rulings and instructing that Airlink had correctly been treated as a concurrent creditor under the business rescue scheme, entitling it to just ~7 cents in the Rand—effectively a zero recovery. Airlink had to move on and rebuild its business alone.

As part of that process, it established interline agreements with carriers such as Qatar Airways, Emirates, United, KLM, and British Airways. These international brands viewed Airlink as the optimal local partner and chose to work with it instead of SAA. These deals reflected the respect Airlink’s brand had earned.

In August 2024, Qatar Airways acquired a 25% stake in Airlink. The investment is strategic, enhancing its connectivity and support infrastructure in southern Africa. Airlink had proven itself to its global peers.

The Competitive Route

The Cape Town-Johannesburg route is the country’s thickest. Every startup has taken a shot at it. This route was first flown in 1929! SAA deployed a DC-4 in 1946, which is regarded as the start of real air service. Today, the route has some 40 flights/day.

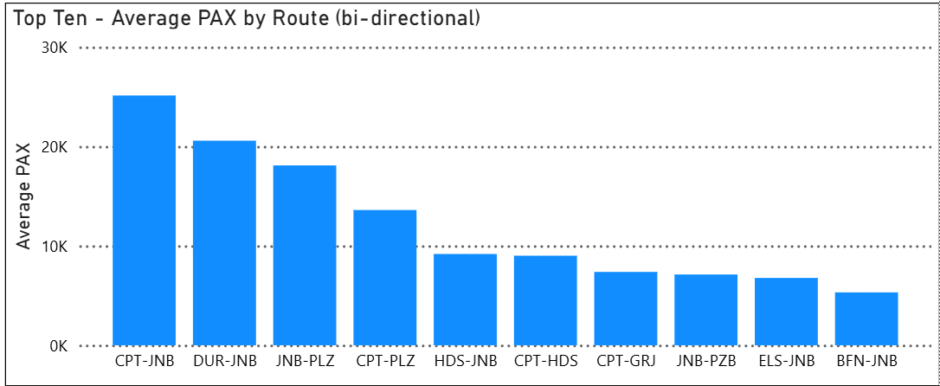

While several airlines fly the route, we focus on SAA and Airlink. We will use several charts to illustrate our points.

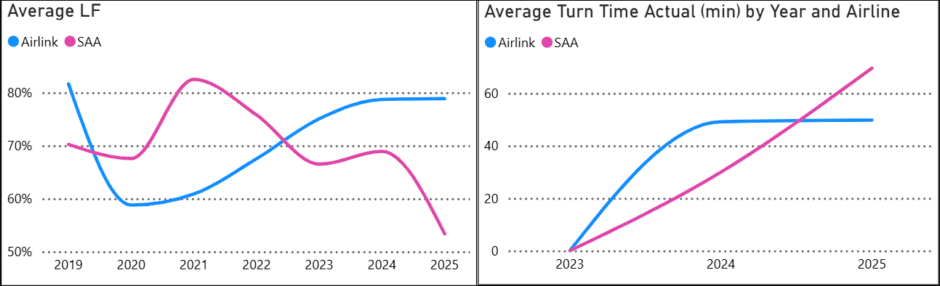

SAA primarily operates A320s on this route, while Airlink operates E190 or E195s. Airlink recently ordered ten E195-E2. The difference between the two airlines is apparent.

SAA’s A320s have 138 seats, which is substantially less than what we see in the US. For example, Delta has 157 and United has 150. SAA’s aircraft have two classes, whereas the US aircraft have three. SAA is not optimizing its A320s at all, and this is a serious issue.

Airlink’s E190 and E195 seating is 98 and 107, respectively, in two classes.

The charts show SAA flying far more flights at the start, in pre-deregulation times. SAA also had better passenger loads. At the time, SAA was a respected airline brand. SAA is one of the few airlines that is nearly a century old, having started in 1934. The market was SAA’s to lose. It is little wonder that so many startups failed.

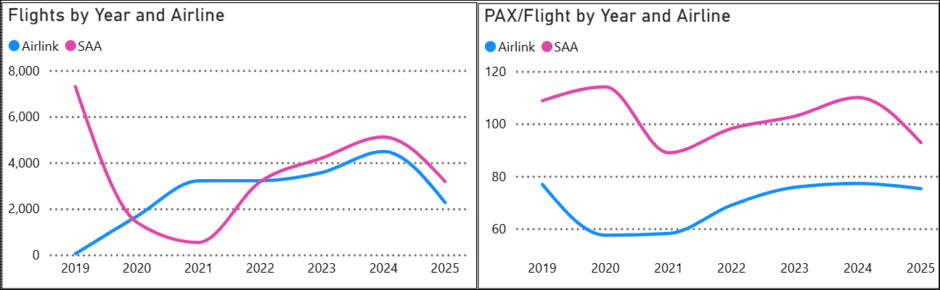

The following two charts begin to paint a different picture. SAA had the brand and the customer base; yet, it started to lose its load factor rapidly. Moreover, as evident in the turnaround time, despite having all its infrastructure in place, the process was inefficient and grew steadily worse over time.

What happened? The most straightforward answer is state ownership. Management did not respond to shareholders in the same manner as its competitors did. The State is a patient shareholder, focused on job creation and other political goals. Airlink was in business to generate revenue and concentrate on its core mission. The charts tell that story.

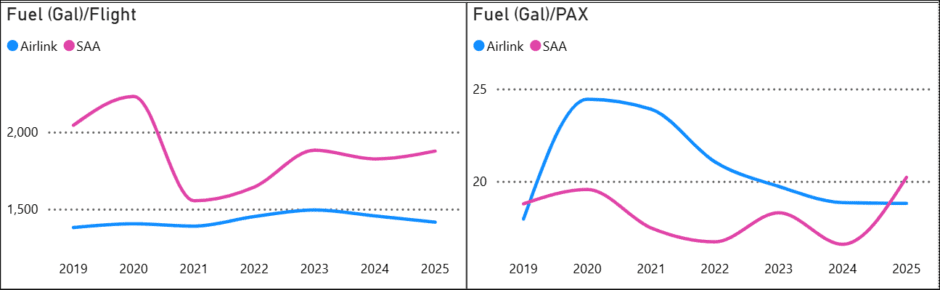

The following two charts further illustrate the difference between these two competitors. SAA’s A320s use a lot more fuel than the EJets do. Considering the South African Rand is weak and oil is priced in US dollars, focusing on fuel efficiency should be priority #1.

Airlink, as a start-up with older aircraft (BAE 146s), moved to E-Jets in 2021. The right chart curve shows the impact of that choice. Focusing on fuel efficiency proved itself at Airlink. One could argue that SAA had to make the most of what it had. But SAA at that time was not being run as a business. In 2025, we see that SAA now burns more fuel/passenger on this route than Airlink.

E195-E2 Impact

With Airlink acquiring E195-E2, things are going to diverge even more. The E195-E2 offers ~18–24% lower fuel burn per trip than the A320ceo, and ~25–30% lower fuel burn per seat (on a normalized, short-haul sector). This lower cost enables Airlink to drive down fares and bleed SAA even more.

This fuel burn advantage also applies to other airlines, such as Safair, which operates 737NGs. The E195-E2 consumes ~16–20% less fuel per hour than the 737-800.

Being the lowest-cost seat producer, Airlink stands to drive the market. However, a significant issue remains with state ownership of SAA.

SAA’s State Support

How long will the government support SAA? A previous attempt to sell the airline failed. Past bailouts have totaled over R50 billion (~$2.7 billion) over the past two decades. Government leaders, including former and current ministers, have emphasized the importance of SAA for enhancing connectivity, fostering national pride, and promoting economic development—especially in Africa. This demonstrates that the political thinking has not changed. SAA’s role as a state toy remains in force.

Direct bailouts have stopped. The government insists that SAA must now operate on commercially viable terms. What this means in practical terms is unclear.

Looking forward to more of the same

SAA faced multiple challenges that led to its financial struggles and operational decline over the years. Here are the key reasons why SAA failed:

- Financial Mismanagement. Persistent financial losses plagued SAA for decades. Large government subsidies masked underlying inefficiencies and poor cost control, resulting in repeated bailouts that drained public funds.

- Political Interference. Frequent political meddling in management and strategic decisions undermined professionalism. Leadership changes were often driven by political patronage rather than expertise.

- Overstaffing and High Labor Costs – the classic state ownership story as seen at Air India, among others. Excessive staffing levels and expensive labor contracts increased operational costs. Frequent labor disputes and strikes disrupted operations, adding to costs. The state is beholden to unions for election support.

- Poor Strategic Decisions – Ambitious expansion without a solid financial footing. Failure to adapt quickly to market changes and competition from low-cost carriers. Plus, inefficient fleet management and route network choices.

- Intense competition from well-managed private and international carriers. The rise of low-cost airlines, such as Airlink, captured market share, particularly in domestic and regional markets.

- Corruption and Governance Issues are endemic to South Africa. The country has made the term “State Capture” famous. There have been several corruption scandals that have eroded trust and efficiency. Well-documented cases of lack of transparency have led to the misuse of funds and poor oversight.

- Finally, economic and external factors played a role, which proves that every airline must look over its shoulder, as there is competition everywhere. South Africa’s financial challenges, including currency fluctuations and political instability, impacted SAA’s profitability.

In summary, SAA’s failure was a result of a combination of financial mismanagement, political interference, labor inefficiencies, strategic missteps, corruption, and intense competition—all of which were exacerbated by external economic shocks. The key question is: Has anything changed? The answer is self-evident.

Conclusion

Although we examined one route in this market, we have sufficient evidence to demonstrate that state ownership hinders South Africa’s air travel market in predictable ways. State support for SAA is likely to incur costs for the state and taxpayers.

Competition in the form of Airlink is likely to succeed because it is investing in improving fuel efficiency and aircraft economics. As a privately owned company, it focuses on shareholder returns. The environment in which Airlink operates is challenging. It has no control over the exchange rate, which drives fuel costs. It can only focus on getting to the lowest possible fuel burn. And the E2 will get them there.

Views: 413