Time on wing (TOW) refers to the duration (typically in flight hours or cycles) an engine remains installed on an aircraft before removal for major maintenance, overhaul, or due to durability limits. It varies significantly based on operating environment.

- Benign conditions (cooler climates, low dust): Longer TOW.

- Harsh conditions (hot, dusty regions like the Middle East): Shorter TOW due to accelerated wear on hot-section components (e.g., turbines).

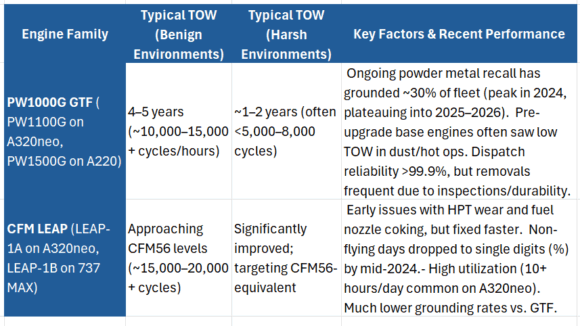

Both the Pratt & Whitney PW1000G family (GTF) and CFM International LEAP engines (introduced ~2016–2017 on A320neo/737 MAX/A220/E2 families) initially faced shorter-than-expected TOW compared to the legacy CFM56 (which matured to ~18,000–20,000 cycles average, or ~9+ years).

The newer engines run hotter and offer higher fuel efficiency. But the heat and pressure increases lead to early durability challenges. As of late 2025, both improved via hardware upgrades, with LEAP generally achieving better real-world TOW and reliability today.

Among single-aisles, the CFM-56 is the benchmark. Any engine performance will be measured against that engine. And, for now, both are lacking. Both manufacturers have rolled out fixes to close the gap with CFM56 maturity:

GTF (Pratt & Whitney)

- Hot Section Plus (HS+) upgrade (2025–2026 retrofit): ~35 new parts; nearly doubles TOW (90–95% of full benefits).

- GTF Advantage (new-build, certified 2025; entry into service 2026): Doubles TOW in harsh environments to ~2 years; 4–5 years in benign. Includes better cooling, coatings, and full-life parts.

- Overall: Significant gains expected 2026+, but current fleet still impacted by recalls.

LEAP (CFM International)

- High-Pressure Turbine (HPT) durability kits (certified 2024–2025): New blades/nozzles; standard on all new/overhauled engines.

- Reverse Bleed System (RBS): Eliminates fuel nozzle changes mid-cycle.

- Result: TOW now “in line with CFM56” per CFM (2025 statements); maturing faster than predecessor despite early harsh-environment wear.

Current Status

- LEAP has had fewer systemic grounding events and resolved hot-section issues more quickly (e.g., via kits installed on >50% of fleet by 2025).

- GTF’s geared design offers efficiency advantages but faced more durability/recall challenges, especially in harsh ops. Interestingly, these challenges were not about the gear.

- Market impact: LEAP powers ~75% of A320neo orders (vs. GTF) due to better early reliability.

In summary, as of November 2025, LEAP engines generally achieve longer real-world time on wing and higher fleet utilization than current GTFs. However, upcoming GTF upgrades (HS+ and Advantage) are expected to close or reverse this gap starting in 2026, potentially doubling harsh-environment durability.

The big challenge though is that the GTF experience scarred many. Pratt & Whitney’s “Dependable Engines” tagline has been severely tarnished. The fixes coming soon may be too late for many. The Dubai showed scant market interest. Rumors about the stretched A220 come with talk of LEAP power.

Our analysis from US DOT data shows the GTF offers better fuel burn. But what’s the point when the engine isn’t running? Pratt’s President noted at a pre-Paris briefing that customers were happy to trade fuel burn savings for durability. No kidding. Can P&W emerge from the malaise to get back to 50% of the market? They started off so well.

While actual TOW varies by operator (e.g., IndiGo or Middle East carriers report shorter because of dust), airlines around the world are ditching A220s because of the engines. These engines power the majority of commercial aircraft. This is the fattest segment and offers decades of MRO support revenues – the quintessential long tail revenue stream. The entire industry depends on the engine makers getting them right.

Views: 486