A321neo Take Off scaled

Market values for the Airbus A321neo are expected to firm up, even more, confirming the trend that this is currently the most popular aircraft type in use. The Boeing MAX is catching up as well, but the Airbus is still ahead, UK consultancy IBA says in its July market update that was presented last week. A321neo market value continues to rise.

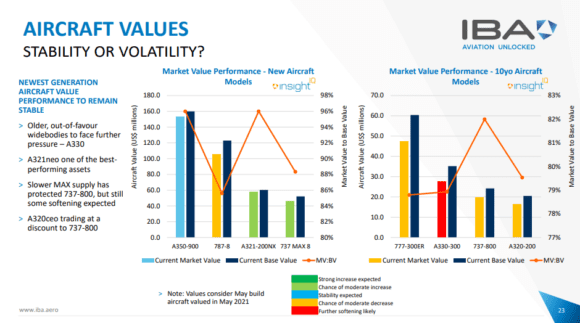

The current market value of an A321neo is somewhere near $58 million. This is likely to rise as the largest Airbus narrow-body gains market share. The current base value is $60 million. This makes the neo one of the best-performing aircraft assets and very popular for sale and leasebacks.

The MAX is slightly behind, with a current market value for the MAX 8 of some $45 million and a current base value of $50 million, explained IBA’s Mike Yeomans.

While the market value of the A321neo narrowbody continues to rise, IBA is seeing stable values of the widebody Airbus A350. The current market value of a new aircraft is some $155 million and a current base value touching $160 million. The Boeing 787-8 is rated with a CMV of $110 million, but values are expected to decrease as some relatively new aircraft have become available on the second-hand market. Especially after Norwegian has disposed of its Dreamliners, although some will be picked up again by start-ups like Norse Atlantic. The recovery of the long-haul travel segment will also take time, but overall IBA thinks base values of the widebodies will eventually reunite upward.

Values of 10-year old, mid-life aircraft are all expected to get under pressure even more. With a CMV of $20 million, the Boeing 737-800 is doing better than the Airbus A320ceo at some $17 million. IBA says the 737NG has retained its value as Boeing struggled to deliver the MAX. The current base value of a 737NG is even around $23 million.

The 777-300ER is the best performing second-hand wide body, with a current market value of around $48 million and a base value as high as $60 million. Its value compares to a CMV for the Airbus A330-300 of only $28 million. With more A330ceo’s coming out of lease over the next years, Yeomans said that there is every reason to believe that base values of the -300 and -200 will decrease. This confirms the trend that has continued for the last couple of years. Here is what Airinsight said on values in April 2020.

Fewer retirements than expected

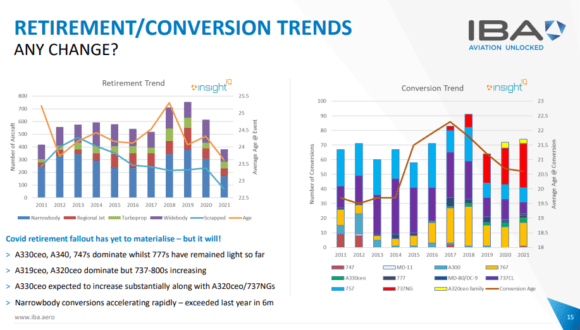

IBA also looked at retirement and conversion trends. It notes that both have been actually very low this year compared to the peak seen in 2019 and to a lesser extent in 2020 when wide-body aircraft, in particular, were retired. The hand back of aircraft has been slowed, but Stuart Hatcher expects this to change rapidly over the next years when the dust settles over the Covid-crisis. This will affect the A320ceo and 737NG but in particular, the A330ceo which together with the A340 and 747 has already dominated retirements. The average retirement age for an aircraft has come slightly down from 25 years in 2018 to some 23-24 now.

While many widebodies risk parting out, IBA sees a bright future for conversions to full freighters of narrowbodies. In 2020, there were some 43 conversions. This year, based on confirmed conversions this number will rise to 110 aircraft and for 2022 is already approaching 40. The 737NG in particular has a growing presence in the passenger-to-freighter market, with aircaft entering a new lease of life with an average age of some 17 years. The NG is taking over from the 757 as fleets are retired and offered for parting out. The A320ceo someway behind the NG but is catching up. More retired 767s and to a lesser extent, A330ceo’s are also seeing a new lease of life as freighters.

On lease ends, IBA says that it will be interesting to see what happens in the third quarter. Until now, airlines have extended leases or concluded sale and leasebacks that together with a slow re-fleeting process have pushed out lease ends. However, Hatcher is expecting more early hand-backs as IBA is counting on more airline failures in the third quarter. Rising oil prices will be a factor in this, just as a slower than anticipated recovery as travel restrictions continue to upset the airline industry. Lease ends are also likely to increase as airlines that are in the position financially will opt for newer, greener, and more fuel-efficient aircraft. This push for greener aircraft has significantly increased, Hatcher said.

Over 1.700 aircraft affected by airline failures and restructuring

The effects of the pandemic and airline failures are most evident in IBA’s data. In 2020, 647 aircraft (of which 80 percent leased) were involved in airline failures. So far this year, they are 69 (61 percent leased). Another 993 (71 percent leased) were with airlines that are in a restructuring process last year, while the number for 2021 stands at 12 aircraft (all leased). That’s 1.721 aircraft in total, of which regional jets have been affected most (282, of which 237 were leased).

While there have been identified some 130 airlines that intend to launch this year or in 2022 and aircraft could find new operators here, there is a risk that lessors end up with lots of unused metal that will affect their financial strength. This will depend on the type of lessor, said Hatcher: the bigger ones with deeper resources are often seen to dispose of older aircraft quicker while smaller ones with only a few aircraft leased to one airline tend to stick with them and hope their customers get through the crisis.

That the A321neo market value continues to rise has for one reason to do with its popularity with start-up airlines. Stuart Hatcher remarked that while many start-ups tend to fly with brand-new aircraft, it would much more sense to launch with a tried and test fleet of leased aircraft: “Once the business model has improved then it is time to move to join new equipment. It has worked for other successful start-ups.”

Views: 138

I have been working as a consultant for the purchase and sale of commercial aircraft for several years. Your information is very useful and valuable.

Thank you so much