AMX MAX2 med

New York’s Southern District Bankruptcy court will be busy with another Chapter 11 case after Grupo Aeromexico has filed for bankruptcy protection on June 30. It is the third Latin American airline after Avianca and LATAM to seek protection with the New York-court to restructure its business.

On June 19, Aeromexico denied it had plans to initiate a restructuring process under Chapter 11 despite facing a difficult situation following the Covid-19 crisis. It said it was seeking additional financial resources to strengthen its cash position. The average passenger traffic was down -92.4 percent in May to just 135.000 passengers, international traffic down by -98.3 percent.

The airline said it would analyze different alternatives for short-term financial restructuring with the help of unions, lessors, and other creditors. Come to the end of June, and it was clear this process would be impossible without filing for Chapter 11.

“We expect to utilize the Chapter 11 process to strengthen our financial position, obtain new financing and increase our liquidity, and create a sustainable platform to succeed in an uncertain global economy”, CEO Andres Conesa said. This includes obtaining $50 million debtor-in-possession financings to secure funding before it started the Chapter 11-filing. Meanwhile, Aeromexico will continue to operate and plans to quadruple domestic services and double international ones, although Latin and South America are now the hotspots of the pandemic.

Request of lease obligations relief

On July 1, the New York court has approved all First Day motions related to the case. Aeromexico has filed for Chapter 11 for four of its subsidiaries: Grupo Aeromexico, Aerovias de Mexico, Aerolitoral, and Aerovias Empresa de Cargo. Jointly, they asked for the rejection of aircraft leases of some of its 126-strong fleet, of which 25 are owned, 96 leased, and five leased through so-called Japanese operating leases with call-option (Jolco). The airline had to pay $36 million is monthly lease rates for these 101 aircraft.

Aeromexico has requested lease obligation relief for five Boeing 737-700s and five 800s operated by Aerovias de Mexico (out of a fleet of 11 -700s and 39 -800s), all nine Embraer E170LRs operated by Aerolitoral, as well as four General Electric CF34 spare engines used on the Embraers. The equipment is available to the lessors for immediate retrieval. Lessors include JLPS Leasing Caelum from Tokyo, Wilmington Trust Company from Wilmington (Delaware), Constitutional Aircraft Leasing/Aircastle in Dublin, Willis Lease Finance in Larkspur (California), Wells Fargo Trust Company and Jet-I in Dublin, Rapide Leasing in County Meath (Ireland), and NAC in Limerick (Ireland). Aeromexico had a staggered lease contract for eleven regional aircraft that were up to annual renewal from 2020 up to 2024.

Dreamliners excluded from request

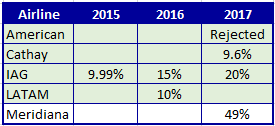

Excluded from the request its 47 Embraer E190s and all Boeing 787-8s and -9s, of which the first leases for three aircraft were due in 2023. The airline has 19 Dreamliners of which six are owned. Aeromexico had taken delivery of six MAX 8s out of 60 -8s and -9s ordered back in November 2012 which include 30 options, but the status of this is now unclear. It has been seeking compensation from Boeing for the costs of grounding the fleet since March 2019.

Only last February, Aeromexico said it was looking at the Embraer E195-E2 and Airbus A220 for fleet renewal by 2025 for its regional subsidiary Aeromexico Connect/Aerolitoral.

In 2019, Aeromexico recorded a -2.368 billion pesos net loss, up from -1.878 billion the previous year. It operated 577 daily flights and flew 20.7 million passengers. Its network included 42 domestic hub and spoke-services, 21 to the US and Canada, 15 in South America and the Caribbean, five to Europe, and two to Asia. It is a founding member of SkyTeam.

Thanks to its joint cooperation agreement with 49-percent shareholder Delta Airlines, it has strong penetration within the US, flying sixteen million passengers in transborder markets in 2019. At its Mexico City hub, Aeromexico and Delta had a combined 24 percent share of international traffic while on domestic routes Aeromexico claims a 41 percent market share.

Troubles with Aeromexico are another setback for Delta, which has already seen LATAM enter in an identical bankruptcy protection scheme this Spring.

Views: 2