Top 15 ancillary revenue 2

Each year, ancillary revenues are becoming more and more important for airlines across the world. According to CarTrawler’s 2020 Yearbook of Ancillary Revenue, the simple ancillary revenue average during the first quarter for 2020 among 17 surveyed airlines was 22.1% of total airline revenue.

In Latin America, these revenues seem to be of incredible importance. Three carriers in the Top 15 airlines that had the most ancillary revenues as a percentage of total revenue in 2019 are in Latin America.

Ancillary revenue is a “revenue beyond the sale of tickets that is generated by direct sales to passengers, or indirectly as a part of the travel experience.” For instance, frequent flyer activities, a la carte features, and advertising sold by the airline are ancillary revenues.

Viva Aerobus ranked fourth worldwide, by having 47.6% of its total revenue coming from ancillary revenue. Last year, the Mexican low-cost carrier earned 5,788 million Mexican pesos in ancillary revenue, which is about $273 million. Between 2018 and 2019, there was a 20.1% increase, according to the airline’s 4Q earnings release.

While 2020 was supposed to be a breakout year for Viva Aerobus, COVID-19 struck the finances of the low-cost carrier. In the second quarter of 2020, the ancillary revenue of Viva fell 78.6%. Nevertheless, this revenue held better than operating and fare revenue, as both of them fell 83.9% and 89.0% respectively.

According to CarTrawler, Volaris and Azul Linhas Aereas are also in the top 15 carriers for ancillary revenues. Volaris’ ancillary revenue was 38.5% of the total revenue in 2019, while Azul’s was 22.4%. Both increased their percentage in comparison with the previous year.

So, what about the rest of Latin American carriers?

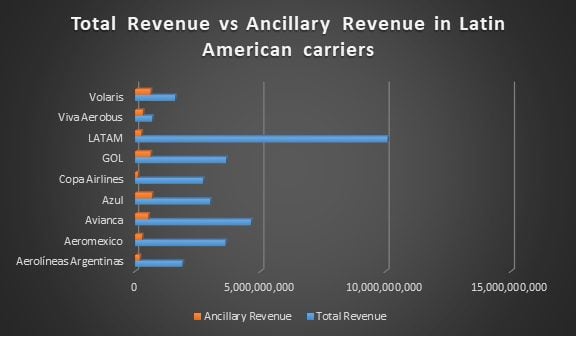

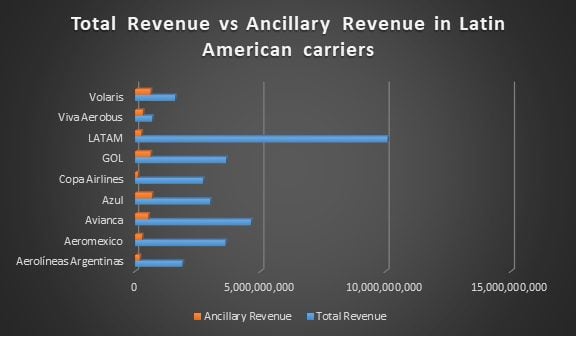

The study researched nine Latin American carriers: Aerolíneas Argentinas, Aeromexico, Avianca, Azul, Copa Airlines, GOL, LATAM Airlines Group, Viva Aerobus, and Volaris. In 2019, between the nine, they had $3,5 Billion in ancillary revenues.

The average passenger spent $13.87 in ancillary revenues to these airlines. Also, on average, 14.2% of the total revenue of these nine carriers came from non-ticket sales.

What can we learn from this information?

Before the COVID-19 pandemic, ancillary revenues were increasing across airlines, mainly among low-cost carriers. The current crisis has hit airlines really hard and they will have a tough time bouncing back to 2019 historic levels. Despite that, there’s an area of opportunity with ancillary revenues.

Many carriers across the world (and Latin America will not be the exception) may have found new sources of income with COVID-19 testing, for example.

In Latin America, low-cost carriers are bouncing back faster than the traditional legacy airlines from the current crisis. Currently, the three most important airlines in the region are under Chapter 11 reorganization and will shrink the size of their fleets. They will also have to adapt their business models to compete better in domestic markets, where low-cost carriers are gaining the upper hand. Ancillary revenue is an area where improvement must be made. Take LATAM Airlines Group as an example. In 2019, only 2.4% of its total revenue came from ancillary sources.

Finally, it will be very interesting to analyze the ancillary revenues airlines obtained during the 2020’s third quarter. We’ll keep an eye on that.

Views: 18