2020 10 27 9 51 22

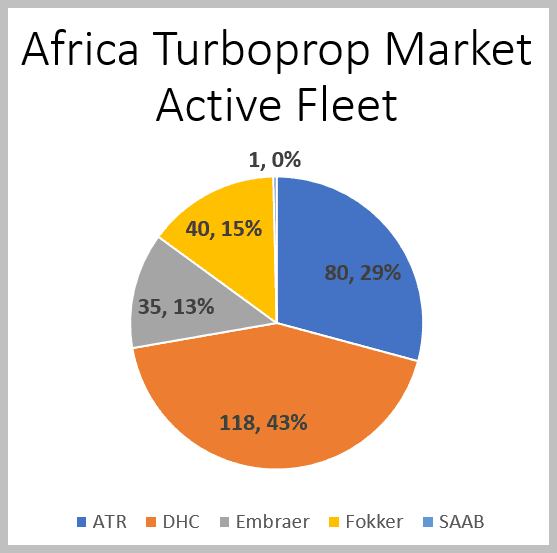

News this week that Ethiopian took delivery of its 30th Dash8-400 reinforces just how much the turboprop means in Africa. Ethiopian is the continent’s biggest airline, and it keeps growing its turboprop fleet. As we can see in the next table, from the 2Q20 active fleet, nearly one-third of the African fleet is turboprops. Only Canada has a higher ratio of turboprops.

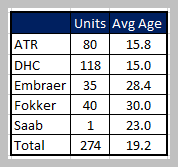

When you unpack the African turboprop market we see De Havilland Canada has the largest share. But, crucially, 29% of the market consists of aircraft that are no longer being manufactured. In fact, when adding up all the models no longer being manufactured (including those at ATR and DHC), there are 150 in African service or 55% that are replacement targets.

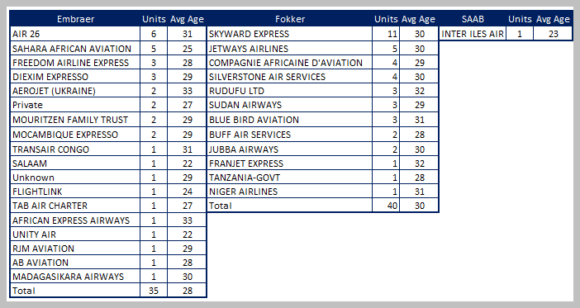

Look at this market from another perspective. The Embraer, Fokker, and SAABs are aging and African flying is tough on aircraft. The aircraft characteristics sought by African operators and which would be criteria for replacement include payload-range, hot temperatures & high altitudes, gravel runway performance, airframe robustness, and long life, plus the ability to fly offer 2-class service, along with local support infrastructure.

Now to breakdown the numbers by OEM, we see the following. Here’s what we have for ATR and DHC. The key here is the quality of the customer. Ethiopian is, by far, the continent’s biggest airline.

To get an idea of how utilitarian the Dash8-400 is for Ethiopian, take a look at this chart. Even though it is a turboprop, the aircraft is being across the breadth and length of the continent. Turboprops offer operators a level of flexibility in markets where rail and road networks are undeveloped. Small communities can be plugged into the global economy because turboprops can reach areas that are otherwise economically unreachable.

A quote from Rui Carreira, CEO TAAG Angola Airlines offers useful perspective: “[the Dash 8 -400 aircraft] allow for significant operating gains, especially due to their low fuel consumption, which is one third lower than that of the Boeing 737 aircraft currently operating on these routes.” Indeed on a typical 320NM mission, the Dash8-400 has an estimated 45% lower trip cost. Africa has many routes of this stage length, where road and rail connections simply don’t exist, as the above map illustrates.

Now let’s look at the other aircraft that should be up for grabs within the next five years. In general, these are smaller aircraft than the DHC or ATR. So “natural” replacement is not obvious. Moreover, several of these operators are small and may go out of business in the current environment unless they have a state backer. Consequently, these operators may not offer much attraction for ATR and DHC.

Which brings us back to the key issue of customer quality. Africa has many state-owned airlines. For either ATR or DHC, the quality of airline customers is the key to growth. The largest markets are listed in the next table, within the red banner. These will be the key focus markets for ATR and DHC over the next five years. It is here that the replacement of older aircraft is important. But also, these are markets where one can expect traffic growth to drive fleet growth.

Views: 6