A321 American Airlines CE DSC 0966 scaled

Top line numbers:

- Revenue of $13.66 billion, up 4.6% over the same period last year.

- The company’s reported revenue is $13.42 billion, a surprise of +1.81 % compared to the Zacks Consensus Estimate. It also delivered an EPS surprise of +34.38%.

- Operating cost/ASM excluding net special items – 17.49 cents compared to the 17.47 cents average estimate.

- Operating cost/ASM excluding net special items and fuel – 13.99 cents compared to the average estimate of 13.96 cents.

- ASM – 71.5 billion compared to the average estimate of 71.18 billion.

- Passenger load factor – 84.9% compared to the 84.3% average estimate.

American’s results came after impressive numbers from United and Delta. Consequently, American appears to be a weaker performer. As JP Morgan stated: “We’re not hearing anything that implies American can improve from its bronze medal position, as Delta and United peer down from above.”

JP Morgan did go on to note that even with its relatively lower numbers, American will benefit from the general airline sector’s strength. For example, as we said in our Alaska Airlines report yesterday, the expectation of lower fuel prices will be the tide that raises all ships (or planes).

Here are charts that support a more positive outlook for American.

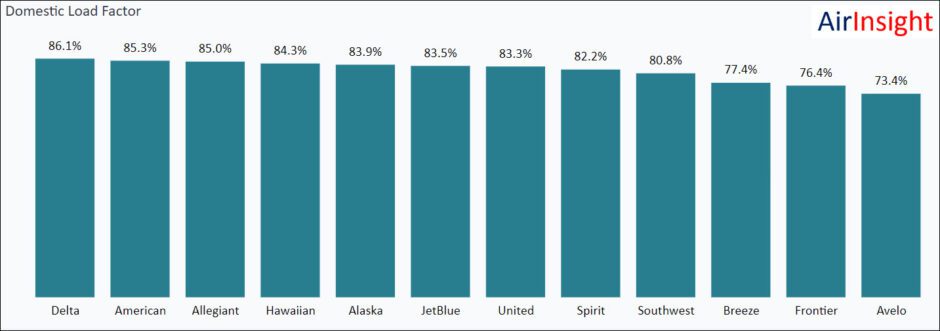

Load Factor

The industry experienced high loads throughout 2024. That environment will probably remain in 2025 as consumer confidence rises after the elections.

Moreover, as the following chart illustrates, American is flying larger aircraft and maintaining that high load factor. In 2024, 33% of its traffic (through 3Q) was flown on A321s. That is quite a metric.

Fuel Burn

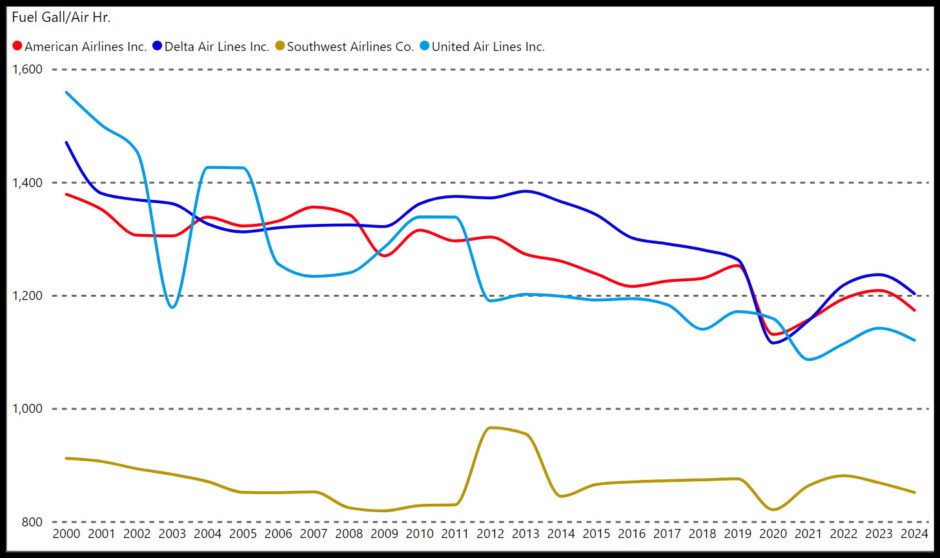

The tables list the airline’s average fuel burn over the past five years.

Here, we show the peer group’s fuel burn for reference.

The big three show impressive improvements in fuel burn. Amwerican’s reaction (overreaction?) to the pandemic led it to park aircraft it could have used, such as the 757, 767, and A330. Delta benefited from acquiring the new aircraft it ordered. United kept many of its older fleets active. Even with this possible misstep, American’s fuel burn is like its peer group.

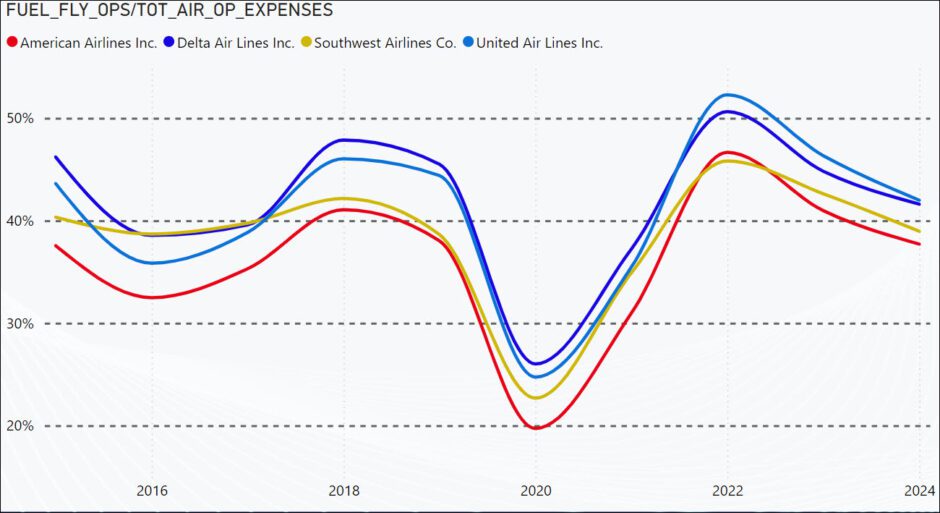

A final word on fuel burn. Even with that potential overreaction to the pandemic, American’s fuel costs as a percentage of air ops costs are the lowest in the peer group.

Summary

Nearly half the operating costs are fuel-related, so American is doing fine. In terms of fleet fuel burn, American is acquiring MAX 8s and A321neos as fast as it can get deliveries—just like its peers. Load factors are strong, and fuel costs are likely to decline. Lower fuel costs are likely to spur consumer confidence and travel demand. Even if American’s numbers weren’t as good as its peers, it looks set to perform better going forward.

Views: 75