The aviation industry has established some challenging sustainability goals for itself. Hopes for a carbon reduction of 50% by 2035 appear to hinge on sustainable aviation fuel (“SAF”) and incremental technological improvements rather than a technology revolution. The emerging hydrogen and electric aviation segments are struggling to meet goals, as the technical challenges remain daunting. Industry observers are now questioning whether net zero goals by 2050 will be attainable.

The current state of affairs

If we examine what’s happening in the industry, it appears that significant changes in propulsion technology will be much slower than anticipated just a few years ago. Airbus is pulling back on its hydrogen research, which was once thought to be the focus of its following and more radical new aircraft designs. Electric players like Heart Aerospace are re-thinking all-electric operations and evolving into hybrid designs with larger aircraft. That’s primarily because the economics and performance of smaller designs aren’t yet what the market needs or can successfully support.

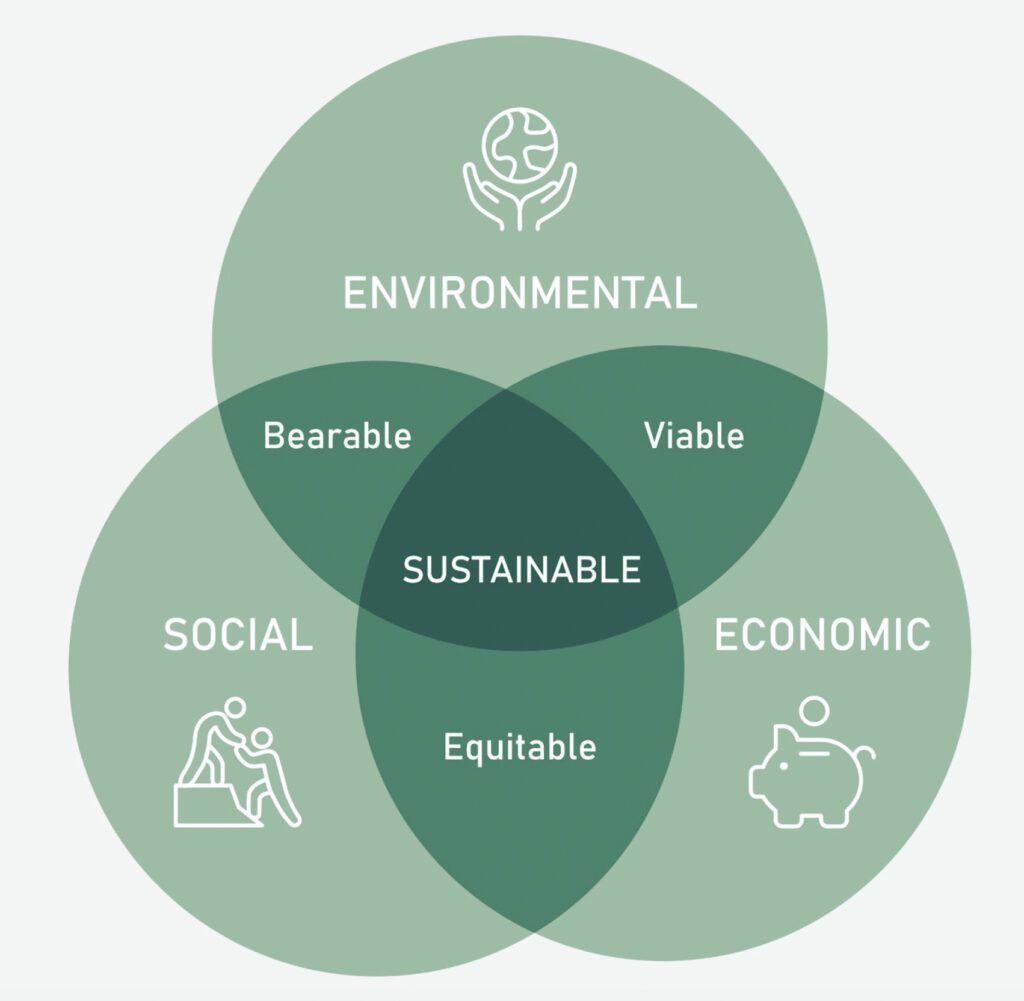

Sustainability also needs reasonable costs, and the current options appear pretty expensive.

The electric-powered Urban Air Mobility market, which began and grew to more than 20 players and designs, is slowly shaking itself out, with several players going belly-up and more approaching that precipice. The promise of UAM is late, as we didn’t see the flights that were promised at the Paris Olympics. We are not likely to see UAMs for quite some time, as aircraft need to be certified, which is neither fast nor inexpensive. That last hurdle, certification, will be the toughest for the pioneers, who will see the new certification process evolve as issues emerge.

Finally, the focus on the environment changes with Trump 2.0 in the United States. Concerns about climate change and US support for global climate accords have turned into “drill, baby drill,” with sustainability taking a back seat for the next four years. That doesn’t bode well for electric aircraft or designing aircraft for sustainability. The two primary industry goals, a 50% reduction in carbon by 2035 and net zero carbon by 2050, now appear unlikely to happen, and SAF will rely on them to, at best, get them to 90% of the way. Massive investments must be forthcoming with current SAF production only a fraction of what will be needed. Since SAF is more expensive than JetA, passing those costs onto travelers will challenge the industry.

Hydrogen – the infrastructure dilemma

Hydrogen in aviation hasn’t proved successful. Pioneering company Universal Hydrogen has gone belly-up, and Airbus is significantly reducing its R&D into hydrogen technologies, reflecting the difficulties of using hydrogen in aviation.

Hydrogen technologies can potentially work for commercial aviation, but several hurdles remain. Cleaner burning hydrogen fuel, with a byproduct of water instead of pollution from the tailpipe, is technologically feasible. Still, the energy density of hydrogen is lower, likely lowering the range for hydrogen-powered aircraft. Quickly changing the infrastructure, from gearing up production to airport facilities to support hydrogen, will be a significant challenge.

Airports are already space-constrained, and duplicating complex infrastructure to deliver hydrogen to airplanes instead of JetA will be expensive. It will be difficult to host multiple technologies at existing facilities, meaning massive investments may be required, or trucks may be crowded into the airport to refill hydrogen tanks instead of pipelines.

By contrast, SAF can use existing tanks and airport pipelines to deliver fuel to airplanes just as they do today. SAF’s lack of infrastructure investment makes adoption much easier and less expensive than hydrogen, and airlines, airport authorities, and even governments are loathe to spend on infrastructure that still needs to be proven. Airbus’s 25% cutback on hydrogen research has sent a chill through the aviation environmental community.

All-Electric Battery Operations

Most electric-powered airplanes are currently in the design stages, with the 2-seat Pipistrel Velis Electro being the only certified electric aircraft. While several companies have proposed 9, 19, 30, and 50-seat electric models, they depend on the future development of improved battery technology to perform with profitable aircraft economics. The evolution of batteries from Lithium-Ion to Iron Phosphate to solid-state batteries will deliver performance improvements by 2035. However, even those improvements will not be at the order of magnitude level needed to replicate fossil fuel performance in electric-powered aircraft.

The latest NASA research into solid-state batteries indicates that a potential for 800 Wh/kg exists, a bit over a 3.2 to 1 improvement from today’s 250 Wh/kg batteries. However, we need about 2,000 Wh/kg to provide a similar range and speed to fossil fuels. That won’t happen before 2050 without an unforeseen research breakthrough.

Several electric aircraft concepts are available for the regional market. Unfortunately, because of the energy density of batteries, they will fly lower and slower than today’s aircraft. The time to recharge today’s batteries is also slower than desired, impacting the potential efficiency of flight turnarounds.

Looking at the performance of some electric airplanes, we find speeds in the 200-250 knot range to be low compared to regional jets or turboprops. Cruising altitudes vary between FL100 and FL250, but both leave passengers in the midst of the weather on inclement days. Range limitations are to about 400nm, which matches the two-hour maximum one would want to spend in a tight cabin.

Is it any wonder that hybrid systems are being considered? These systems would use conventional turboprops for takeoff, ascent, descent, and landing and electric power for cruise. But to truly be competitive with today’s regional aircraft, they would need to operate substantially in hybrid rather than electric mode.

Tomorrow’s solid-state batteries will feature faster recharging with times comparable to today’s refueling operations. But we are still a decade away from having these batteries in production. Designing an aircraft around a technology that hasn’t been tested and proven and is expensive is risky. Not many companies that take such risks can financially survive unless exceptionally well funded. With DOGE efforts underway with radical cuts in Washington DC, can the federal government fill that gap in a Trump 2.0 administration? We doubt it.

The urban air mobility shake-out

Urban Air Mobility promises to skim over traffic in congested cities worldwide, moving more of the last mile of connectivity to the air instead of the ground. There are cities like Saõ Paulo and Mumbai, where getting to the airport from downtown is often a three-hour ordeal, or Los Angeles, where a trip from one side of the city to another can be an ordeal. UAM would provide a strong alternative to businessmen who value their time at a premium. That promise has fueled at least two dozen competing start-ups to capture a portion of that market. Much like any new industry with multiple players, the industry dynamics are expected to shake out to a few key players, with those already in the aircraft business holding an advantage.

Airbus is a competitor, as is Embraer’s Eve, and Boeing has an ownership stake in Joby. Leveraging knowledge in the certification process is a key advantage, as aircraft OEMs understand the difficulties involved and have relationships with key global regulatory authorities. It wasn’t until late last year that the FAA outlined rules and certification requirements for this segment.

Other start-ups, once viewed as promising, have failed. Volocopter, which was to be one of the Paris Olympics providers, has fallen into bankruptcy. Just before last Christmas, Lillium, which developed an interesting concept with multiple small electric motors, was on the brink of bankruptcy before an 11th-hour rescue. Numerous other small providers are looking at potential capital raises for the next tranche that may not materialize. The costs for certification, training, and meeting operational rules established by regulators could dramatically change the economics of UAM operations.

The shakeout in the UAM segment has begun, and with no aircraft yet certified, the race remains wide open. But the strong players seem to have deep pockets and expertise. While the concept of travel to and from thousands of small landing pads to others is appealing, the actual test will be whether they can be operated economically enough to attract passengers in key markets. We’ve seen projections for tens of thousands of these light aircraft serving markets around the globe but remain skeptical until their economics can be proven.

Sustainable Aviation Fuel

Sustainability will depend increasingly on SAF, given that promising technologies are being developed further into the future. However, producing enough SAF is a problematic process in itself. Agricultural feedstock for SAF needs to be significantly increased, while a potential gain for farmers could impact land used for food production. While some winter crop feedstock looks promising, they are unlikely to be produced north of I-70 in the United States.

Other methods to produce SAF range from recycling cooking oil to municipal solid waste. These methods will require processing and infrastructure for that processing. All in all, to produce enough SAF for the airline industry by 2050, we will need about $1.5 trillion in investment, a substantial sum higher than most governments could begin to subsidize.

While SAF appears to be the only way for the industry to meet its sustainability goals, it doesn’t seem that investment will catch up with demand shortly. With the likelihood of SAF production being lower than airlines could take up, pricing could also become an issue if carriers bid against each other for their sustainability needs.

The Bottom Line:

Sustainability appears to be taking a hit as new technologies push further to the right. SAF seems to be the only medium-term solution, but supply lags behind demand. Significant new investments will be needed, but those investments are primarily in the planning stages today.

The promise of hydrogen appears to be a potential future technology, batteries are not yet ready for prime time, and Urban Air Mobility is amid a shake-out as electric aviation players jockey for market leadership.

While research into sustainability is important and should continue, it doesn’t appear that current research is leading to a long-term solution. We’re down to SAF as a viable alternative, but we’re not investing enough to get close to the 2035 and 2050 goals of 50% and net zero carbon, respectively. Unfortunately, those targets may remain out of reach.

Views: 178