e63398bcabac93cf830cfcd9cc8a92ae

Australia has been struggling to get airborne again. The pandemic hit hard and the reaction was (like many places) overdone. Australia and New Zealand created one of the first travel bubbles. That too has been a struggle. Qantas recently pushed back its plans for overseas flights to the end of 2021.

Domestic Australian air travel has also faced hurdles – Victoria has seen severe lockdowns. Victoria’s capital city, Melbourne, is Australia’s second-largest city with a population about equal to Sydney. Cutting Melbourne off is a significant impact on Australia’s potential domestic air traffic. Australian Aviation reported that Qantas earlier this year revealed border closures resulting from the Northern Beaches COVID cluster at Christmas cost the airline $400m in lost earnings. Qantas is trying to get its flight crews vaccinated as fast as possible.

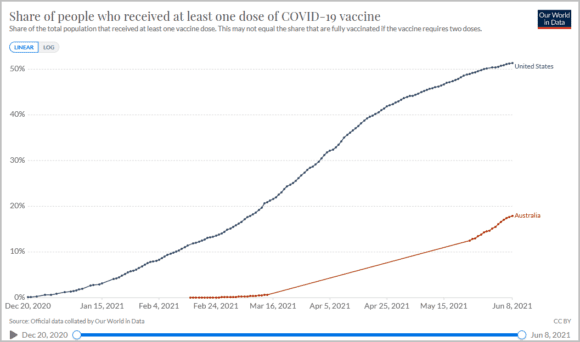

Looking at the chart we can see why Qantas wants this hurried. The US experience shows how an economy can get restarted as the vaccination rates rise.

To see how the pandemic has hit Australian air travel, we developed this model using the Australian government’s air travel data. Please click the double-arrow at the bottom right to optimize your viewing of the model for your screen.

The chart allows you to view the main Australian air routes. Overall, on the first page of the model, we note that traffic declined sharply in 2020. The 2021 data is only through the first quarter. Note in the second chart on page one that airlines are using larger aircraft (more seats/flight) as part of their recovery efforts. These larger aircraft should offer better economics but the third chart illustrates just how much load factors have dropped. So it is unclear just how Australia’s airlines are going to break even. Indeed, this is becoming an issue. In other markets, like the US with similar distances, airlines have discovered that “right-sizing” is the optimal way to provide flights and lessen the economic risk.

On page two of the model, we allow readers to select a state and see traffic flow over time. Notice how several markets have been abandoned. Again this is similar to the US experience, where smaller communities have seen a loss of air service. Another feature this data highlights is that Australia is a market with many relatively long flights but light traffic – much like Canada. That means the economic risks of running an airline in Australia is relatively high. Operating costs of these flights with low traffic make for thin margins. Any shock, like the pandemic and an over-reaction to it, can push an airline into the red quickly.

Views: 5