1627892552113

Lessor BOC Aviation is taking a cautious approach to new aircraft deliveries for this year and 2024 as it expects supply chain issues to continue to have an impact. The Singapore-based lessor has adjusted its delivery schedules to reflect the new realities of the OEMs, it reported last week in its FY22 earnings presentation. BOC Aviation counts on fewer new deliveries this year.

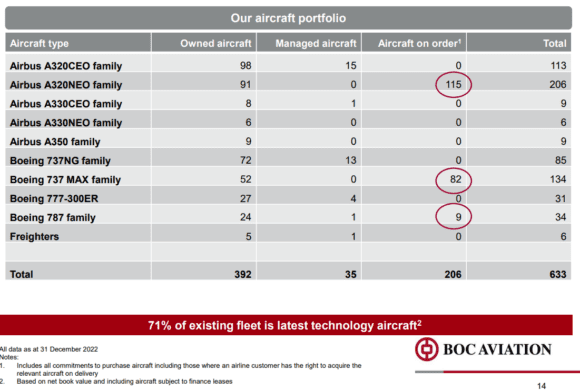

BOC Aviation delivered 34 aircraft last year of which 29 were direct orders from the lessor and five purchase and leasebacks (PLBs) of aircraft that were ordered by airlines. In particular, the lessor grew its Boeing MAX fleet by twelve aircraft top 52, its 777-300ERs by three to 27, and the 787 fleet by three aircraft. The Airbus A320neo family fleet remained static at 91 aircraft, while the A320ceo family fleet was reduced by four aircraft to 98 and that of the A330ceo by two to eight aircraft. Yet, COO David Walton said that four A320neo aircraft were added to the balance sheet last year.

In March last year, BOC Aviation said it expected to take delivery of 36 aircraft in 2022, but Walton said that five have been pushed out to 2023. Instead of 42 expected for 2023 in last year’s schedule, there are now only 24 in the plan for this year, of which eighteen come from the order book and six are PLBs. The current schedule foresees 44 deliveries in 2024, up from 39 in last year’s schedule, of which 39 are from the order book and five PLBs.

From 2025 and beyond, BOC Aviation has 138 deliveries in the schedule, which reflect the orders for eighty Airbus A320neo family aircraft and for forty Boeing MAX that were placed last year. This brings Capital expenditures from 2025 and beyond to $7.7 billion or to $11 billion if this year and 2024 are included. Including the new orders and sales of seventeen aircraft last year, the owned, managed, and committed fleet brings the number of aircraft to 633, up from 521 in 2021.

“Our new aircraft deliveries highlighted the global nature of our customer base as we delivered aircraft to customers that included American Airlines, Turkish Airlines and Scoot, Singapore Airlines’ low-cost subsidiary. Looking ahead, all of our 2023 order book deliveries are placed with airline customers,” Walton said. Committed lease revenues will grow to $16.8 billion, of which $14.3 billion from the owned portfolio and $2.5 billion from future deliveries. Lease contracts are for on average 8.1 years, but have come down from 8.6 years in 2020.

Profit impacted by Russian write-off

BOC Aviation reported a core profit after tax for the 29th consecutive year, ending the year at $527 million compared to $561 million in 2021. This includes $791 million of the write-off of aircraft in Russia and $223 million as cash collateral from missed revenues from these same aircraft and tax impacts of $61 million. The statutory net profit was $20 million. The company took a $65 million asset impairment related to the carrying value of fourteen widebody aircraft.

Core revenues ended at $2.084 billion (statutory revenues $2.307 billion) compared to $2.183 billion in 2021. In the second half year, revenues were up fourteen percent to $1.111 billion compared to HY1, and the core profit was 56 percent higher to $364 million. BOC will pay out $0.2659 in dividends per share. It has $5.3 billion in liquidity and a gross debt of $2.9 billion. The lessor raised $900 million in new capital last year, of which $300 million was from capital markets and $600 million from banks.

BOC Aviation is positive for 2023, based on the continued strong recovery of air travel in Europe, the US, and now in China too since January. Flights in China recovered by eighty percent in the first two months of this year and are closing in on 2019 levels by the week. “In international and regional markets, airlines serving China have increased their scheduled capacity by nine times for the second quarter of 2023 compared with the same period last year and this recovery should continue to build into the second half,” said CEO Robert Martin.

Views: 4