MG 7951

UPDATE – Boeing produced a strong fourth quarter of 2022, reducing its net losses compared to the same period of the previous year. But the full-year consolidated loss was higher than in 2021, mainly to be blamed on the Q3 charge on Defense projects. Boeing Commercial Airplanes remained loss-making, but results and margins improved, the airframer announced in its Q4 and FY22 results on January 25.

Let’s look at Q4 first. Boeing Group ended the quarter with a $-663 million net loss compared to $-4.164 in 2021. The operating loss improved to $-353 million from $4.171 billion, resulting in a -1.8 percent operating margin versus -28.2 percent the year before. Total revenues were up to $19.890 billion from $14.8 billion.

The full-year result of Boeing Group ended with a $-5.053 billion loss, up from $4.290 billion. This reflects the losses at Defense, Space & Security in Q3 when the business unit took a $2.8 billion charge on some fixed-priced contracts. The consolidated operating loss was $-3.547 billion versus $-2.902 billion in 2021. Total revenues were $66.6 billion versus $62.3 billion. The core operating margin was -7.0 percent versus -6.5 percent in 2021. At $3.512 billion, the operating cash flow was significantly better than the $-3.416 billion in 2021.

But to Boeing’s great satisfaction, free cash flow improved significantly. “Our key matrix, as anybody knows, is free cash flow. Importantly, we were able to generate more than three billion ($3.131 billion) in the fourth quarter, driven by the progress in our performance and the continued strong demand”, said President and CEO David Calhoun. By comparison: free cash flow was $716 million in the same quarter of 2021. Full-year free cash flow improved to $2.290 billion from $-4.396 billion, the first time since 2018 this was positive. To mark the significance, Chief Financial Officer Brian West noted that free cash flow had been $-20 billion in 2020.

Boeing ended the year with $14.6 billion in cash and $2.6 billion in marketable securities. Consolidated debt was only marginally lower from Q3 at $57 billion but net debt was down by $3 billion to $40 billion year on year.

BCA

Boeing Commercial Airplanes (BCA) produced a $-626 million operating loss, an improvement over $-4.454 billion in Q4 2021 and also better than $-643 million in Q3. The airframer delivered 152 aircraft during the quarter compared to 99 in the same period last year and 112 in Q3. December was especially strong with 69 deliveries. This gave a boost to revenues, which reached $9.224 billion versus $4.750 billion in 2021. But higher deliveries for the MAX and 787 were offset by higher abnormal costs and customer considerations on the Dreamliner program. Total abnormal costs for the year were $1.753 billion, of which $1.240 on the 787, $325 million on the 777X, and $188 million on the 737/MAX.

Full-year 2022, BCA delivered 480 aircraft compared to 340 in 2021. Boeing won 808, including more than 200 widebody orders thanks in part to the large United order for 100 787s in December. “That’s the most since 2018”, Calhoun noted. In its 10K report, Boeing says that it lost $11.3 billion in commercial orders, mostly MAX and 787s.

The operating loss improved to $-2.370 billion from $-6.475 billion, while revenues were up to $25.9 billion from $19.5 billion. BCA’s operating margin for the year also drastically improved to -9.2 percent from -33.2 percent and reached even -6.8 percent in Q4.

Boeing Global Services (BCS) improved its full-year operating profit to $2.727 billion from $2.017 billion, with revenues up to $17.6 billion from $16.3 billion. The operating margin is a solid 15.5 percent. BCS has benefitted from both commercial and defense contracts. “BGS is simply following the recovery of the industry in general and everywhere in the world”, Calhoun said.

Production stability

Boeing’s focus for 2023 is on “driving stability in our operations and within the supply chain to meet our commitments in 2023 and beyond”, Calhoun said. “Our realities are still the same: a difficult, difficult supply chain. While average deliveries met our objectives, we continue to face a few too many stoppages in our lines. While they are coming down, they aren’t where they need to be as we think about stable rates going forward.”

Calhoun didn’t want to highlight any one supplier, but it’s no secret that the engine makers are the ones to suffer most from those issues. General Electric and Raytheon said on Tuesday themselves that they expect these issues to continue well into 2023. The biggest issue now is not recruiting people but training them for complicated, technical jobs.

Asked if Boeing could go to rate 40 per month on the MAX in 2024, Calhoun said that he is positive that the suppliers will recover over the year. “But by far the more challenging is: are we going to be stable, month to month, quarter to quarter? I think is will take us all year to ultimately demonstrate that stability will be achieved. But if we get to that, and I hope we will do, then I take on that conjecture (that we can increase rates in 2024). December was good, but if you look month to month you can’t be happy with that. Watch the month to month, that’s going to tell you a lot about our willingness to consider higher rates.” The recovery of the Chinese market (see separate story) is a key factor in that.

For now, this leaves Boeing little option but the keep the production rate of the MAX at 31 aircraft per month, although it struggles to meet even this number. Monthly deliveries are higher because there are still 250 MAX 8s and -9s in inventory that need to be re-delivered. This includes 27 MAX 7s and three -10s that are waiting to be certified, with 236 MAX 7s and 720 MAX 10s in backlog. “We do expect monthly deliveries from the inventory to slow slightly as fewer airplanes will be available combined with some impact of the -7 and -10 builds. We still expect most inventory aircraft to have been delivered by the end of 2024,” said Brian West. He added later that as the inventory winds down, this could be the moment to ramp up the production rate on new builds and get the rate up towards 40 aircraft.

Calhoun offered no date when he expects the MAX 7 and 10 to be certified, but he expects the smallest MAX to enter service later this year and the biggest MAX next year. The upgrade of the Angle of Attack system to add a third source of input will be mainly software that will have only a marginal financial impact. The program accounting for the MAX now stands at 10.800 or 400 more compared to last year.

787

Boeing also still has 100 787s in inventory as it delivered 22 during Q4 and 31 in 2022 since deliveries were resumed in August. Like the MAX, the Dreamliner inventory should be cleared by the end of 2024. Abnormal costs for the 787 were $350 million during the quarter, taking the total to date to $1.2 billion. This is for rework on the aircraft that have production quality shortcomings.

West said that Boeing has increased total abnormal costs by $600 million to roughly $2.8 billion, as the production will be below the production rate of five per month for a bit longer due to supplier constraints. “We still expect to hit five per month before the end of this year.” Thanks to the strong orders for the 787, Boeing added 100 aircraft to the accounting quantity to 1.600, which increases GAAP program margins. Total deferred production costs for the Dreamliner now stand at $12.7 billion.

777X

Boeing also took another $112 million in abnormal costs on the 777X program, but this doesn’t change the $1.5 billion estimate that was announced last year when the airframer also said that production was paused until the end of 2023. Three years to the day today that the first 777-9 made its first flight, the aircraft is still not certified, but Brian West said that good progress is being made. But he mentioned that discussions with a number of customers are ongoing about compensation for the delayed deliveries. “But keep in mind that the revenue and cash impact of these settlements will be over several years and all contemplated in both the near and long-term guidance.” Boeing included more 777X in ASC 606 reserve, which is for aircraft of which deliveries are uncertain. At the same time, it added fifty aircraft to the accounting quantity to bring it to 400 aircraft, reflecting the launch of the -8F freighter. 777 production is currently three aircraft per month

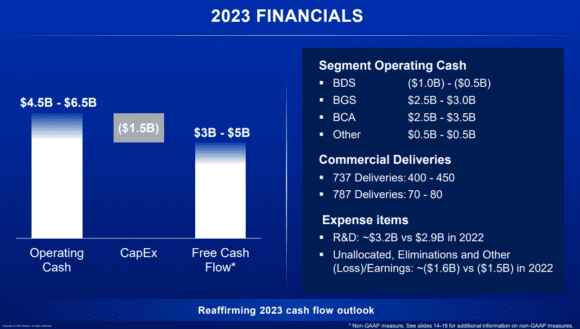

For 2023, Boeing targets 400-450 MAX deliveries this year compared to 374 in 2022 and 70-80 Dreamliners. Operating cash flow should be between $4.5 and $6.5 billion. With $1.5 billion being re-invested as capital expenditures, consolidated free cash flow should be between $3 to $5 billion. BCA is expected to contribute between $2.5 to $3.5 billion. R&D spending will be $3.2 billion or $300 million up from 2022 due to higher spending for BCA.

Medium-term, Calhoun and West reiterated the target outlined for 2025/2026 in November during Investor’s Day. That means a monthly production rate of fifty MAX and ten 787s, or 800 aircraft for a full year. Boeing Commercial Airplanes should produce low double-digit profit margins. Free cash flow for 2025 is still $10 billion while Group revenues should reach $100 million.

Views: 9