GAMA

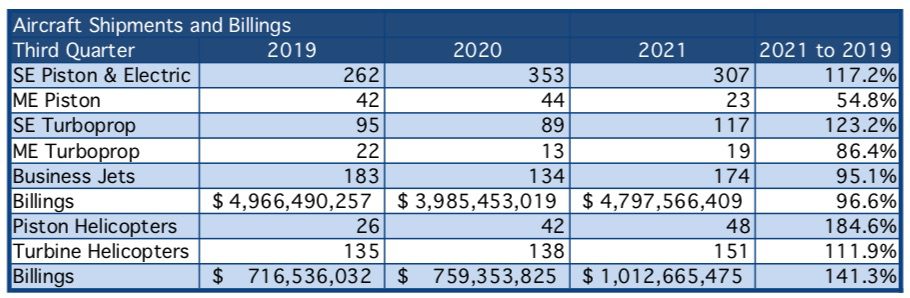

Business Aviation continued to recover from the pandemic in the third quarter of 2021, with deliveries and billings close to pre-pandemic levels, according to data from the General Aviation Manufacturers Association (GAMA). The following table compares third-quarter shipments and billings from pre-pandemic 2019 with 2020 and 2021, illustrating the comeback in both aircraft deliveries and billings.

It is notable that the helicopter market rebounded to higher than pre-pandemic levels in both aircraft shipments and deliveries during the third quarter. Business jets were close to pre-pandemic levels in both deliveries and billings, at 95.1% and 96.6% of 2019 levels. The recovery in business aviation has arrived in the third quarter.

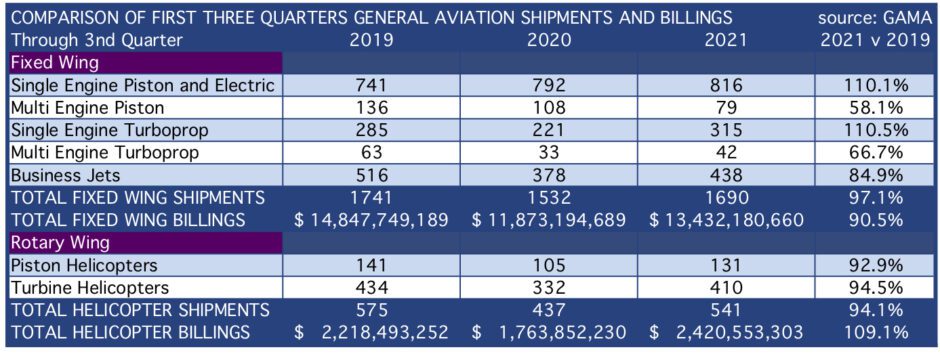

Year to date, the numbers indicate a recovery but have still not reached pre-pandemic levels after a more difficult start to the year. Nonetheless, business jets deliveries year-to-date have reached 84.9% of 2019 levels, with billings for fixed-wing aircraft at 90.5% of the pre-pandemic level. Helicopter billings are higher in 2021 than in 2019, with a strong. recovery in rotary-wing aircraft. The following table summarizes the year-to-date performance for 2019, 2020, and 2021 through three quarters. It should be noted that Dassault reports on a semi-annual basis, and no data for the third quarter are available for either the number of aircraft shipped or billings.

The fourth quarter is typically the strongest for business aviation, and it appears that the industry is positioned for a strong fourth quarter and recovery to near pre-pandemic levels, and a full recovery in 2022 with the growth in demand for business aircraft during and post-pandemic.

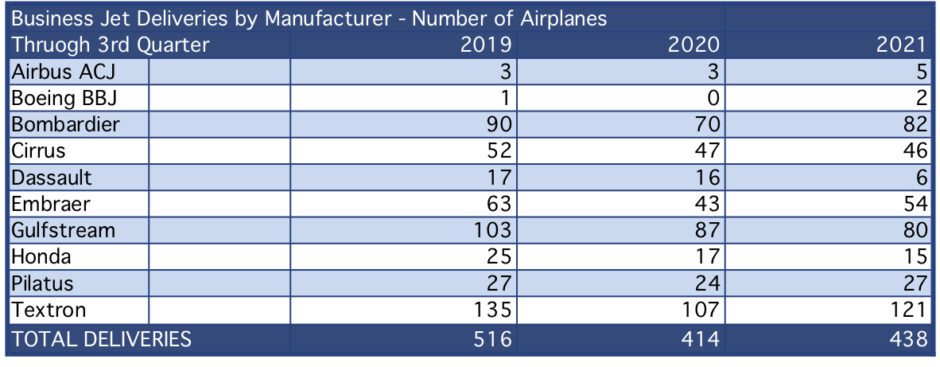

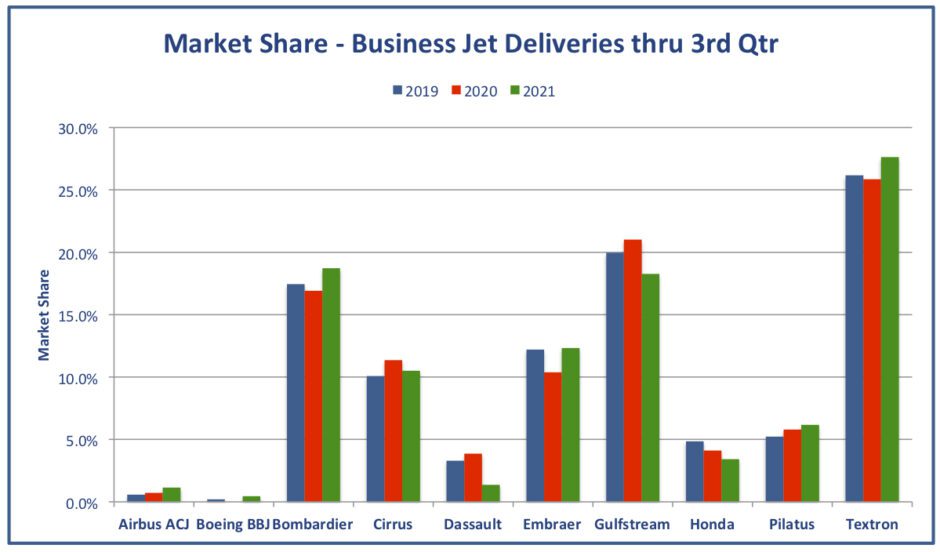

The recovery in business aviation has not been equally distributed across all OEMs, as shown in the table below showing business jet deliveries by manufacturer. Year to date, the industry has delivered 438 business jets, compared with 516 and 378 for the same period in 2019 and 2020, respectively. The trend is clearly upward and moving in the right direction quarter by quarter. Year to date, Textron has delivered the most business jets, 121, followed by Bombardier with 82 and Gulfstream with 80. The following table shows year to date deliveries for the first three quarters by manufacturer for 2019, 2020, and 2021.

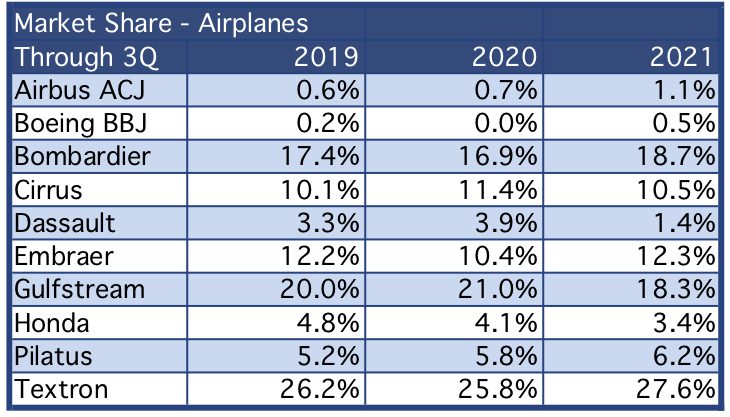

Market share based on the number of business jets delivered is shown on the following table. Textron has maintained its lead at 27.6% , followed by Bombardier at 18.7% and Gulfstream at 18.3%.

The following chart present the aircraft market share data graphically, illustrating the fairly consistent performance among the major players.

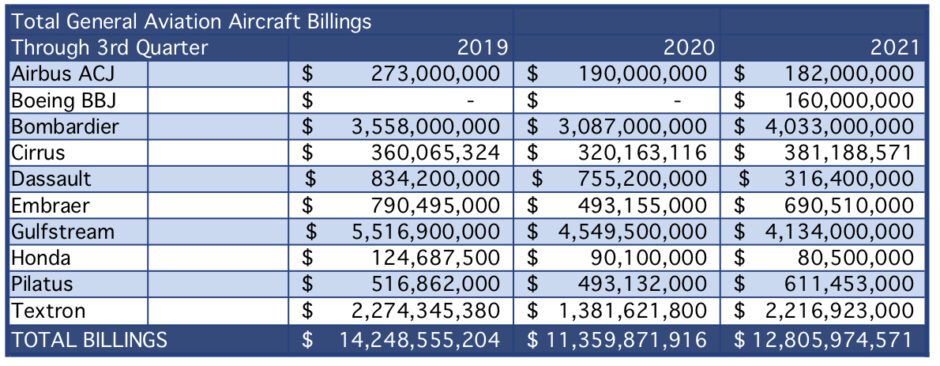

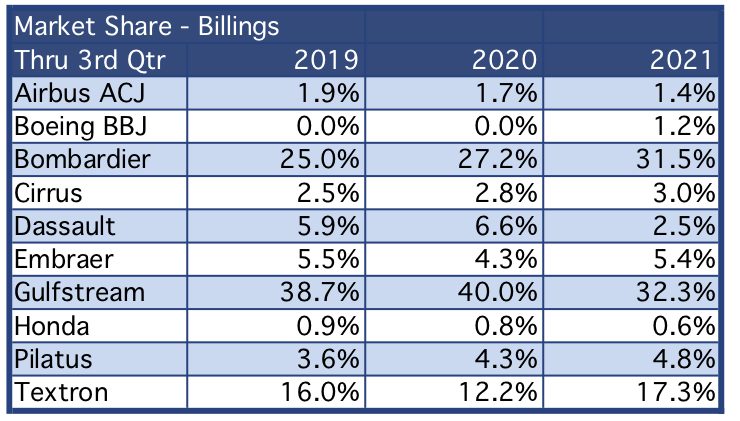

From a billings standpoint, the mix of smaller and larger business jets favors Gulfstream and Bombardier at the top end of the market, and to a lesser extent Dassault, which is awaiting its two new highly anticipated Falcon Jet models. Textron’s mix of smaller business jets places it third in billings. The following table shows billings by manufacturer, which includes all aircraft produced, not only business jets, for Cirrus, Pilatus and Textron.

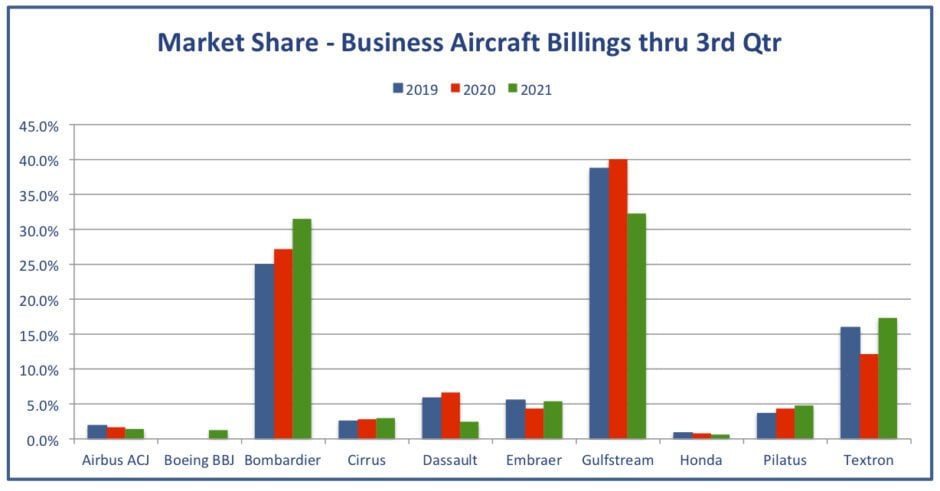

Market share based on billings shows a narrowing gap between Gulfstream and Bombardier as Global 7500 production has ramped up for Bombardier and Gulfstream’s new G700 is not yet in production.

Graphically, the market share in billings illustrates an upward tick from Bombardier as its flagship Global 7500 production has ramped up, growing its average revenue per aircraft. Gulfstream also remains quite strong in billings, but its lead over Bombardier has diminished somewhat in 2021.

The GAMA shipments data indicate that the industry is approaching a full recovery in the third quarter, but will likely not yet reach pre-pandemic levels in deliveries on an annual basis, despite record high demand for business jet travel. Used business aircraft availability also remains at a ten-year low, so expectations for the fourth quarter and early 2022 are high.

With positive trends, it appears business aviation will recover faster than the commercial sector, with recovery to pre-pandemic levels now expected in 2022.

Views: 2