SpiritA320neoEngineCU9 16 e1476209180462

Engine makers are under some of the greatest stress as the pandemic continues. The Power by The Hour business model worked well until engines stopped working. The business model of offering the engines at near-zero and making up the value in spares and shop visits does not work if the engine is parked.

Engines already delivered with more than a decade of life left, as “life” was defined prior to March 2020, are probably not going to deliver the cash flow that was expected. But the engine OEMs are committed with billions in assets parked.

This post focuses on the CFM LEAP and P&W GTF because these are the two largest volume programs and it is aircraft powered by these engines that make up most of the limited flying currently taking place.

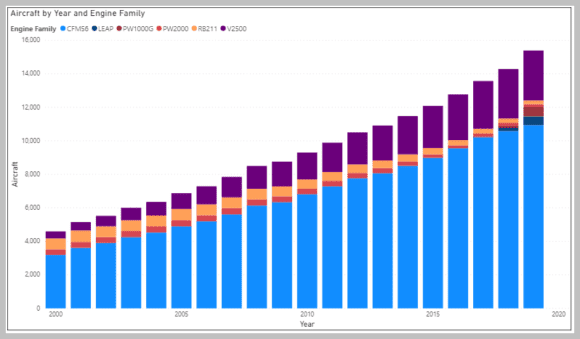

The engine OEMs face a quandary – they are struggling with so many engines underperforming in financial terms, and they want to deliver on the large backlogs for their latest engines. The following chart illustrates what the market looked like at the end of 2019. At the end of 2019, there were 12,410 active aircraft powered by these engines.

The domination of the market by CFM is clear. The PW2000 and RB211 were used on the 757 and is winding down. The key issue here is the big change taking place as aircraft were being delivered with the next-generation LEAP and GTF.

P&W was the OEM most under pressure. It had lost the 737 to CFM and was sharing its role on the A320 family with Rolls-Royce (V2500). The P&W PW2000 was not the most selected engine of the 757. The new GTF that P&W offered was not only a new engine, but the company bet the farm and they were determined to make it a success. P&W bought the Rolls-Royce stake in the V2500 to give it control and a path for airlines to migrate from V2500 to the GTF on their A320neo orders.

CFM spent years delivering engines at a rate far greater than P&W has seen since WW2. This added to the pressure on P&W – it had to offer state of the art of performance and offer deliveries at the same rate as CFM. This may have led to the GTF not being as tested as it might have been, and the engine ran into several challenges. P&W has been working to provide fixes. The largest pool of GTFs is in India and vocal customer complaints uncovered that besides the fixes P&W needed to provide, Indian pilots were using the engines more aggressively than they were supposed to. The new instructions to pilots and P&W’s fixes have ensured GTF hiccups have declined markedly.

CFM ran into its own series of challenges, principally not of its own doing. The LEAP also had new engine settling in issues, but the largest disruption came from the grounding of the MAX. CFM is the sole MAX engine supplier and this hit has been highly disruptive. Whereas CFM had the production capacity to deliver to both Airbus and Boeing at volume, the loss of MAX deliveries has had a painful financial impact.

Both engine OEMs offered state of the art engines with exceptional fuel burn, low noise and NOx. Then the market turned upside down. Oil prices dropped, making the better fuel burn less attractive. The ecological benefits became the big driver instead. This is especially true for EU airlines.

How are these two engines doing? We analyzed data from the US DoT Form 41 and have these charts to share. We start with the A320neo and then show the same charts for the A321neo.

A320neo

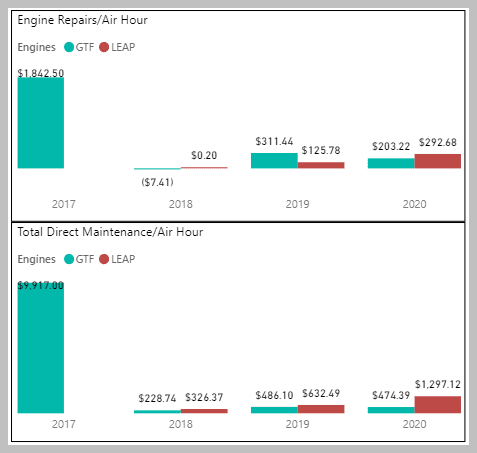

On the A320neo we see that the LEAP has a lower engine repair rate per flight hour and a lower rate of direct maintenance per flight hour.

The higher numbers for the GTF may reflect the P&W efforts to provide repairs as airlines uncovered items that needed fixing.

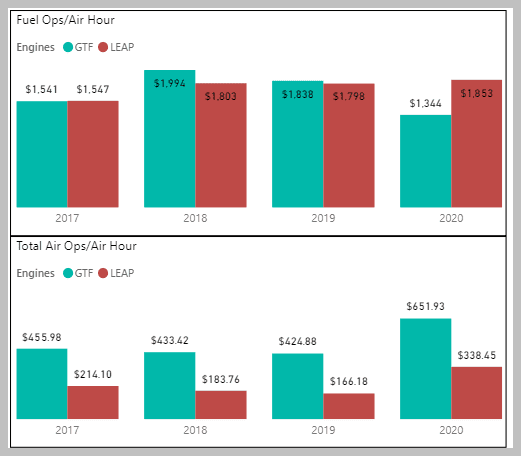

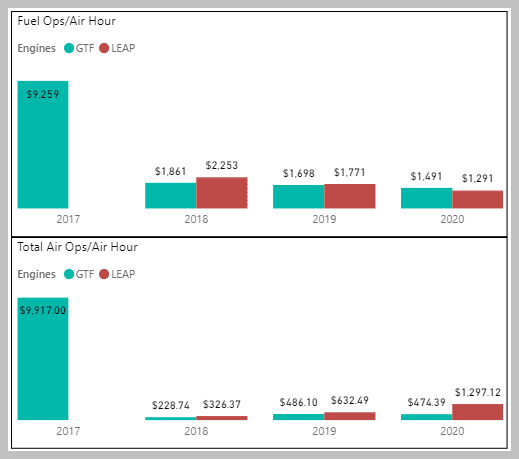

Next, we look at the fuel burn and overall air operational costs for these engines.

The GTF appears to have a small advantage in fuel burn over the LEAP.

But in terms of overall air operations costs, the LEAP is doing better.

The A320neo numbers are primarily driven by the aircraft flown by Frontier.

A321neo

Next, we look at the A321neo. This aircraft is becoming much more important as it now outsells the A320neo and is an aircraft that is finding itself more popular as it replaces the 757.

Next, we look at the A321neo. This aircraft is becoming much more important as it now outsells the A320neo and is an aircraft that is finding itself more popular as it replaces the 757.

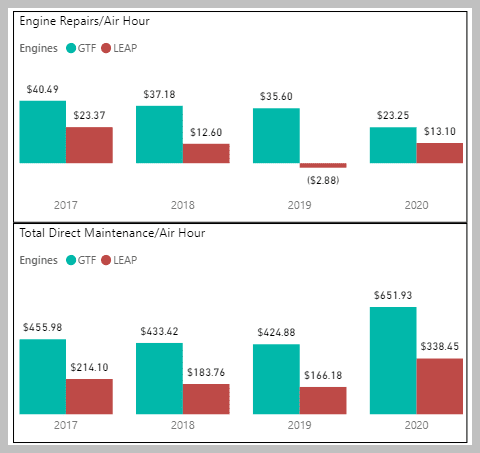

In 2017 we see a settling in period that occurred at Hawaiian. By 2018 this resolved. The A321neo is used on longer segments as its numbers differ from those on the A320neo.

In terms of the engine repairs per air hour, the GTF has the advantage. This is also true for direct maintenance per air hour.

In terms of fuel burn, both engines deliver competitive numbers.

As we saw with the A320neo, the individual advantages add up to drive the overall total air operations costs per hour. On the A321neo, the GTF has the advantage.

In US airline use, the A321neo numbers are driven by Hawaiian’s fleet. This airline is flying stages over 2000 miles.

In summary, the results show that the competition between CFM and P&W is close, but the LEAP is clearly doing better on the A320neo. The GTF shows better fuel burn and is doing better on the A321neo. As the fleets grow, we will monitor the data for changes.

Meanwhile, the engine OEMs face tough times as older engines stop generating expected incomes which, in turn, hampers R&D improvements on the latest generation engines. The intense competition between CFM and P&W for the large single-aisle market will remain aggressive. But we expect progress on tweaks (PIPS) to slow as fuel prices remain low and market demand remains tepid.

Views: 2577

Excellent information. Would be better if added total fleet (manufactured), flown hours, durability measures. If at some time such statistics will be added, pls repeat the whole analysis and re-publish it regular (annually). Hope to grasp it here or somewhere.

On the A321neo fuel ops, what did GE do in 2020 to get the cost down so much?

$1771/hr 2019 to $1291/hr 2020

Great question and only GE and the airline can tell you or us. Neither will talk of course.

Addison:

Thanks for the analysis. Do you have any Production order information on Leap vs GTF quantities or market share for the A320neo/A321 series?

Two good engines for AI A320 family. Unfortunately there is no competition from the environmental aspect. GTF is much quieter. Good for those who live next to an Airport.

Great info. Do you have more data for 2021?

Yes – subscribers have access to the updated models

I still don’t understand one thing, overall which engine is cheaper and more fuel efficient. Also I’m not sure if you m iq but whilst is the new most efficient engine in the world in any size? Thanks!