2020 11 09 9 12 28

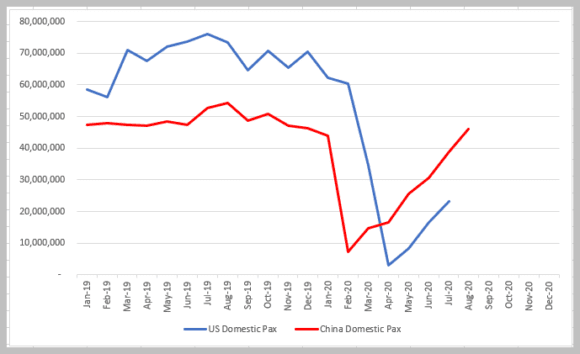

The relative sizes of these markets are quite different. But something big transpired over the past year that deserves attention. The first chart shows the number of monthly domestic passengers in both countries.

Through March 2020, the US had a significantly larger domestic air travel market than China. Then the pandemic came. China got hit first and bottomed out in February 2020. The US got hit in March and bottomed out in April 2020. Both air travel markets are recovering with a V-shape. But China has recovered faster and now has a larger domestic air travel market than the US.

The eye may deceive; the recoveries in these two markets are very close.

Even as they are close, with perhaps the US trendline ever so slightly steeper, China will end the year the larger air travel market.

Moreover, as China seems to have been able to manage its pandemic impact on air travel better than the US (not a political statement) there is a chance we can expect to see the US recovery rate slow.

If that comes to pass, which recent data supports, then China is likely to continue its air travel recovery while the US works its way through a rebound in the pandemic.

With the EU also suffering a pandemic rebound, the news today of Pfizer’s vaccine test results are especially welcome. Absent a vaccine, the chances of Western air travel recovering any time soon is iffy at best.

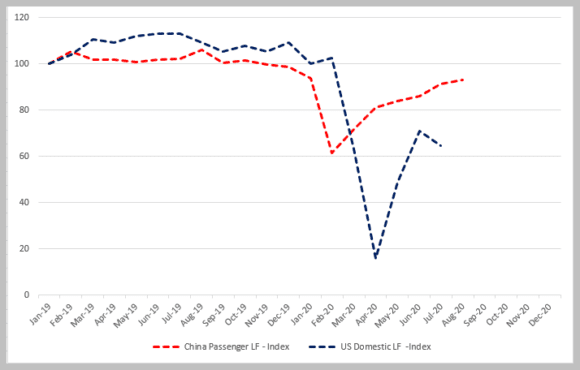

One more chart to illustrate the changes in air passenger traffic between China and the US. The chart is indexed to 100 as of January 2019 and shows load factors. The US had a very good load factor all through the start of the pandemic.

Here we see something really interesting. China’s airlines are very close to being back where they were in January 2019. China’s August load factor was at 93 to January 2019’s 100. The most recent number for the US was July and was at 64.5 – still way off January 2019’s 100. We can see the US airline industry saw a sharp bounce off the bottom in load factors. Schedule cutbacks helped. But traffic recovery did not maintain its trajectory.

It is going to be very interesting to see how long the US air travel recovery takes and, if and when, it will be able to overtake China again. If China maintains its lead, it happened much earlier than projected.

Views: 16