Traffic

US air travel has leveled off in the early part of the second quarter, as airlines struggled with staffing issues and growing operational capacity. The result is that traffic is constrained and flat, with traffic remaining at about 90% of pre-pandemic levels. While future bookings look promising for leisure travel, business travel has not fully returned to pre-pandemic levels and while approaching 65-70% of prior levels, still has a long way to full recovery.

International traffic, particularly international business traffic, also remains constrained and flat. While airlines have adjusted capacity downward to maintain yields, the leisure markets have substantial pent-up demand, with higher than expected yields in main cabins and lower than expected yields in premium cabins. Nonetheless, the industry remains cautiously optimistic as more and more countries re-open routes for tourism. But quarantine areas in Asia have prevented more substantial growth.

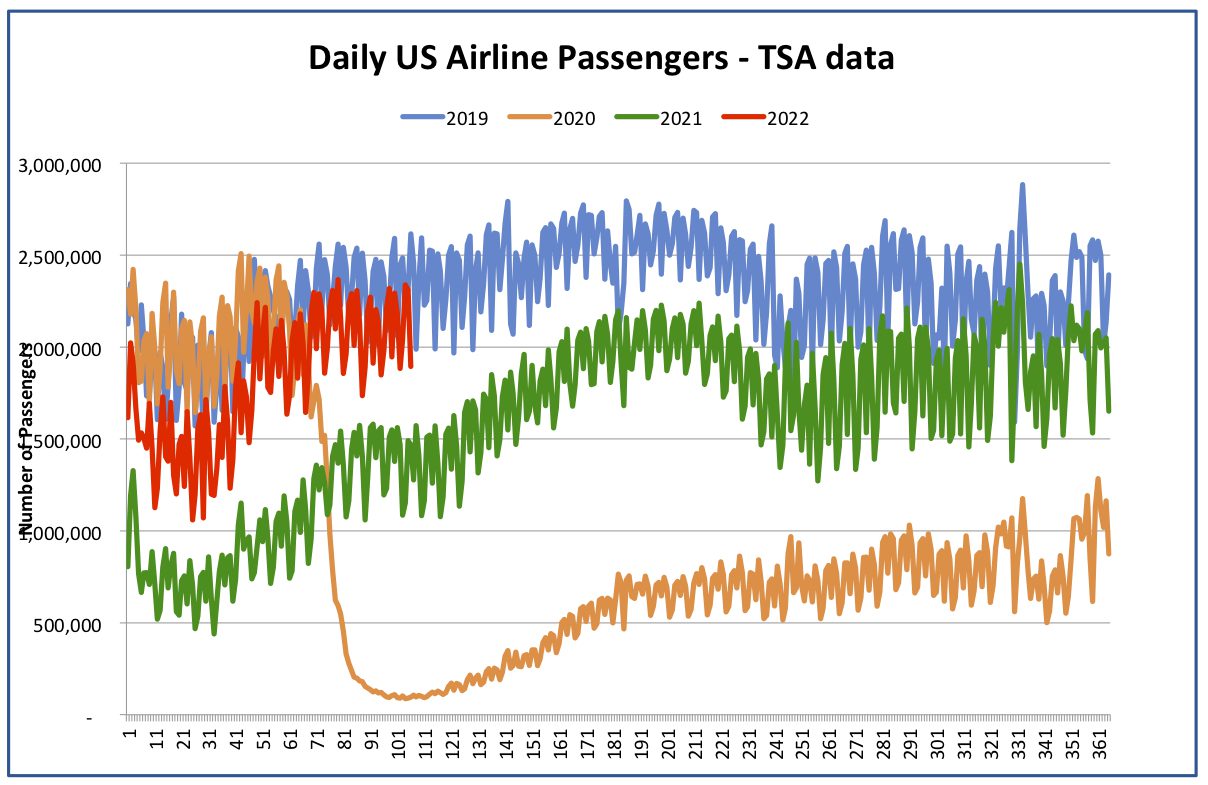

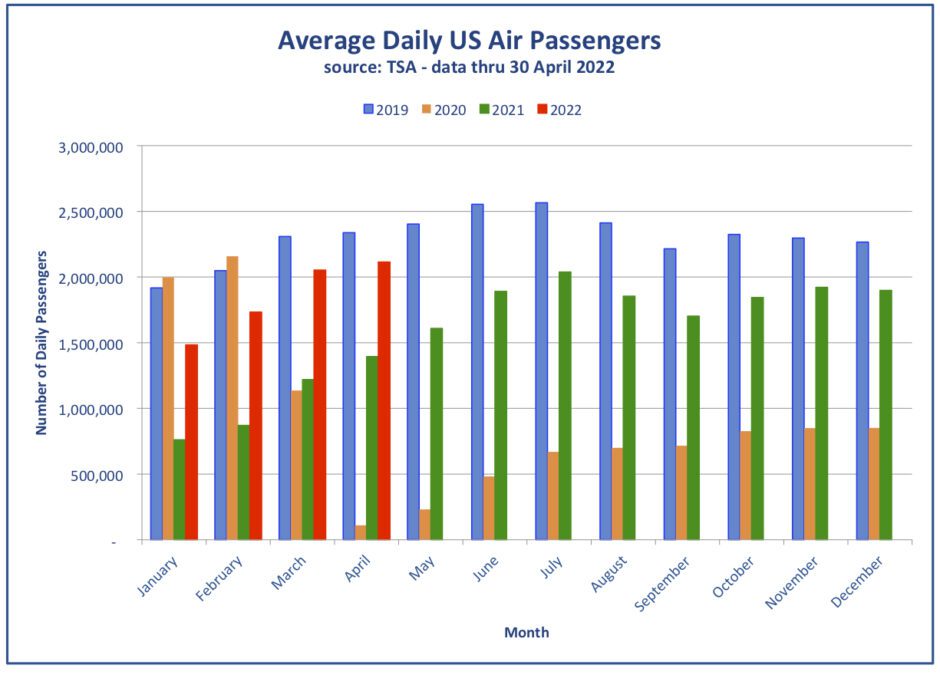

The following chart illustrated the US passenger throughput from TSA and shows that traffic has been constrained and flat at about 90% of pre-pandemic levels. April, in particular, showed traffic levels consistent with historic patterns but at a lower level than pre-pandemic periods.

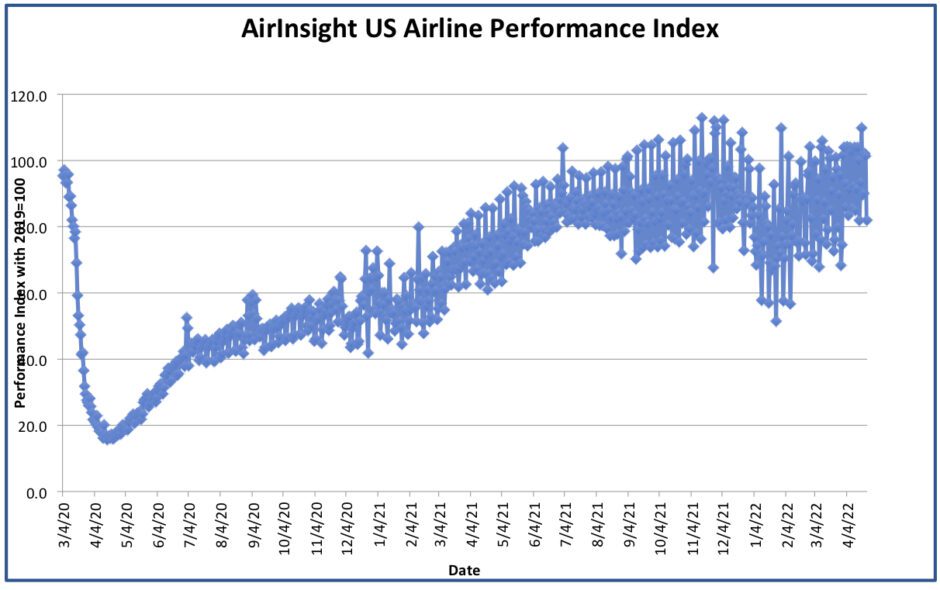

Our AirInsight US Airline Performance Index shows a slight recovery after a weak start to the year, but still under the 100% level that measured pre-pandemic performance. Capacity constraints have restricted growth, and are expected to continue throughout the summer season as airlines struggle with staffing issues and a looming pilot shortage.

A more detailed look at the last three weeks shows our index hovering around 95, just under pre-pandemic performance but not doing much. Again, a constrained and flat April hasn’t moved the index higher.

With respect to traffic, April numbers showed a seasonal improvement over those in the first quarter, but that improvement did not close the gap, as traffic remained constrained and flat. Average passengers per day during April rose from 2.05 million in March to 2.14 million in April, rising to 90.5% of 2019 traffic for the month. The following chart illustrates the average monthly traffic for 2019 through April 2022.

Constrained and Flat

It appears that regaining the last 5 to 10% of traffic lost to the pandemic is going to take some time, longer than many airlines hoped or expected. While international routes are re-opening, many markets, particularly China, remain closed. Domestically, while businesses are returning employees to offices, activities are not quite back to normal, with desktop teleconferencing reducing business travel for some activities. Given traditionally higher yields for last-minute business travel, this will have an impact on the revenue mix for airlines for the foreseeable future, as a 5-10% drop in business travel has a disproportional impact on revenues, which would drop 10-20% depending on the markets involved.

We characterize early second-quarter industry performance as constrained and flat, with the recovery to 90% of prior levels a plateau that will need an external impetus to breakthrough. Whether that will be the opening of international routes or declarations that the pandemic is over from the medical community remains to be seen. But we don’t expect to see pre-pandemic performance levels until at least the third quarter or later, depending on where the economy is headed.

Views: 2