a350 2 2

Delta Air Lines expects to significantly grow its revenues and earnings per share in 2023, based on strong growth and a full recovery to pre-pandemic levels. Solid free cash flow will help the airline to reduce its debt, it said on December 14 on its Investor’s Day. Delta bullish about 2023 as it plans to outpace 2019 levels.

Delta expects to close 2022 with $45.5 to $45.6 billion in revenues. For 2023, this should be 15 to 20 percent higher year on year. The operating margin should grow from 7.7 percent this year to 10-12 percent next year, helped by non-fuel costs that should be between 5 and 7 percent lower. For 2024, EPS is guided at 13-15 percent.

Adjusted earnings per share should be between $3.07 and $3.12 in 2022, increasing to $5 or $6 in 2023 and $7 in 2024. This takes the recent pay agreement with the pilots into account, although this is still subject to union approval. From positive free cash flow of around $0.1 billion this year, the carrier counts on at least $2.0 billion in the year ahead and even $4.0 billion in 2024. This will help to reduce debt, which currently stands at $33 billion (Adjusted).

CEO Ed Bastian said that Delta expects to close Q4 2022 with an operating margin of 11 percent, slightly down on the 12 percent in Q3 and Q2. The operating income will also be a bit lower to $1.4 billion compared to $1.5 billion in Q3 but on par with that in Q2. Overall, the airline is ahead of expectations. Already in Q3, revenues were ahead of 2019 at 103 percent but this is expected to grow to 107-108 percent in Q4, making HY2 a very strong period. Leisure demand was robust during the summer period while corporate travel recovered to 80 percent of 2019. Forward bookings for Q1, usually the weakest quarter, remain strong.

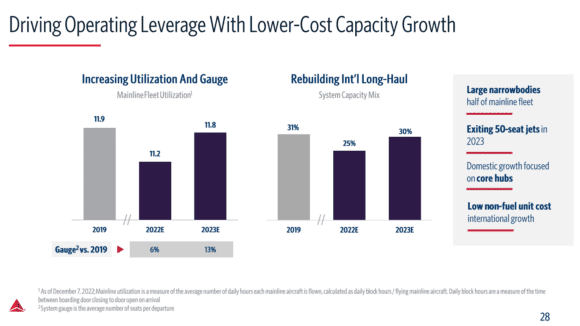

Delta Air Lines plans to operate at 101 percent capacity/available seat miles next year, up from 85 percent this year. Seats offered are at 98 percent versus 86 percent, departures will be 86 percent of 2019 compared to 81 percent in 2022. While the mainline fleet is operating above 2019 levels, the regional fleet is underutilized, said President Glen Hauenstein. This will continue in 2023 when Delta intends to exit its 50-seaters and upgauge regional capacity to bigger aircraft. The focus will be on revenue growth in the core hubs like Atlanta, Detroit, Michigan, and Salt Lake City, where Delta claims to be the industry leader. 75 Percent of domestic seat growth should come from these airports next year.

Delta’s international network should produce high single-digit operating margins next year, which mirror the 9 percent in 2019. Long-term, this should grow even further and even double, thanks to a larger offering in premium seats to 30 percent in 2024. Delta is also expecting significant growth potential from its joint ventures with Aeromexico and LATAM on its network into Central and South America while relying on the successful alliance with Air France-KLM and Virgin Atlantic on the transatlantic.

Views: 1