PXL 20220614 163838019MP

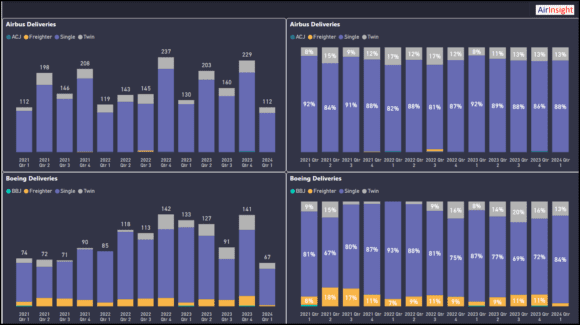

We noted previously that the supply chain is doing better than many realize. Tracking deliveries is the best way to get a big-picture view.

Here’s a summary of quarterly commercial deliveries from January 2021 through today. Please click on the chart to view it larger.

Notes:

- Airbus is out delivering Boeing, and obviously, this is primarily MAX-related.

- Boeing has a substantial advantage in the freighter business.

- It is a product gap Airbus needs to close, and the A330F did not catch on as it might have, which is odd since so much of the freighter market is 767-based.

- The right size, but the wrong price point? Perhaps, since so many 767s are second-life aircraft. The A330F conversion business is small.

- However, Airbus has seen some interest in second-life A330s for Amazon. But nothing like the FedEx and UPS business.

- There is some flowthrough from commercial models to the military market – again pitting 767 against A330s.

- Market takeup of the 777F vs. A350F is vital to watch.

Due to deliveries, the supply chain has de facto swung towards Airbus, providing it with a profound advantage. Industrial advantages from economies of scale are substantial. For example, does Airbus pay the same for inputs as Boeing for avionics? These details are closely guarded, but you get the picture.

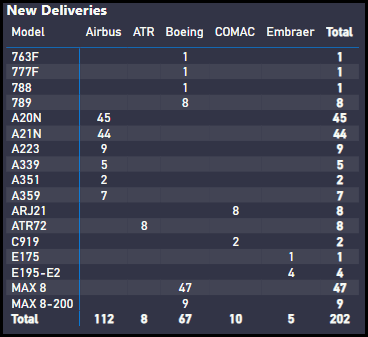

Other delivery details are well-known and bear repeating. Airbus has a model the market wants, as the following table of 2024 deliveries illustrates.

Everyone understands the “What.” Everyone wants to know, “What next?”

- What will Boeing’s plan look like? Spirit AeroSystems will likely be a big part of that, but what else?

- How will the FAA react to this plan? Will it slow the MAX rate even more or allow some relief?

The 90 days until Boeing’s report are anxious times.

Views: 3