Boeing Logo

Boeing’s problems are getting worse. The MAX is grounded, the 787 is being investigated for quality issues and has major engine problems, the 777-X is even further delayed with engine problems, and the KC-46 is failing to meet needs and currently restricted from carrying passengers and cargo. Now, the prior generation 737NG is developing serious premature failure of structural components that should last the lifetime of the aircraft, and could result in an additional financial drain. We’ve been looking for good news about Boeing, but simply can’t find any.

Compounding the problem, trade wars with China and potential WTO tariffs with Europe do not bode well economically and Boeing could end up the big loser in these geo-political disputes. While these are not entirely of Boeing’s making, the company’s efforts to stop the Bombardier C-Series through international trade mechanisms resulted in Airbus picking up a high quality all new aircraft for virtually nothing, forcing Boeing to acquire a majority of Embraer for billions of dollars to keep pace. Advantage Airbus.

Further compounding the problem, a whistleblower report that is quite credible claims that Boeing favored expediency and cost over safety for the 737 MAX.

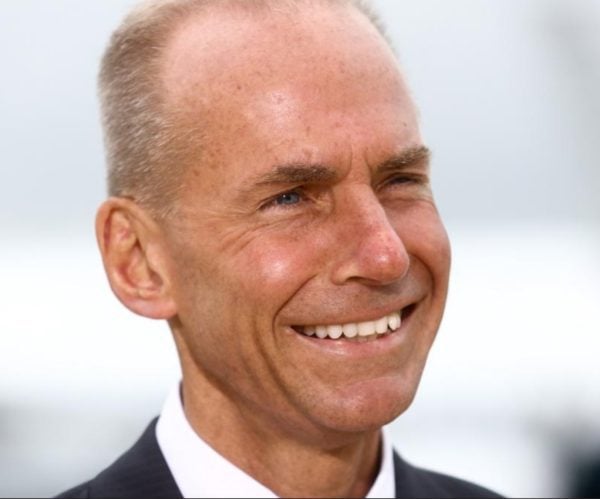

All of this is coming under the leadership of Dennis Muilenburg, whose strategy appears to be to maximize the share price for stockholders, and the executive team that holds stock and options. Having returned nearly $50 billion to shareholders through dividends and stock buybacks over the last five years, rather than invest in new products to better compete with Airbus, Boeing’s market share is falling and, given the aforementioned failures, is losing its reputation for quality and safety.

The more that is revealed about the 737 MAX problems the greater the negative impact on Boeing. When some use the term “criminally negligent” in news articles describing how Boeing failed to disclose the details of the MCAS system to pilots who flew the aircraft, the potential impact is clearly quite serious.

The recent revelations that the 737 MAX single rudder cable does not meet F.A.A. guidelines for protection against an un-contained engine failure and could potentially result in loss of control of the aircraft has serious implications,but is not a part of the current MAX investigation. We hesitate to think what could happen if an in-flight incident occurred. With millions and millions of flight being flown, even a one in a million probability is too large to ignore from a safety perspective.

It appears that Boeing took unfair advantage of a relaxed regulatory environment and, for the sake of speed and cost, cut corners in the certification process. MCAS is the glaring example of a software system that was flawed in both its design and execution, with details hidden from F.A.A. regulators, customers, and pilots, and was the major contributing factor in the loss of 346 lives. Having hidden potential problems from the FAA once, this has resulted in EASA and other foreign regulators to conduct independent testing and evaluation of the MAX, significantly delaying its return to service at a high cost for shareholders, customers, and the traveling public.

Mismanagement at Boeing has left the company vulnerable to an untenable financial situation, caused by rushing a program to market while management was also seeking reductions in costs at every opportunity. While reducing costs and being competitive is laudable, it can, and has, gone too far at Boeing. Safety appears to be the victim of rushing and cost reduction pressures, guided by a corporate culture that starts at the top.

The once engineering driven Boeing culture has changed over the last two decades into a financially driven culture, and Boeing’s current CEO, Denis Muilenburg’s primary objective seems to be increasing the short-term stock price of the company, through whatever means possible. Where is the 797 or NMA to compete with the A321XLR, which is outselling competing Boeing products by a 5:1 margin? The answer lies in buying back shares to raise short-term value rather than investing in the company’s future with highly competitive and advanced products.

Boeing must transform itself into a more competitive entity. The forthcoming NMA and FSA aircraft are both needed to fill out Boeing’s product offering sooner, rather than later, and must rely on innovative materials and manufacturing technologies. But that transformation can’t occur if current programs are not executed well, and those programs cannot be executed well with mandates to reduce both schedule and cost beyond reasonable expectations, particularly when corners are cut with respect to safety. The culture has deteriorated to the point that the Board had to step in to create a safety organization that formerly was ingrained in the company’s culture. That, in itself, is a sad indictment of company leadership, or lack thereof.

The 737 MAX will end up years from now as a Harvard Business School case study in mismanagement, and the buck stops with the CEO. Today, Boeing offers four commercial models for sale – the 737 MAX, the 767 freighter and tanker, the 777, and the 787. Two of the four (MAX and 787) have been grounded by the FAA for safety reasons, which is a rare occurrence, another (KC-46) is operating under severe restrictions until problems can be fixed, and the revised 777-X models have been even further delayed from their initial schedule. The company appears to be incapable of doing what it did for many years — design and build safe new airplanes that advance the state of the art and are completed on time and within budget. Cutting fat is fine, but cutting muscle is another thing entirely.

News reports earlier this year indicated that a good portion of the audience at a business travel convention left the room when Dennis Muilenburg was introduced. When those who pay the highest fares in the industry walk out on the CEO of Boeing, it is clear that he has lost public credibility with the end customers that support the company financially.

The Boeing company needs to move back to the “can do” culture it once had, with safety as a given, to restore its image with airline customers and the traveling public. To accomplish that, new leadership is necessary. It is time for the Board of Directors to take appropriate action and replace Dennis Muilenburg.

Views: 2

Before Boeing filed its complaint against BBD and the C Series, they were about to do a deal with the Canadian government to sell them 18 F/A18-Super Hornet. That would have given Boeing a major advantage for the replacement of Canada’s Fighter jet fleet. Muilenburg’s short term strategy has cost the loss of a big contract with Canada. And he is doing it again with Airbus, way to go Muilenburg to kill Boeing.