image: Embraer

- 2025 Guidance reiterated: Commercial Aviation deliveries between 77 and 85 aircraft, and Executive Aviation deliveries between 145 and 155. Total company revenues in the US$7.0 to US$7.5 billion range, adjusted EBIT margin between 7.5% and 8.3%, and adjusted free cash flow of US$200 million or higher for the year. The company highlights that U.S. tariffs did not materially impact 2Q25 results.

- Revenues totaled US$1,819 million in 2Q25 – an all-time high 2nd quarter – +22% year over year (yoy). Highlight for Executive Aviation revenues with +64% yoy growth.

- Adjusted EBIT reached US$191.8 million with a +10.5% margin in 2Q25 (+9.3% in 2Q24).

- Adjusted free cash flow w/o Eve was US$(161.6) million during the period in preparation for a higher number of aircraft deliveries in the coming quarters.

- Embraer delivered 61 aircraft in 2Q25, of which 19 were commercial jets (10 E2s and 9 E1s), 38 were executive jets (21 light and 17 medium), while four were defense-related; +30% versus the 47 aircraft delivered yoy.

Firm order backlog of US$29.7 billion in 2Q25 – all-time high.

Notes:

- Embraer reported strong 2Q25 results; revenues are at an all-time second quarter $1.819 billion, +22% yoy. Embraer delivered 61 aircraft in the quarter, +30% compared to last year. The breakdown is: 19 commercial and 38 executive jets.

- Embraer reported adjusted EBIT of $191.8 million with a 10.5% margin. This is better than 9.3% in 2Q24.

- Firm backlog is at a record $29.7 billion.

- Executive Aviation showed exceptional performance with 64% yoy revenue growth.

Embraer reaffirmed 2025 guidance, projecting 77-85 commercial and 145-155 executive jet deliveries. Total revenue is expected to be between $7.0-7.5 billion and an adjusted EBIT margin of 7.5-8.3%.

With our focus on aviation, here are some charts highlighting what we see to date.

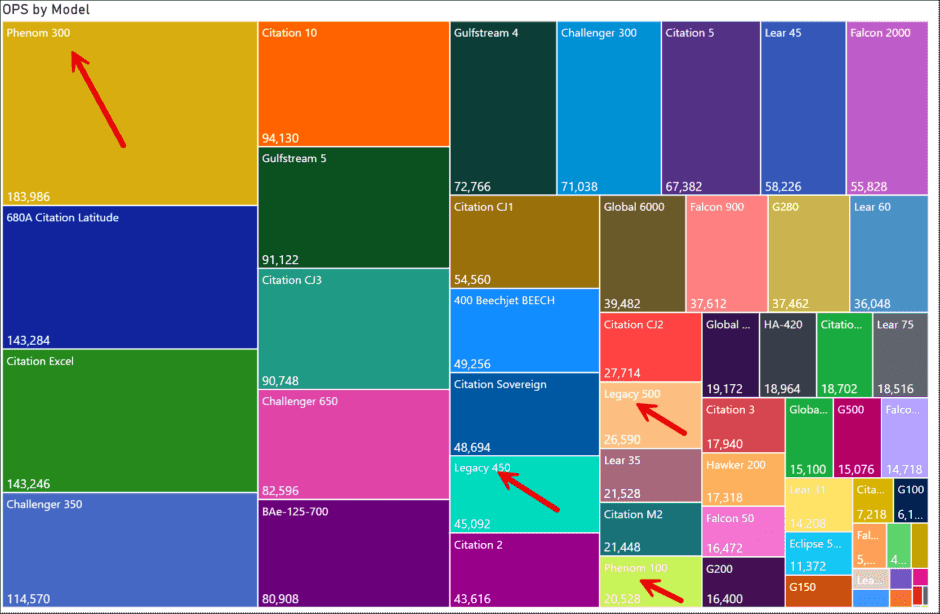

Business Jets

Embraer, shown by red arrows, is the leader. But its product line is Phenom 300 heavy. The Legacy and Phenom 100 are much smaller players. The reliance on one model is mirrored in commercial.

Commercial Jets

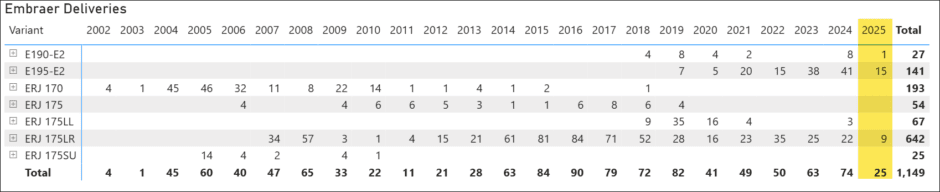

The table lists 29 deliveries YTD, significantly more than the 2Q25 report. Our count is through today, 5ive weeks since the quarter end. The key item here is that the E190-E2 is not winning market support as the E-190 once did. Another key item is the E175, once the bread and butter of Embraer’s commercial division.

The E175 is the sole new regional jet that can be deployed in the US market. The US market accounts for over 70% global regional operations. Slowing E175 deliveries should be a big concern. The Paris show saw a good SkyWest order. But Embraer needs more than this market to keep the E175 on the boil. JP Morgan states: “At this point, Embraer doesn’t expect new orders for the E175 in the short term in the US.” This is an awkward signal.

Summary

Bank of America is possibly the closest among the analysts following Embraer, and they remain supportive with a buy recommendation. They state: “We maintain our Buy rating and expect the Street to view the results favorably.” JP Morgan said, “We expect a positive reaction today due to the stronger-than-expected margins, showing the continuous improvement in the company’s profitability.”

Currently, this is the market’s stance on Embraer. The market seems less enamoured. The market needs more.

We have noted the slow commercial delivery rates. The backlog has grown, but production has, apparently, not kept pace.

The dependence on the E175 is a concern, as well. This model should remain a force, but even with tweaks, operators need a step change. In single-aisle aircraft, there are the NEO and MAX, but for regional jets, there’s nothing. We are aware of two technologies that could significantly impact the economics of the E175 positively. This is one of them.

Embraer needs to embrace new ideas to extend the E175. And it needs to accelerate production and deliveries as a whole. And then there’s the mysterious new airplane everyone is waiting to hear about.

Views: 185

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}