EurowingsAirbusA320ceo

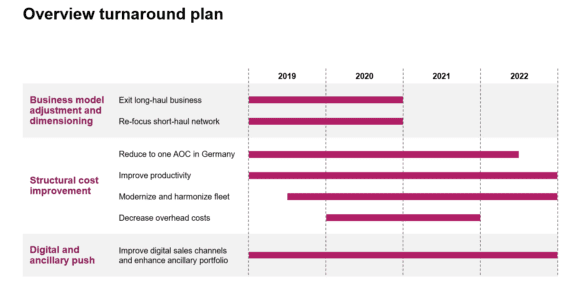

Lufthansa’s low-cost airline Eurowings before the end of next year will re-focus on short-haul, point-to-point operations, slash costs by 15 percent and later on modernize its fleet. This is the most significant announcement at Lufthansa’s Capital Markets Day for investors in Frankfurt on June 24.

Eurowings, built on the foundations of GermanWings and more recently grown on the relics of airberlin, has been loss-making for most of its existence. Last year, EBIT was EUR -231mln due to the high integration costs of former airberlin aircraft and staff. The Lufthansa board expected Eurowings to break-even this year, but its revised strategy confirms it has other plans.

The German LCC operates on 442 routes from 13 bases, using a fleet of 139 aircraft. Last year it flew 27 million passengers, with a 31 to 47 percent point-to-point market share at Dusseldorf, Koln, Hamburg, and Stuttgart at a yield premium that at EUR 86 is higher than that of its competitors. Yet, Eurowings has become too complex and is wasting a potential cost advantage, CEO Thorsten Dirks explained. That’s why Lufthansa wants to simplify its structure.

As a first step, Eurowings will restructure from four Air Operation Certificates (Eurowings Deutschland, Eurowings Europe, Germanwings, Luftfahrtgesellschaft Walter) to just one AOC. The new Eurowings will concentrate on point-to-point short-haul routes with a modernized fleet. Out will go the seven Airbus A330-200s used on long haul routes, which will be transferred to Lufthansa’s network airlines (Lufthansa, SWISS and Austrian Airlines).

Nine of the oldest Airbus A320s – some of which are 28 years old – will be retired this year, while nine wet-leased aircraft will also be returned to their lessors. Also to go are four Bombardier Dash 8 Q400s to be returned from 2021.

In 2021, Eurowings will get four A320neo’s, with 16 to follow in 2022 from an existing order from Lufthansa. To reduce costs Lufthansa will standardize its neo-fleet with deliveries from 2020.

Modest capacity growth

Eurowings will adopt a modest growth in capacity of just one percent per year, having grown by 19 percent since 2015. Its low crew productivity, crew redundancies, and operational inefficiencies will all be dealt with, resulting in an increase in block hours per crew member of 530 to 750 per year. Pilots that are flying under Lufthansa contracts will return to the network airline. In all, aircraft productivity will increase 10-15 percent, CASK be reduced by 15 percent and short-haul overhead costs by 30 percent in 2022. Digital sales channels and ancillary revenues should have increased by 20 percent in 2022 compared to 2018. Before these fruits will be reaped Eurowings plans to invest EUR 50 million this year to gain operational stability.

Instead of breaking even this year, Lufthansa now expects this to happen in 2021 and Eurowings to contribute to Group EBIT by 7 percent long-term.

Brussels Airlines

Lufthansa has another restructuring plan on its hands that will be revealed in more detail in Q3. This concerns Brussels Airlines, the Belgium subsidiary bought in 2008. Brussels Airlines has had some difficult years amidst management uncertainty. Lufthansa has now shelved plans to integrate the airline within Eurowings, instead opting for a closer alignment to the network airlines.

Revenues to grow 3 percent

Lufthansa Group last week revised its 2019 guidance, reducing its EBIT outlook to EUR 2.0-2.4 billion or on average 0.5 billion lower due to over-capacity, high competition and yields under pressure. On Capital Markets Day the German airline group made it clear that a 3 percent revenue growth and 1-2 percent cost reduction is clearly on its radar for 2022.

Lufthansa Airbus A321ceo. (Lufthansa)

Lufthansa will continue its roll-out of Premium Economy, with the introduction next year of an enhanced product on its new Boeing 777-9s, on the SWISS 777-300s in Q1 2021 and in Q2 that year even on the SWISS A340-300s despite the phasing-out of this type later on in the next decade.

By then the fleet will see seven types leave Lufthansa (Boeing 747-400, 777-200, 767-300, Airbus A330-200, A340-300, A340-600, and McDonell-Douglas/Boeing MD11F). Introducing the 787-9, this brings to total numbers of aircraft types to 8 around 2025. New delivered 82 A320neo’s and 42 A321neo’s will have a common specification from 2020. Lufthansa continuous its preference for buying outright over leasing.

Being able to fly the 795-strong fleet (status 2023) and with a pilot shortage looming, Lufthansa will step up training at its Training Academy to 500 pilots a year.

The Lufthansa Board also announced that from now it will pay 20-40 percent dividend of the Group’s net profit to shareholders, up from 10-25 percent.

Views: 1