In the wake of last week’s fatal incident, the FAA has issued an emergency Airworthiness Directive. Southwest Airlines flight 1380 last Tuesday from New York to Dallas experienced an uncontained engine failure of a CFM-56 engine during which shrapnel penetrated the cabin resulting in a passenger fatality resulting from explosive decompression.

The CFM-56 is the most widely utilized aircraft engine in the world, powering the Boeing 737NG series and more than half of the Airbus A320 family fleet. There are more than 8,000 CFM-56-7B engines currently in service on the Boeing 737NG series. The -7B series was introduced in 1999.

This AD is only applicable to -7B engines that have accumulated more than 30,000 total cycles since new. The FAA cites that only 352 engines in the US and 681 engines worldwide are impacted, and the required inspections must be completed within 20 days, with the other engines in service relying on inspection requirements from the manufacturer and its maintenance service bulletins. While the true cause of the accident cannot be determined until the NTSB report is final, this incident is similar to another incident on a Southwest flight in 2016 that also resulted in an uncontained engine failure from metal fatigue in a fan blade.

It should be noted that the CFM56 has had three incidents like this, twice on the 737 (both on Southwest) and once on an A320 (British Midland flight 92). This is an incredible performance given the number of engines in service and the number of cycles they have generated. The CFM56 fleet is the largest in service.

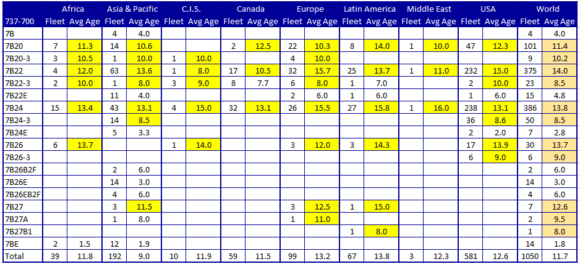

The table lists the number of CFM56-7 engines in service as of the end of 2017.

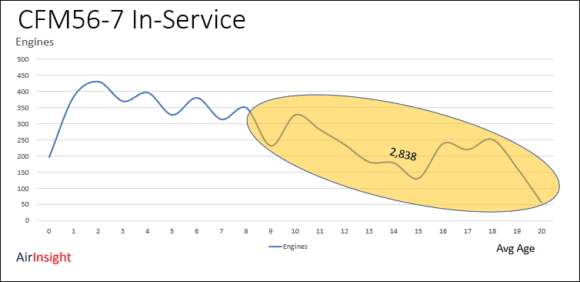

Next, let’s look at the fleet age.

As we can see from these two tables, the FAA AD has a very wide reach. Potentially the AD may impact more engines than suggested elsewhere. As the next chart illustrates, there are over 2,800 engines that average over eight years old and may fall into the 30,000-hour requirement.

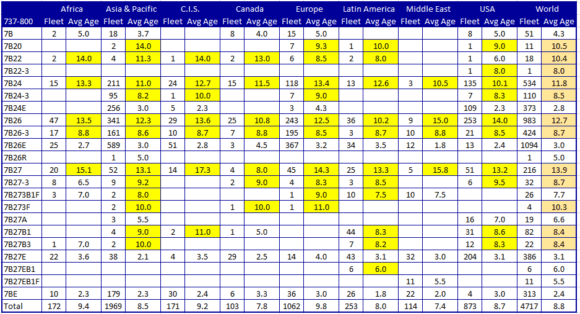

Of course, the FAA focus is on engines within US airspace. But the reach of its influence on safety reaches across the globe. The following two tables show where the CFM56-7B engines in service are located. We highlighted those that are from eight years and up as areas of focus for the inspections. We would expect that inspections will be undertaken on the engines over eight years old. As the tables illustrate the number of aircraft impacted by this AD is large.

On the in-service 737-700 fleet, there are 990 engines that might fall into the inspection category.

On the in-service 737-800 fleet, there are 2,221 engines that might fall into the inspection category.

The Bottom Line

Regulators are catching up with a potential problem but may have dropped the ball after the 2016 failure by not requiring more rigorous inspections. While this AD appears to be overdue, a lingering question is whether the 30,000 cycles, which is about 8-10 years of typical airline operations, is too long an interval for inspections for metal fatigue, which could potentially also occur in younger engines.

A regulatory issue is whether by not taking effective action after the 2016 incident, did the FAA contribute to the first passenger fatality in nine years in the United States because it was unwilling to increase maintenance costs for airlines?

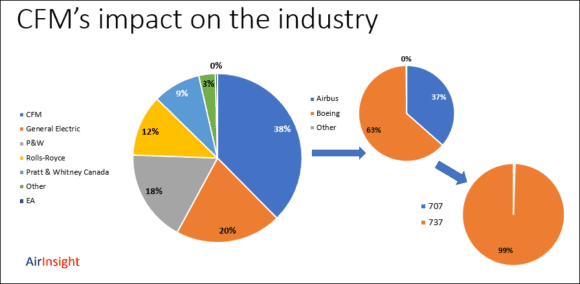

While CFM, a joint venture of Safran Aircraft Engines in France and General Electric in the United States, builds a fine engine with a strong safety record, erring on the side of caution is always appropriate in matters of safety. The impact of CFM on the industry is explained in the following chart.

CFM accounts for 38% of all aero engines in service, and of those engines, Boeing accounts for 63% of those, 99% of which are on 737s. The impact of the FAA AD is clearly going to impact a significant part of the airline fleet. Expect a lot of disruptions, which have already started.

Views: 12

What about the CFM56-7Bs powering the 737-900, the 737-900ER and the 737-600? Have you counted those and if not why have you missed them out of the analysis?

We did include them in the last chart. The -700 and -800 are the biggest fleets where we focused.