gtf xlr

PR: Cologne/Toulouse, 21 February 2025 – The European Union Aviation Safety Agency (EASA) has issued the Type Certificate for the Airbus A321XLR powered by Pratt & Whitney GTF™ engines. This follows the certification of the CFM LEAP-1A powered A321XLR in July 2024 and paves the way for the first customer aircraft with Pratt & Whitney engines to enter into service later this year.

Christian Scherer, CEO Commercial Aircraft at Airbus said, “The A321XLR already displays its great versatility crossing the Atlantic in daily operations. With the certification and entry-into-service of the GTF-powered A321XLR we will see more operators introduce this game changing aircraft. It is also good news for our customers’ passengers who will benefit from the convenience of new direct city to city connections with a heightened level of cabin comfort.”

The A321XLR sits side by side with widebodies in an airline’s fleet. It introduces the flexibility to add capacity, to open new routes, or even to continue operating existing ones when demand is variable. This is all while burning 30% less fuel per seat than previous generation competitor aircraft. The A321XLR’s new Airspace cabin will provide passengers long haul comfort in all classes.

The first A321XLR completed its maiden flight in June 2022. This was followed by an extensive test programme involving three test aircraft. In 2024, the A321XLR entered into service. So far more than 500 Airbus A321XLRs have been ordered.

With this certification, Airbus can expedite deliveries to key customers who selected the GTF engine. These customers include Wizz Air in Europe and Delta and United in the US. The US market best understands the case for the single-aisle middle-of-market airplane. The US was home to most of the 757 fleet, which remains in passenger service at Delta and United.

Airbus points out that more than 500 XLRs have been ordered. Is this a good number? If the XLR is considered the proper 757 replacement, these orders need to be around double that. Last summer, at the air show, Boeing’s marketing VP Darren Hulst was asked about the lack of a competitor to the XLR. He made the case that this market is a niche. We took a look at that thesis and found it holds water.

We have been gung-ho on the XLR as a disruptor, looking at operational ideas and Aer Lingus‘ plans for the US.

Airlines typically acquire equipment with ranges above average requirements. For example, the average stage length in the US is just under 1,000 miles. Yet airlines need their equipment to have “transcon” capabilities of 3,000 miles. Readers may remember the fuss comparing the A220 (then C Series) with over 3,000 miles range compared to the 2,800 for the E2. Miraculously, once the Boeing/Embraer deal collapsed, the E2 could exceed 3,000 miles. Go figure.

The XLR’s long-range does enable new markets to be considered. For a US operator, that will almost certainly be from a fortress hub to a secondary city across the Atlantic. The same logic applies to Latin America, perhaps even the African West Coast. These are going to be niche markets. The XLR, at probably 200 seats, is a low-risk tool to develop a market before a twin-aisle is deployed. Think of it as a sniper – you don’t need many of them to make an impact.

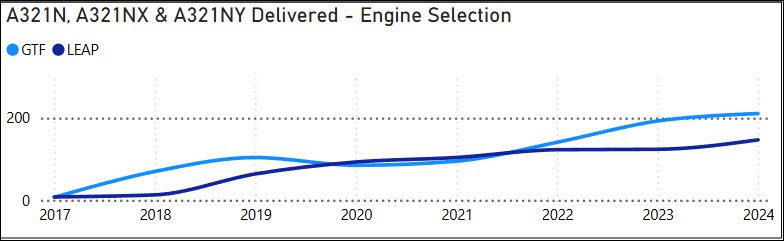

The GTF-powered XLR will help Airbus get the deliveries it has been waiting for. Operators will deploy the aircraft, and it will hopefully prove itself. However, considering most of the missions airlines need to operate can be done with the A321LR. This is not a negative for Pratt & Whitney. The chart below shows deliveries through the end of last year.

Pratt’s GTF has had a strong lead, but the trends might change.

Summary

The XLR offers more range than most operators need, but it will likely be a niche model. For instance, US operators won’t use the XLR for domestic services as they did with 757. Their A321neo and LR adequately cover these markets. Perhaps new markets outside the US will see more opportunities.

Views: 116