EvK72kRXUAAl6x

This post is a rejoinder to our earlier post on this fleet decision. As noted in that post, there is a six-year gap until the arrival of the first A321XLR, so Icelandair intends to lease several A321LRs from 2025. What do we know about Icelandair’s fleet now to guide us on how the A321neo is likely to impact the airline? As before, we turn to the excellent skailark data source. Let’s review Icelandair’s A321 decision.

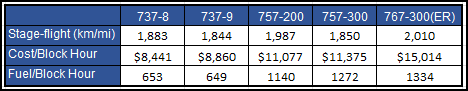

Icelandair is a small island-based airline; it has little domestic traffic. Like other island-based airlines like Cathay Pacific and Singapore Airlines, the fleet focuses on longer hauls. The table below lists three key metrics Icelandair would focus on. Regarding stage length, the airline flies its single-aisle models nearly twice the stage length of US operators. The 757 and 767 aircraft deployed are well into their second decade. Their fuel costs are more than double that of the MAX fleet on a per-seat basis.

Looking at EU operators deploying the A321neo, we note that, on average, stage lengths are ~1,500 miles. Among EU operators, the outliers are Aer Lingus (~2,700 miles) and SAS (~3,750 miles). Local Iceland competitor, Play, also operates the A321neo and averages ~1,800 miles. In terms of range capability, Icelandair will be able to maintain its reach by moving to the A321neo.

In terms of fuel burn, we note a substantial performance improvement. Using EU A321neo operator data as a benchmark, the average 2022 cost/block hour was ~$8,000. This guides to a saving of over 27% compared to the 757 and nearly 47% compared to the 767. Regarding fuel (gallons)/block hour, the A321neo should deliver over 34% better performance than the 757 and 42% better than the 767.

Some issues bear itemizing, though. Icelandair is looking at 13+12 A321XLRs. The first number guides to the 13 XLRs replacing the 757-200s. The 12 options appear to be growth and replacements for the 757-300s. Icelandair only operates three 767s. The XLR is on the small side to replace the 767. Icelandair’s 767 seats 259, and their XLRs are unlikely to be much over 200 seats. Icelandair President & CEO Bogi Nils Bogason previously commented: “For the long term, we have two options. One is to remain a Boeing company with the MAX as our core aircraft supported by the 767 on longer routes. The 767 might then be replaced by the 787 going forward. The other option is to introduce Airbus into our fleet, with the A321LR or XLR replacing the 757s. We are now in discussion with Boeing, Airbus, and the engine manufacturers about this. Our plan is to make a decision in the coming months. That is the reason we are in this long-term fleet strategy now. What is the right fleet to develop our network going forward?” The decision has been made and Icelandair selected the A321XLR.

Even though the airline has a total commitment of 25 A321XLRs, there looks like a good case for the 787 to find a home there still. Of course, one can assume that as conditions evolve, Airbus can flex the current commitment so that A321XLRs might be swapped for A330-800s. Indeed, we would think Airbus would play that “flex card” as it has in several other campaigns. Either way, an updated wide body presence is quite possible at Icelandair before 2030.

Views: 28