supply chain management

Airlines and lessors are frustrated by slow delivery rates on their ordered aircraft. We previously wrote a note discussing the recovering supply chain. As the year progressed, the supply chain appeared more stressed than we had thought. There is a seat supply issue and a well-covered engine supply issue. Underlying these items is the ongoing impact of the “Great Retirement.” The commercial aviation silo doesn’t have the right talent in the volume needed. Boeing’s X-66A program is a recent example. A recent example of this is the A220 program at Airbus in Montreal.

The industry’s need for skilled people is quite clear. Even if the skills needed were met this year, the type of work is highly specialized. Recruits, even those with advanced engineering degrees, must undergo some apprenticeship. The industry’s relentless safety focus demands perfect aircraft. We have seen what happens when this focus wavers. There can be no compromise on safety.

This brings us to the trade-off: Very high demand for new aircraft (traffic growth and need for fuel economy being the key drivers) with constrained delivery ability. This creates a squeeze – older aircraft are sent to MRO shops for unplanned maintenance. Emirates 777-300EREs are being brought into service, and the A380s at Emirates, BA, and Lufthansa are also examples. Then, we see lessors are renewing leases at better rates than before.

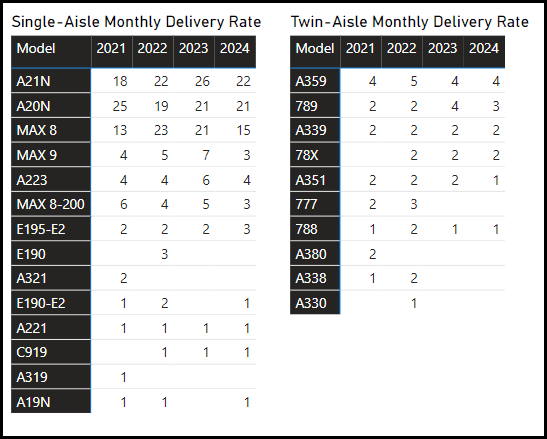

What does the data show? From our daily delivery model, we can share these tables.

Airbus

- The A321neo is the most in-demand model, and rates are significantly lower this YTD.

- The A320neo is also not seeing the rates we expect.

- The A220 program is far below the expected rate.

- The A350 is seeing no rate uptick despite a strong order book.

- The A330-900 is steady – we would have expected this to be higher than 2.

Boeing

- MAX deliveries have seen interruptions, and Boeing built up a sizable inventory.

- This inventory was awkward, with China not taking deliveries. But India came to the rescue, taking lots of MAXs.

- Still, MAX rates are not as high as expected. Many of the deliveries came from the inventory rather than the FAL.

- The 787 program has seen seat shortages and QA issues that slowed rates.

- The absence of the 777X also hampers Boeing’s potential rates.

COMAC

- Delivery rates, to be polite, are anemic.

- Yes, the C919 and ARJ21 also depend on Western supply chains.

- However, both programs are well along in terms of maturity, and the rates do not match the order books.

- Delivery rates do not support chatter about COMAC taking on the duopoly.

Embraer

- Among the big OEMs, Embraer can deliver the fastest.

- Their challenge has been E2 orders, which is why new customer Porter is getting deliveries rapidly.

- Embraer faces a skilled labor threat as the duopoly entices people away. An unsettled Brazilian economy encourages this migration.

- Embraer faces some unique challenges that it has little control of.

Conclusions

- Slow delivery rates will continue for several years.

- This is great news for MRO shops and lessors.

- Suppose you’re looking for better career opportunities; commercial aerospace beckons. The silo is vast and global, so opportunities abound.

Views: 0