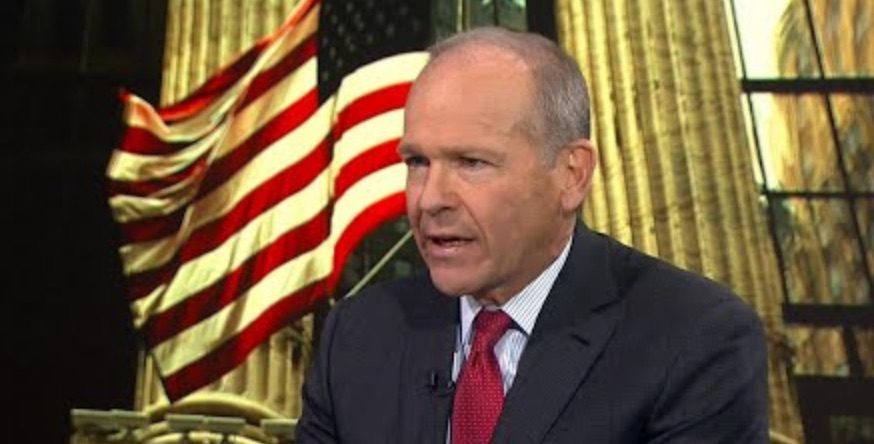

David Calhoun 1

News:

On NBC’s Today show, Boeing CEO David Calhoun made a bold prediction that a major US airline will go out of business by the end of the year, and that it will take up to five years before the industry recovers from the coronavirus pandemic. When asked if a major airline will go out of business, he answered “Yes, most likely. Something will happen when September comes around,” which is when the airlines run out of their federal government bailout. One observer described the situation as “Boeing’s CEO finds another rake to step on.”

He went on to say “traffic levels will not be back to 100 percent, they won’t even be back to 25. Maybe the end of the year we approach 50. So there are definite adjustments that have to be made on the part of the airlines.” He was more positive about the long-term future, stating “we believe we will return to a growth rate similar to the past but it might take us three to five years to get there.”

Subscriber content – Sign in [maxbutton id=”1″ ] [maxbutton id=”2″ ]