DSC 1446 Enhanced NR

The air travel market recovery has been stronger than expected and continues to show robust signs. The pandemic hit the travel sector hard, and as a primarily service industry, the labor impact was horrendous. Now that traffic seems to be coming back in line with historical patterns; it is helpful to see if there are implications for airline fleets.

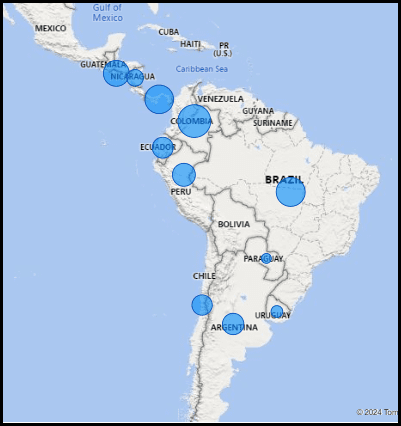

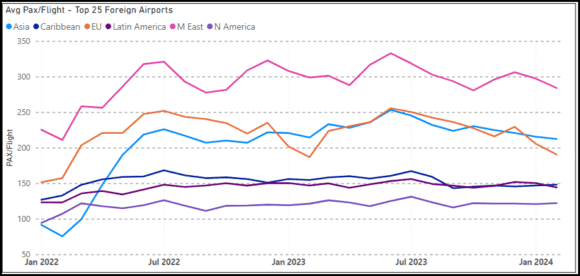

The following chart shows the average number of passengers per flight departing the US. It is clear which markets require twin-aisle aircraft. Asia and the Middle East require large aircraft because of the distance covered. However, the US-EU traffic offers intriguing flexibility. The geographically closer markets look like mainly single-aisle, but larger traffic markets like Brazil or longer range markets like Chile and Argentina benefit from larger aircraft.

Here are four key regional markets to consider. We exclude Canada and Mexico, the largest markets, as they have big drive markets. The markets we are looking at are dependent on air travel.

Looking at regional markets, we find the following.

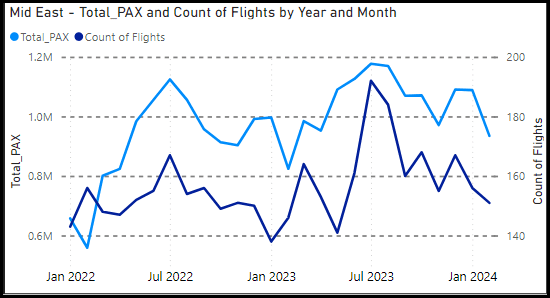

Middle East

- Traffic recovered fast and went into its seasonal cycle right away

- It is not a particularly large market

- The traffic is optimally served with larger aircraft on fewer flights

- A gauge mistake can be financially disastrous, as the map indicates

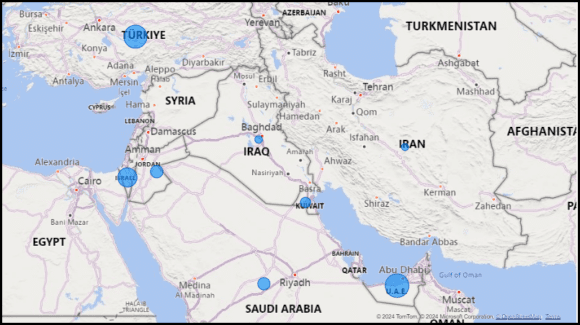

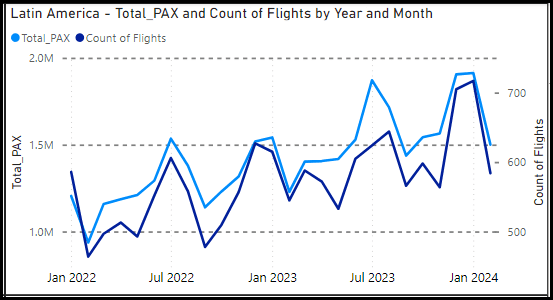

Latin America

- This is a mature travel market that immediately went back to the pattern

- The US-Latin market is ~50% larger than the US-Middle East market

- Airlines have fleet flexibility on routes up to 4,000 miles

- The map shows the relative market sizes;

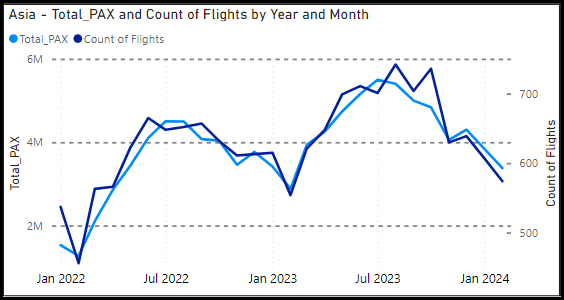

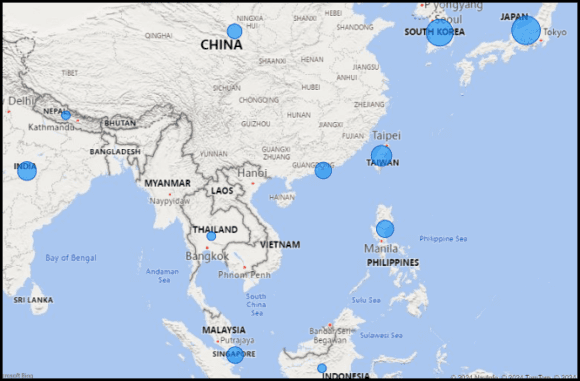

Asia

- Another mature market; a fast recovery with immediate pattern settling

- This is the largest international travel market from the US

- The large stage length drives fleet choices

- But small twins are likely to find opportunities, especially the 787-8 and A330-900 connecting secondary cities

This is a vast region with rapid economic growth. The map shows how much potential there is for connecting secondary cities

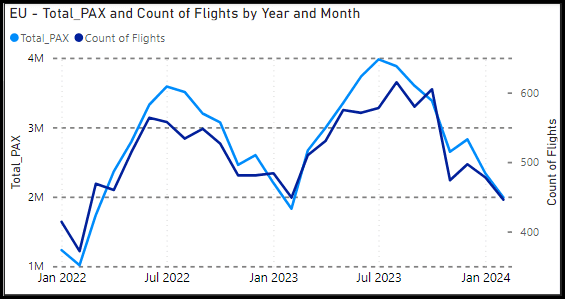

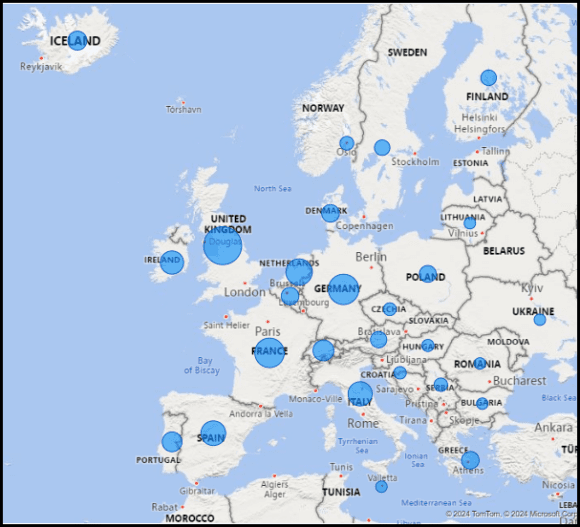

Europe

- This is the most mature US international travel market, and its size shows its importance

- The recovery and pattern consistency are apparent

- Similar to the Latin American market, Europe offers range flexibility, and this means fleet choices are impacted

- Because it is a mature market, operators know all about the secondary cities and the opportunities

- New operators like JetBlue, Norse, PLAY, and others are going to upset established operators

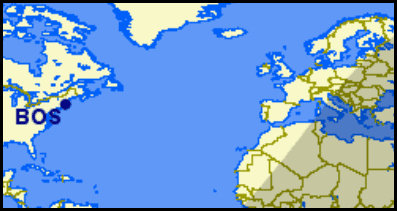

A 3,500NM range from Boston puts the entire EU within reach of a MAX 9 or A321

As this map shows, there are several markets within which secondary cities could effectively make MAX and NEO aircraft work.

This makes airlines like JetBlue very attractive in the US because of its A321neo fleet. The same goes for Spirit and Frontier. Of course, the DOJ might not like it, but airline consolidation is still a thing. Southwest’s pilots think consolidation isn’t over.

What happens if an EU airline, for example, decides to invest in one of these US airlines because its fleet profile allows creativity?

Views: 0